7 value 200 points Dybala Corporations produces and sells a

7. value: 2.00 points Dybala Corporation\'s produces and sells a single product. Data concerning that product appear below Percent of Sales Selling price Varlable expenses Contribution margln Per Unit $160 ?) $ 80 50% 50% The company is currently selling 6,200 units per month. Fixed expenses are $440,200 per month. The marketing manager belleves that a $6,800 Increase In the monthly advertising budget would result In a 120 unit Increase in monthly sales. What should be the overall effect on the company\'s monthly net operating Income of this change? O Increase of $9,600 O Decrease of $2,800 ODecrease of $6.800 O increase of $2.800

Solution

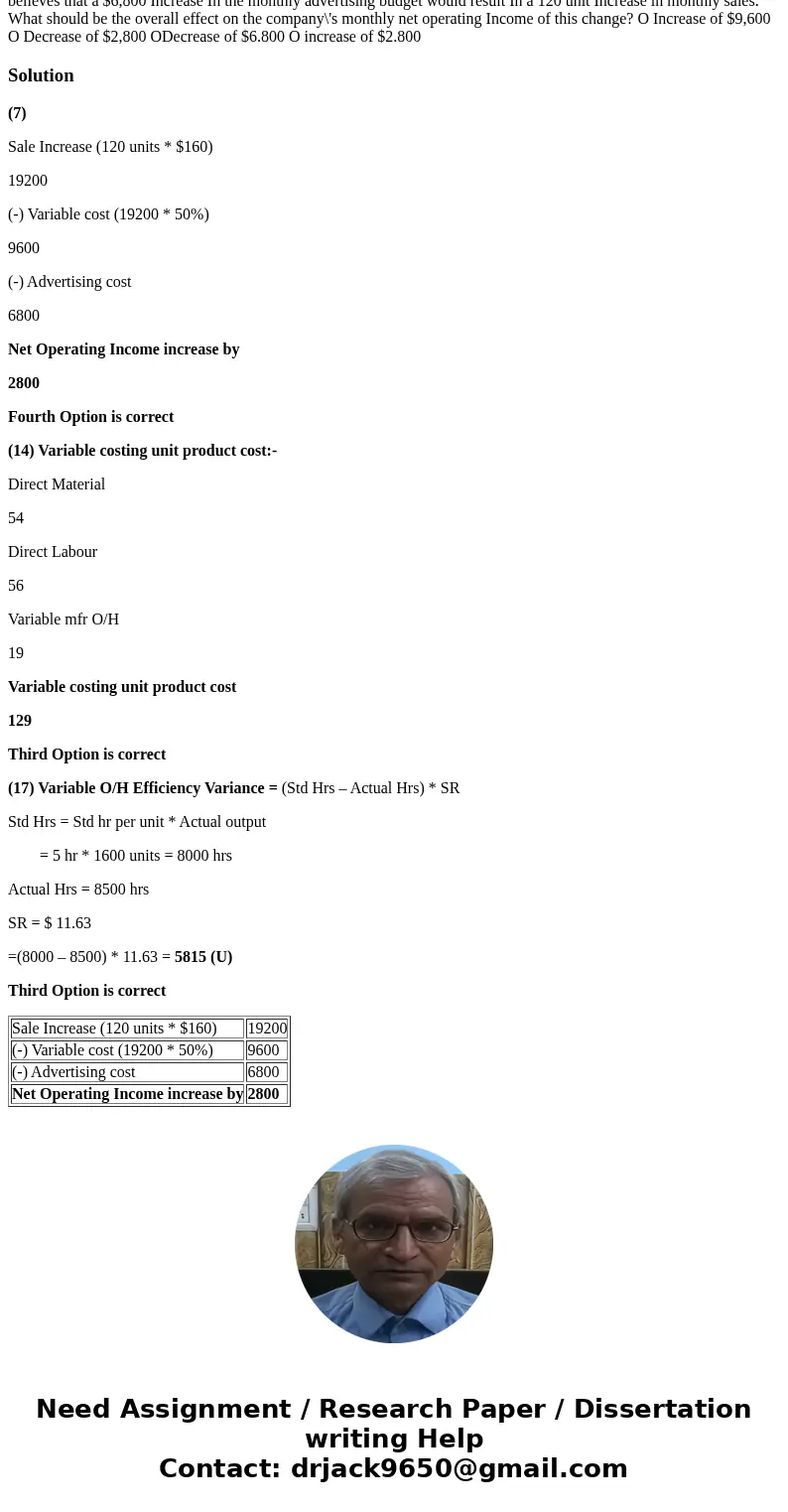

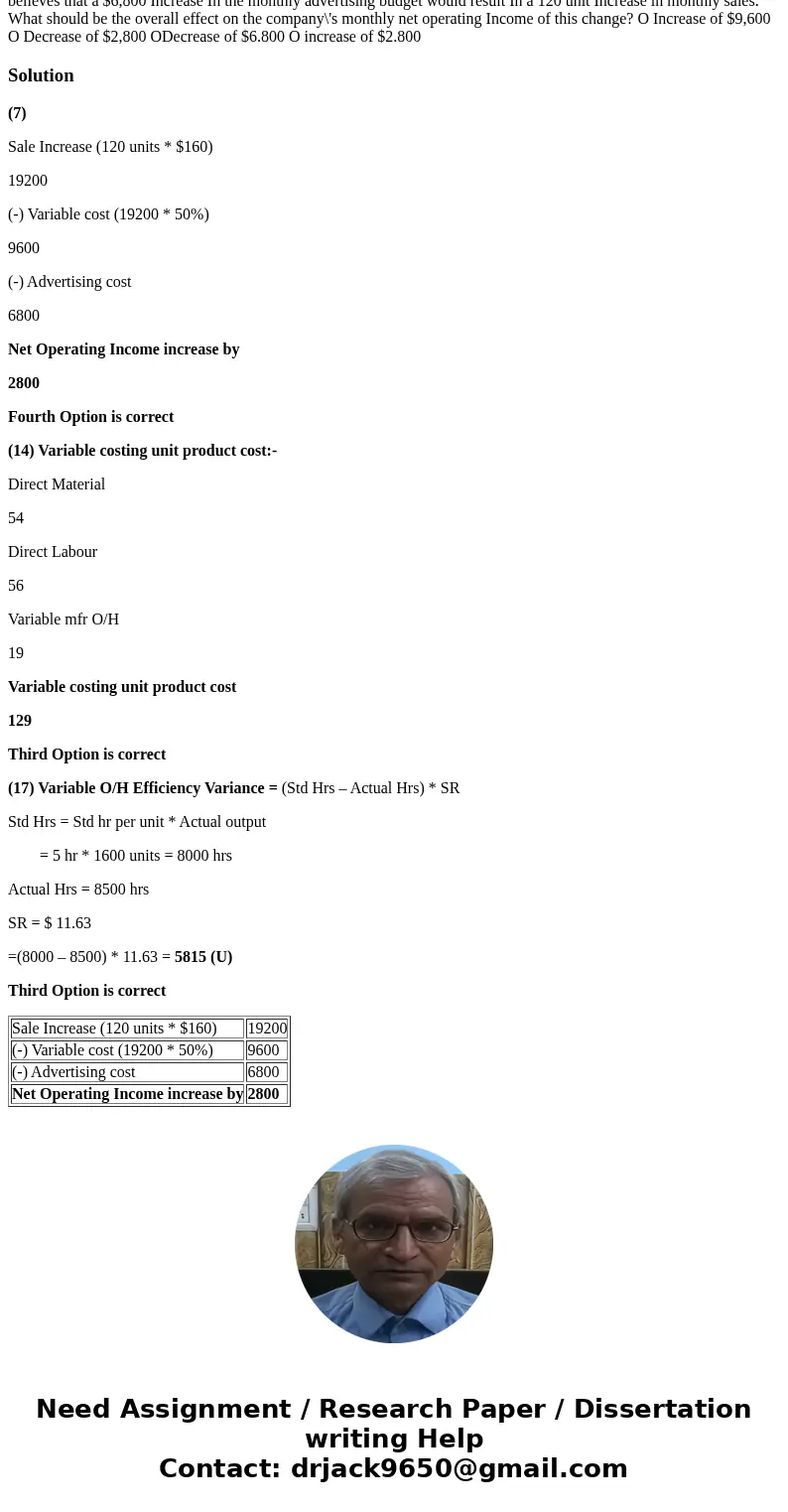

(7)

Sale Increase (120 units * $160)

19200

(-) Variable cost (19200 * 50%)

9600

(-) Advertising cost

6800

Net Operating Income increase by

2800

Fourth Option is correct

(14) Variable costing unit product cost:-

Direct Material

54

Direct Labour

56

Variable mfr O/H

19

Variable costing unit product cost

129

Third Option is correct

(17) Variable O/H Efficiency Variance = (Std Hrs – Actual Hrs) * SR

Std Hrs = Std hr per unit * Actual output

= 5 hr * 1600 units = 8000 hrs

Actual Hrs = 8500 hrs

SR = $ 11.63

=(8000 – 8500) * 11.63 = 5815 (U)

Third Option is correct

| Sale Increase (120 units * $160) | 19200 |

| (-) Variable cost (19200 * 50%) | 9600 |

| (-) Advertising cost | 6800 |

| Net Operating Income increase by | 2800 |

Homework Sourse

Homework Sourse