The following transactions pertain to Price Corporation for

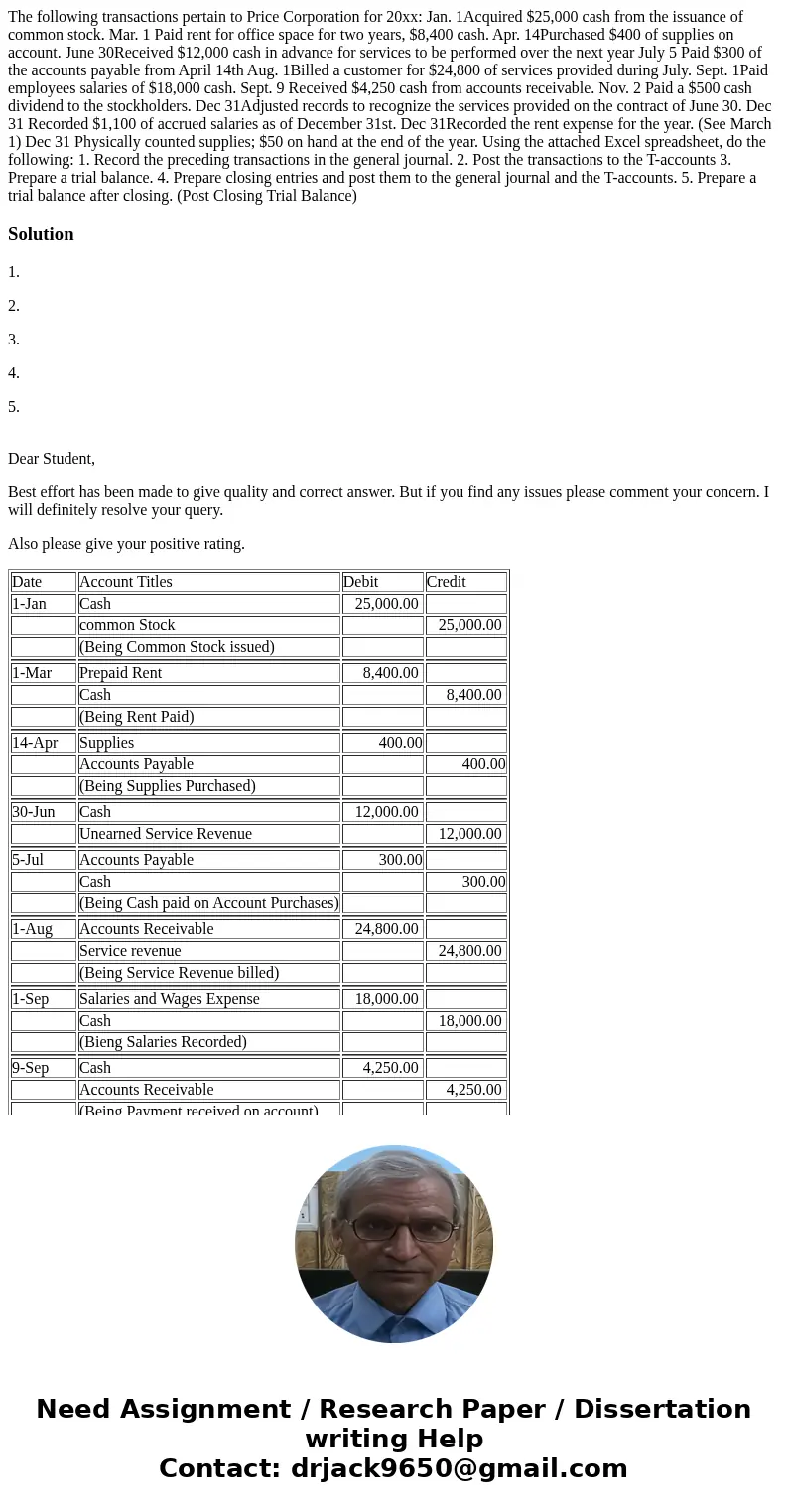

The following transactions pertain to Price Corporation for 20xx: Jan. 1Acquired $25,000 cash from the issuance of common stock. Mar. 1 Paid rent for office space for two years, $8,400 cash. Apr. 14Purchased $400 of supplies on account. June 30Received $12,000 cash in advance for services to be performed over the next year July 5 Paid $300 of the accounts payable from April 14th Aug. 1Billed a customer for $24,800 of services provided during July. Sept. 1Paid employees salaries of $18,000 cash. Sept. 9 Received $4,250 cash from accounts receivable. Nov. 2 Paid a $500 cash dividend to the stockholders. Dec 31Adjusted records to recognize the services provided on the contract of June 30. Dec 31 Recorded $1,100 of accrued salaries as of December 31st. Dec 31Recorded the rent expense for the year. (See March 1) Dec 31 Physically counted supplies; $50 on hand at the end of the year. Using the attached Excel spreadsheet, do the following: 1. Record the preceding transactions in the general journal. 2. Post the transactions to the T-accounts 3. Prepare a trial balance. 4. Prepare closing entries and post them to the general journal and the T-accounts. 5. Prepare a trial balance after closing. (Post Closing Trial Balance)

Solution

1.

2.

3.

4.

5.

