PROBLEM IV A boiler acquired on January 2 at a cost of 31500

Solution

Answer

Straight Line Method working

A

Cost

$ 3,15,000.00

B

Residual Value

$ -

C=A - B

Depreciable base

$ 3,15,000.00

D

Life [in years]

20

E=C/D

Annual SLM depreciation

$ 15,750.00

Year

Book Value

Depreciation expense

Ending Book Value

Accumulated Depreciation

1

$ 3,15,000.00

$ 15,750.00

$ 2,99,250.00

$ 15,750.00

2

$ 2,99,250.00

$ 15,750.00

$ 2,83,500.00

$ 31,500.00

Answer----

Depreciation expense: Year 1 = $ 15,750

Depreciation expense: Year 2 = $ 15,750

Declining Balance Method working using twice the SLM rate:

A

Cost

$ 3,15,000.00

B

Residual Value

$ -

C=A - B

Depreciable base

$ 3,15,000.00

D

Life [in years]

20

E=C/D

Annual SLM depreciation

$ 15,750.00

F=E/C

SLM Rate

5.00%

G=F x 2

DDB Rate

10.00%

Year

Beginning Book Value

Depreciation rate

Depreciation expense

Ending Book Value

Accumulated Depreciation

1

$ 3,15,000.00

10.00%

$ 31,500.00

$ 2,83,500.00

$ 31,500.00

2

$ 2,83,500.00

10.00%

$ 28,350.00

$ 2,55,150.00

$ 59,850.00

Answer----

Depreciation expense: Year 1 = $ 31,500

Depreciation expense: Year 2 = $ 28,350

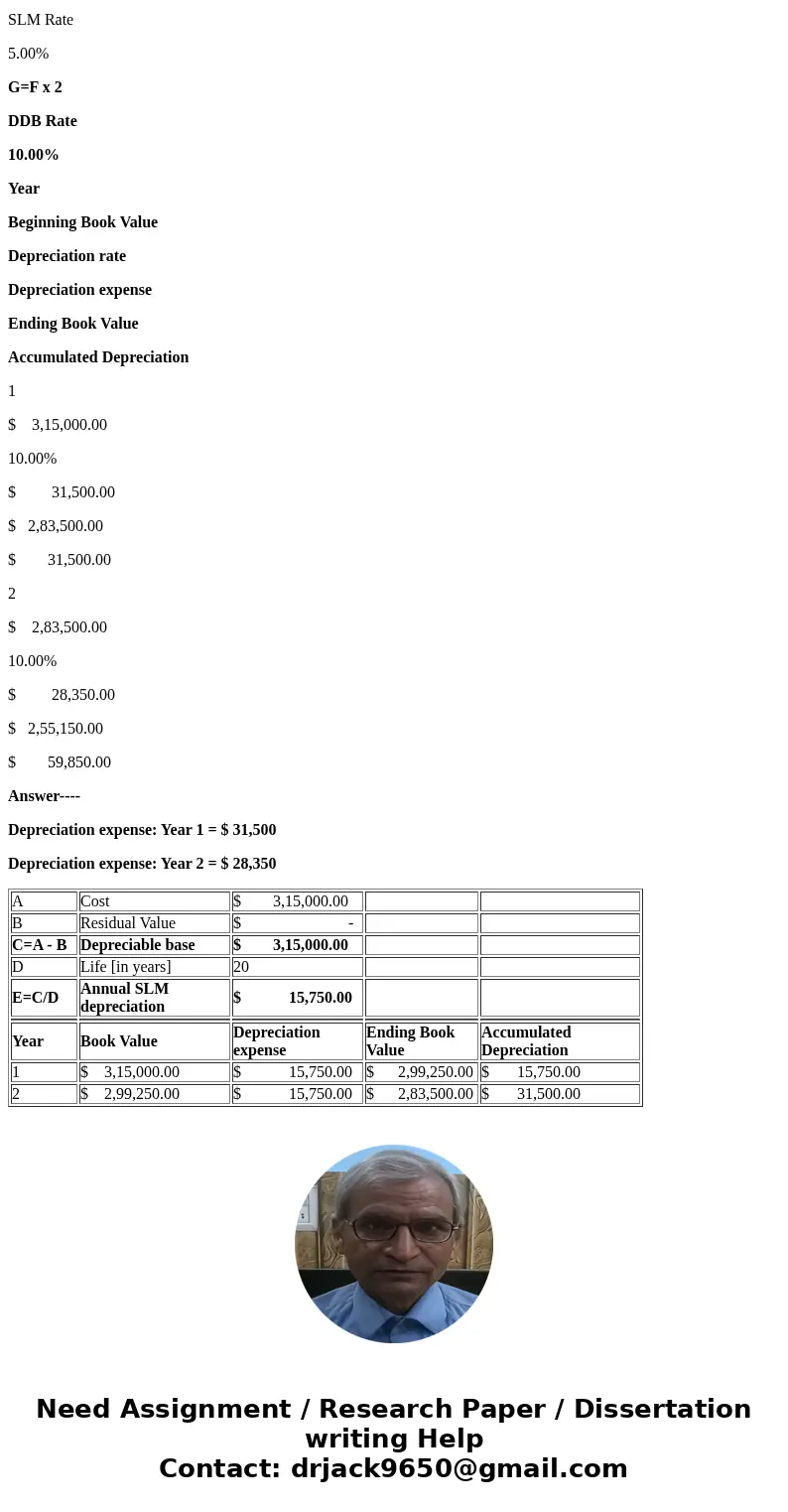

| A | Cost | $ 3,15,000.00 | ||

| B | Residual Value | $ - | ||

| C=A - B | Depreciable base | $ 3,15,000.00 | ||

| D | Life [in years] | 20 | ||

| E=C/D | Annual SLM depreciation | $ 15,750.00 | ||

| Year | Book Value | Depreciation expense | Ending Book Value | Accumulated Depreciation |

| 1 | $ 3,15,000.00 | $ 15,750.00 | $ 2,99,250.00 | $ 15,750.00 |

| 2 | $ 2,99,250.00 | $ 15,750.00 | $ 2,83,500.00 | $ 31,500.00 |

Homework Sourse

Homework Sourse