Problem 211 information relates to the lease agreement 1 The

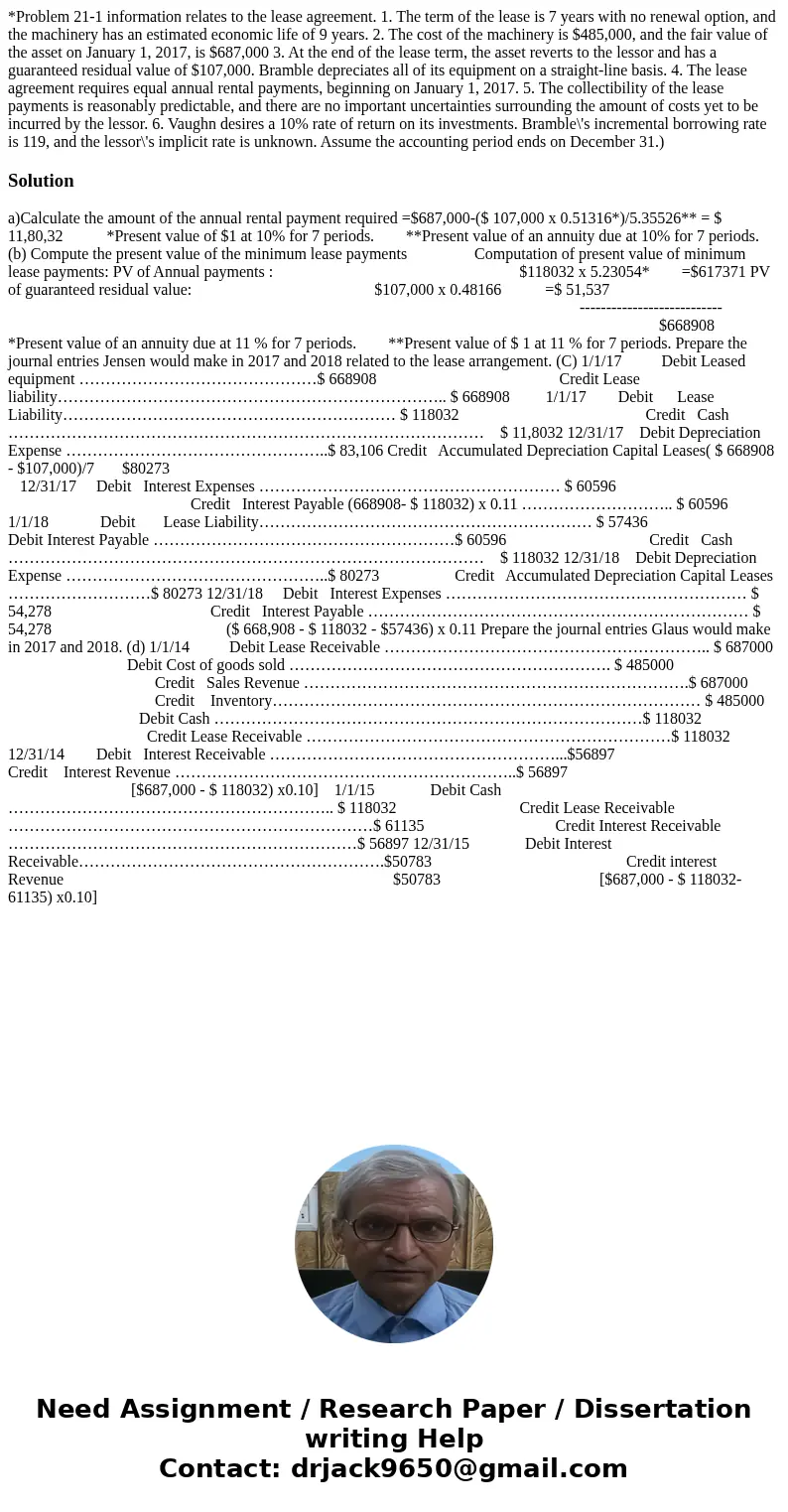

*Problem 21-1 information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $485,000, and the fair value of the asset on January 1, 2017, is $687,000 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $107,000. Bramble depreciates all of its equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2017. 5. The collectibility of the lease payments is reasonably predictable, and there are no important uncertainties surrounding the amount of costs yet to be incurred by the lessor. 6. Vaughn desires a 10% rate of return on its investments. Bramble\'s incremental borrowing rate is 119, and the lessor\'s implicit rate is unknown. Assume the accounting period ends on December 31.)

Solution

a)Calculate the amount of the annual rental payment required =$687,000-($ 107,000 x 0.51316*)/5.35526** = $ 11,80,32 *Present value of $1 at 10% for 7 periods. **Present value of an annuity due at 10% for 7 periods. (b) Compute the present value of the minimum lease payments Computation of present value of minimum lease payments: PV of Annual payments : $118032 x 5.23054* =$617371 PV of guaranteed residual value: $107,000 x 0.48166 =$ 51,537 --------------------------- $668908 *Present value of an annuity due at 11 % for 7 periods. **Present value of $ 1 at 11 % for 7 periods. Prepare the journal entries Jensen would make in 2017 and 2018 related to the lease arrangement. (C) 1/1/17 Debit Leased equipment ………………………………………$ 668908 Credit Lease liability……………………………………………………………….. $ 668908 1/1/17 Debit Lease Liability……………………………………………………… $ 118032 Credit Cash ……………………………………………………………………………… $ 11,8032 12/31/17 Debit Depreciation Expense …………………………………………..$ 83,106 Credit Accumulated Depreciation Capital Leases( $ 668908 - $107,000)/7 $80273 12/31/17 Debit Interest Expenses ………………………………………………… $ 60596 Credit Interest Payable (668908- $ 118032) x 0.11 ……………………….. $ 60596 1/1/18 Debit Lease Liability……………………………………………………… $ 57436 Debit Interest Payable …………………………………………………$ 60596 Credit Cash ……………………………………………………………………………… $ 118032 12/31/18 Debit Depreciation Expense …………………………………………..$ 80273 Credit Accumulated Depreciation Capital Leases ………………………$ 80273 12/31/18 Debit Interest Expenses ………………………………………………… $ 54,278 Credit Interest Payable ……………………………………………………………… $ 54,278 ($ 668,908 - $ 118032 - $57436) x 0.11 Prepare the journal entries Glaus would make in 2017 and 2018. (d) 1/1/14 Debit Lease Receivable …………………………………………………….. $ 687000 Debit Cost of goods sold ……………………………………………………. $ 485000 Credit Sales Revenue ……………………………………………………………….$ 687000 Credit Inventory……………………………………………………………………… $ 485000 Debit Cash ………………………………………………………………………$ 118032 Credit Lease Receivable ……………………………………………………………$ 118032 12/31/14 Debit Interest Receivable ………………………………………………...$56897 Credit Interest Revenue ………………………………………………………..$ 56897 [$687,000 - $ 118032) x0.10] 1/1/15 Debit Cash …………………………………………………….. $ 118032 Credit Lease Receivable ……………………………………………………………$ 61135 Credit Interest Receivable …………………………………………………………$ 56897 12/31/15 Debit Interest Receivable………………………………………………….$50783 Credit interest Revenue $50783 [$687,000 - $ 118032-61135) x0.10]

Homework Sourse

Homework Sourse