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

Also please give your positive rating.

| Date | Account Titles | Debit | Credit |

| 1-Jan | Cash | 25,000.00 | |

| common Stock | 25,000.00 | ||

| (Being Common Stock issued) | |||

| 1-Mar | Prepaid Rent | 8,400.00 | |

| Cash | 8,400.00 | ||

| (Being Rent Paid) | |||

| 14-Apr | Supplies | 400.00 | |

| Accounts Payable | 400.00 | ||

| (Being Supplies Purchased) | |||

| 30-Jun | Cash | 12,000.00 | |

| Unearned Service Revenue | 12,000.00 | ||

| 5-Jul | Accounts Payable | 300.00 | |

| Cash | 300.00 | ||

| (Being Cash paid on Account Purchases) | |||

| 1-Aug | Accounts Receivable | 24,800.00 | |

| Service revenue | 24,800.00 | ||

| (Being Service Revenue billed) | |||

| 1-Sep | Salaries and Wages Expense | 18,000.00 | |

| Cash | 18,000.00 | ||

| (Bieng Salaries Recorded) | |||

| 9-Sep | Cash | 4,250.00 | |

| Accounts Receivable | 4,250.00 | ||

| (Being Payment received on account) | |||

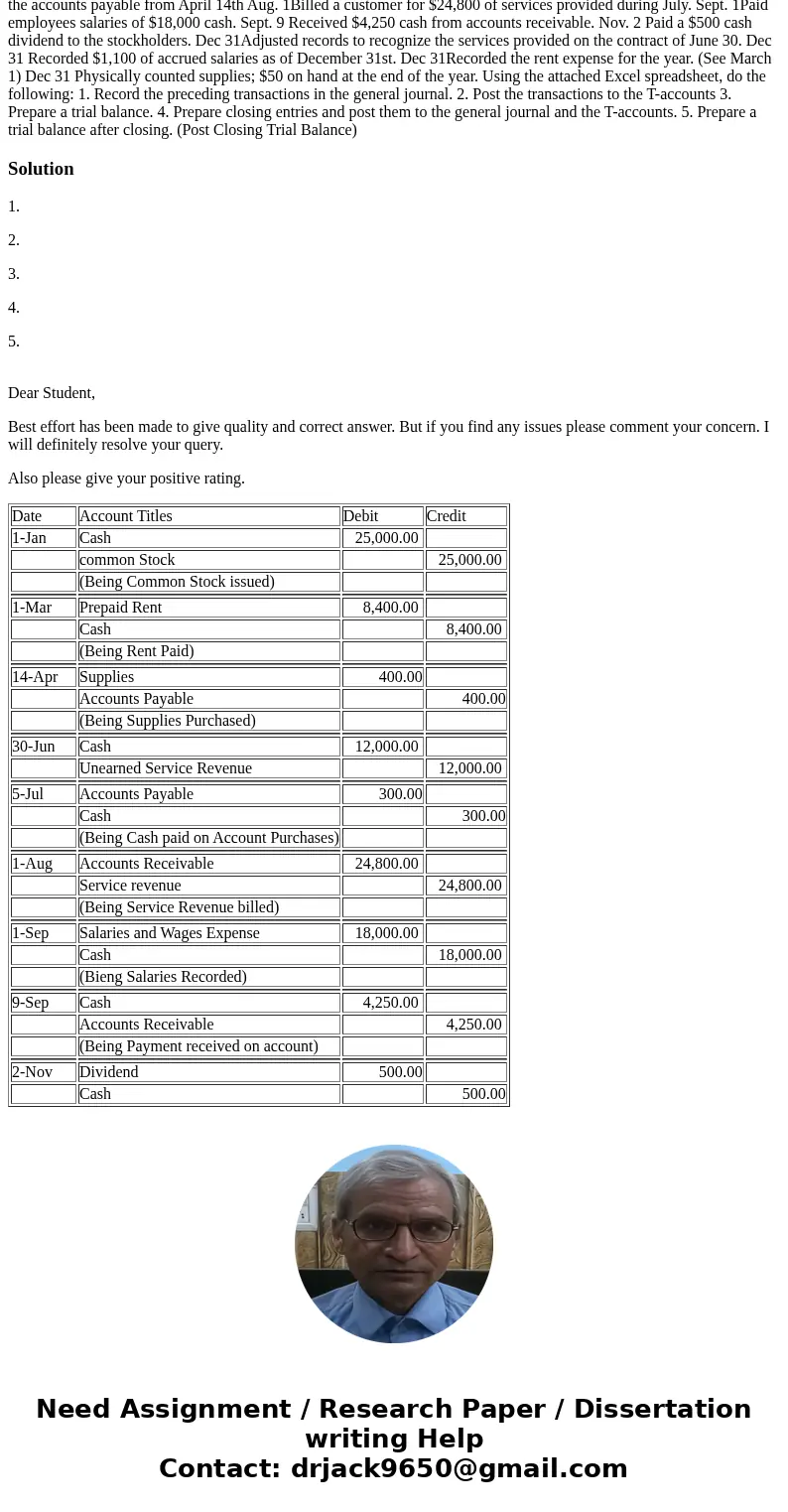

| 2-Nov | Dividend | 500.00 | |

| Cash | 500.00 |

Homework Sourse

Homework Sourse