Last year TBA Corporation a calendaryear taxpayer reported a

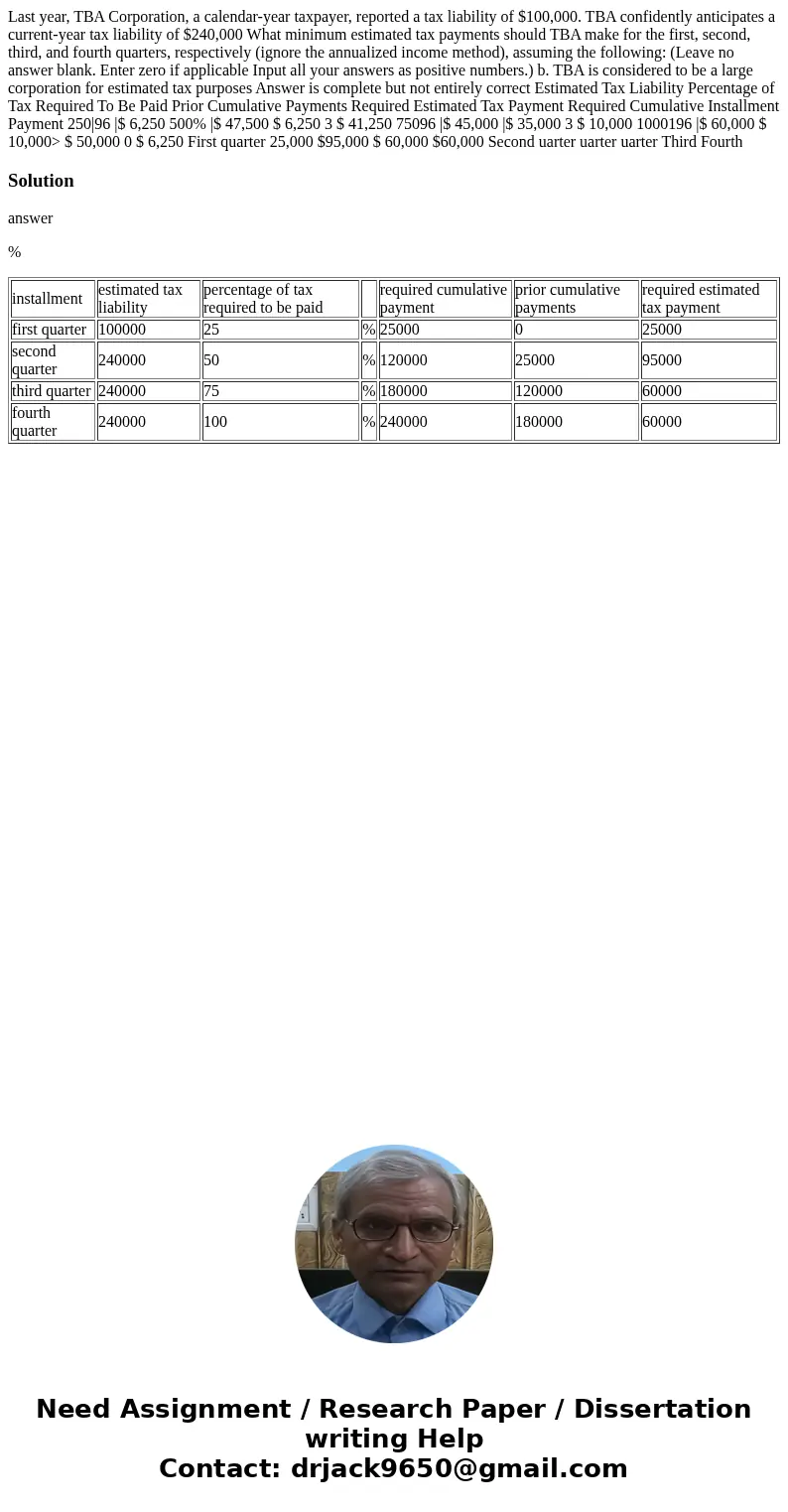

Last year, TBA Corporation, a calendar-year taxpayer, reported a tax liability of $100,000. TBA confidently anticipates a current-year tax liability of $240,000 What minimum estimated tax payments should TBA make for the first, second, third, and fourth quarters, respectively (ignore the annualized income method), assuming the following: (Leave no answer blank. Enter zero if applicable Input all your answers as positive numbers.) b. TBA is considered to be a large corporation for estimated tax purposes Answer is complete but not entirely correct Estimated Tax Liability Percentage of Tax Required To Be Paid Prior Cumulative Payments Required Estimated Tax Payment Required Cumulative Installment Payment 250|96 |$ 6,250 500% |$ 47,500 $ 6,250 3 $ 41,250 75096 |$ 45,000 |$ 35,000 3 $ 10,000 1000196 |$ 60,000 $ 10,000> $ 50,000 0 $ 6,250 First quarter 25,000 $95,000 $ 60,000 $60,000 Second uarter uarter uarter Third Fourth

Solution

answer

%

| installment | estimated tax liability | percentage of tax required to be paid | required cumulative payment | prior cumulative payments | required estimated tax payment | |

| first quarter | 100000 | 25 | % | 25000 | 0 | 25000 |

| second quarter | 240000 | 50 | % | 120000 | 25000 | 95000 |

| third quarter | 240000 | 75 | % | 180000 | 120000 | 60000 |

| fourth quarter | 240000 | 100 | % | 240000 | 180000 | 60000 |

Homework Sourse

Homework Sourse