Annual cash inflows that will arise from two competing inves

Annual cash inflows that will arise from two competing investment projects are given below: ar InvestmentA-Investment $ 5,000 6,000 7,000 8,000 $ 26,008 $ 8,000 7,000 6,000 5,000 $26,00e The discount rate is 11%. Click here to view Exhibit 138-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using tables. Required: Compute the present value of the cash inflows for each investment. Each investment opportunity will require the same initial investment. (Round discount factor(s) to 3 decimal places.) Present Value of Cash Flows Year Investment A Investment B

Solution

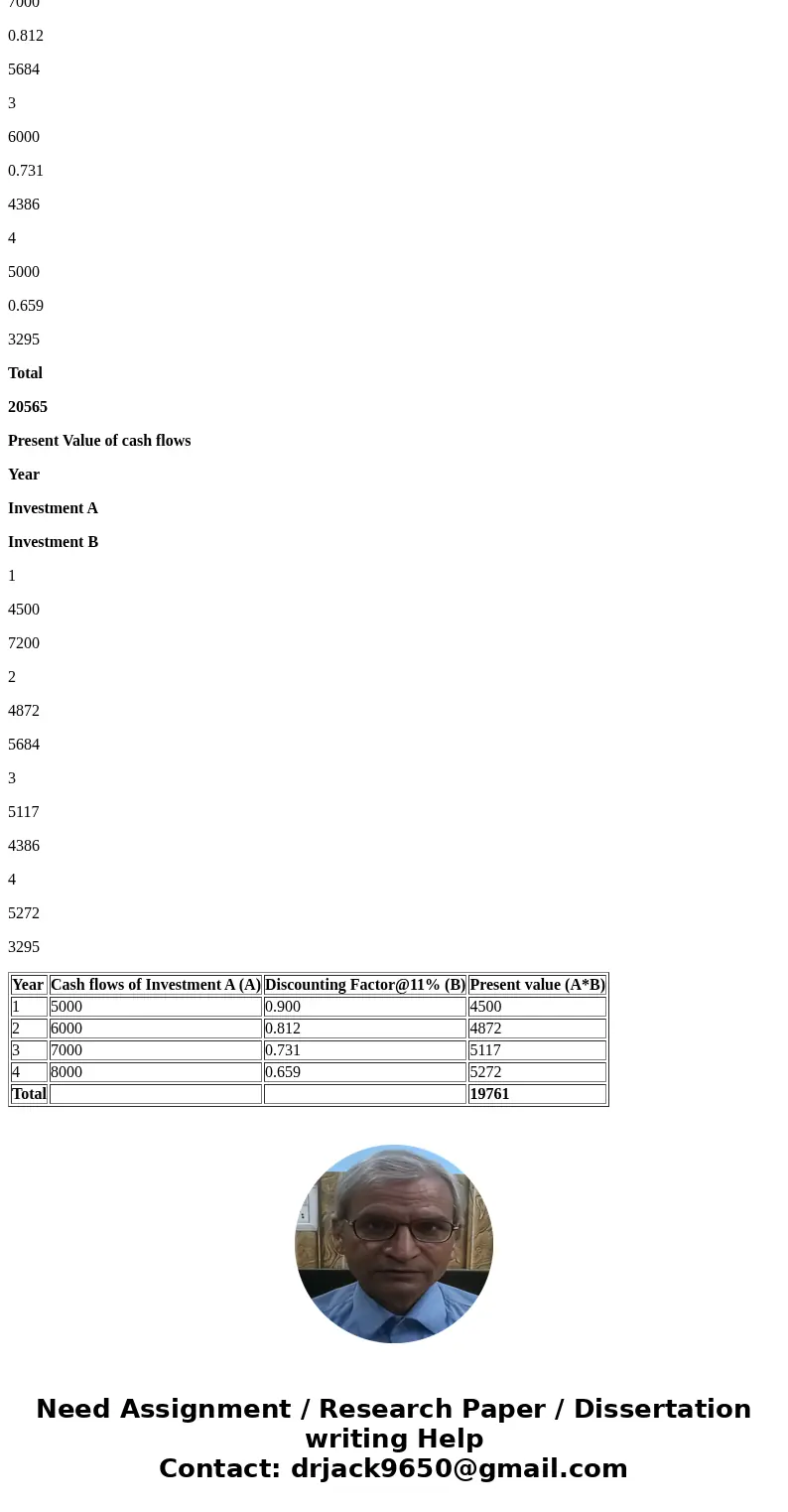

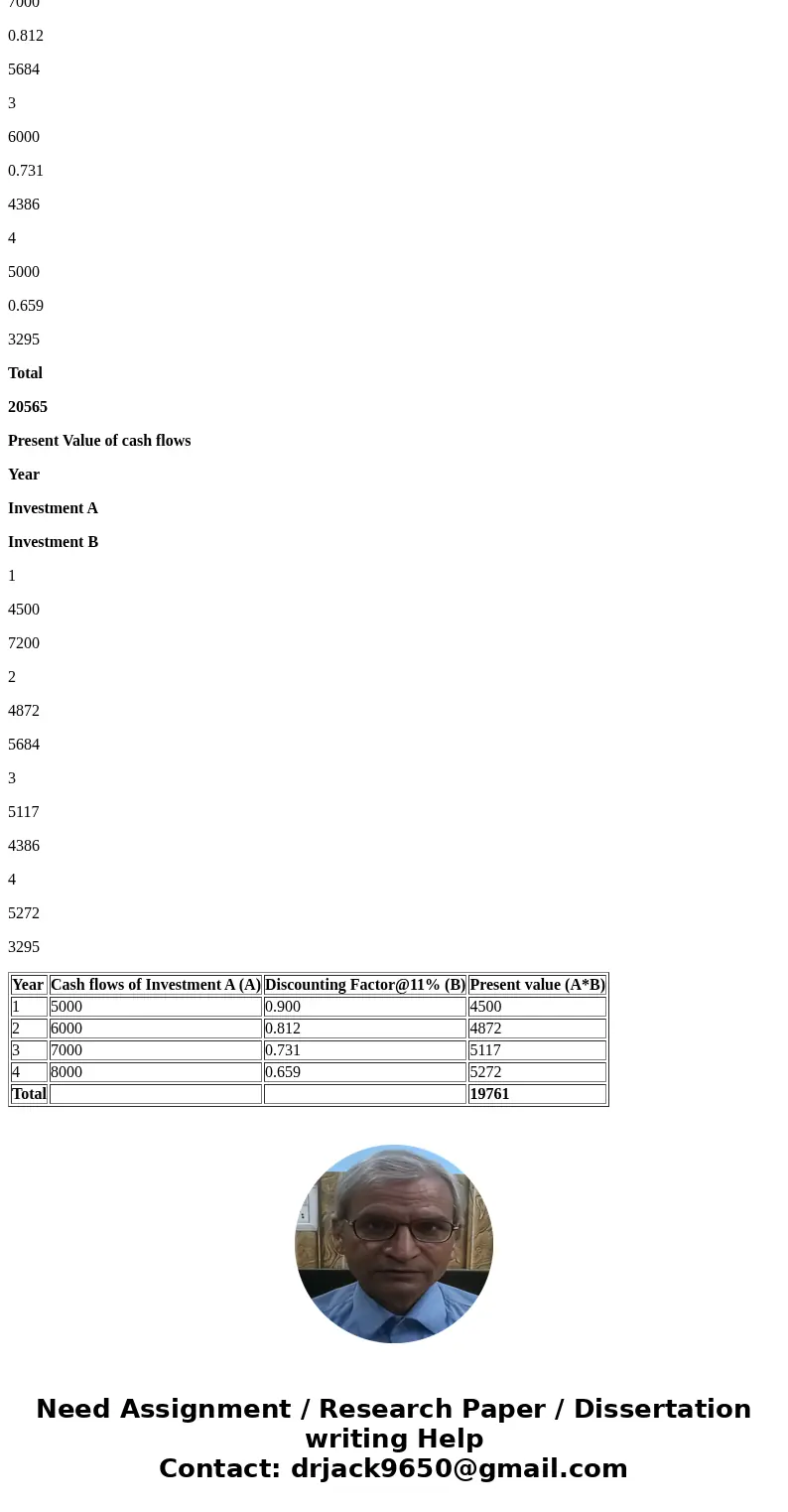

Investment A:

Year

Cash flows of Investment A (A)

Discounting Factor@11% (B)

Present value (A*B)

1

5000

0.900

4500

2

6000

0.812

4872

3

7000

0.731

5117

4

8000

0.659

5272

Total

19761

Investment B:

Year

Cash flows of Investment B (A)

Discounting Factor@11% (B)

Present value (A*B)

1

8000

0.900

7200

2

7000

0.812

5684

3

6000

0.731

4386

4

5000

0.659

3295

Total

20565

Present Value of cash flows

Year

Investment A

Investment B

1

4500

7200

2

4872

5684

3

5117

4386

4

5272

3295

| Year | Cash flows of Investment A (A) | Discounting Factor@11% (B) | Present value (A*B) |

| 1 | 5000 | 0.900 | 4500 |

| 2 | 6000 | 0.812 | 4872 |

| 3 | 7000 | 0.731 | 5117 |

| 4 | 8000 | 0.659 | 5272 |

| Total | 19761 |

Homework Sourse

Homework Sourse