Chuck Wagon Grills Inc makes a single producta handmade spec

Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $300. Data for last year\':s operations follow: Units in Units produced Units sold Units in ending inventory Variable costs per unit: beginning inventory 10,400 8,400 2,000 Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit 60 40 10 30 140 Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total fixed costs $ 200,000 1,240,000 $1,440,000 Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill 2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year. 3. What is the company\'s break-even point in terms of the number of barbecue grills sold?

Solution

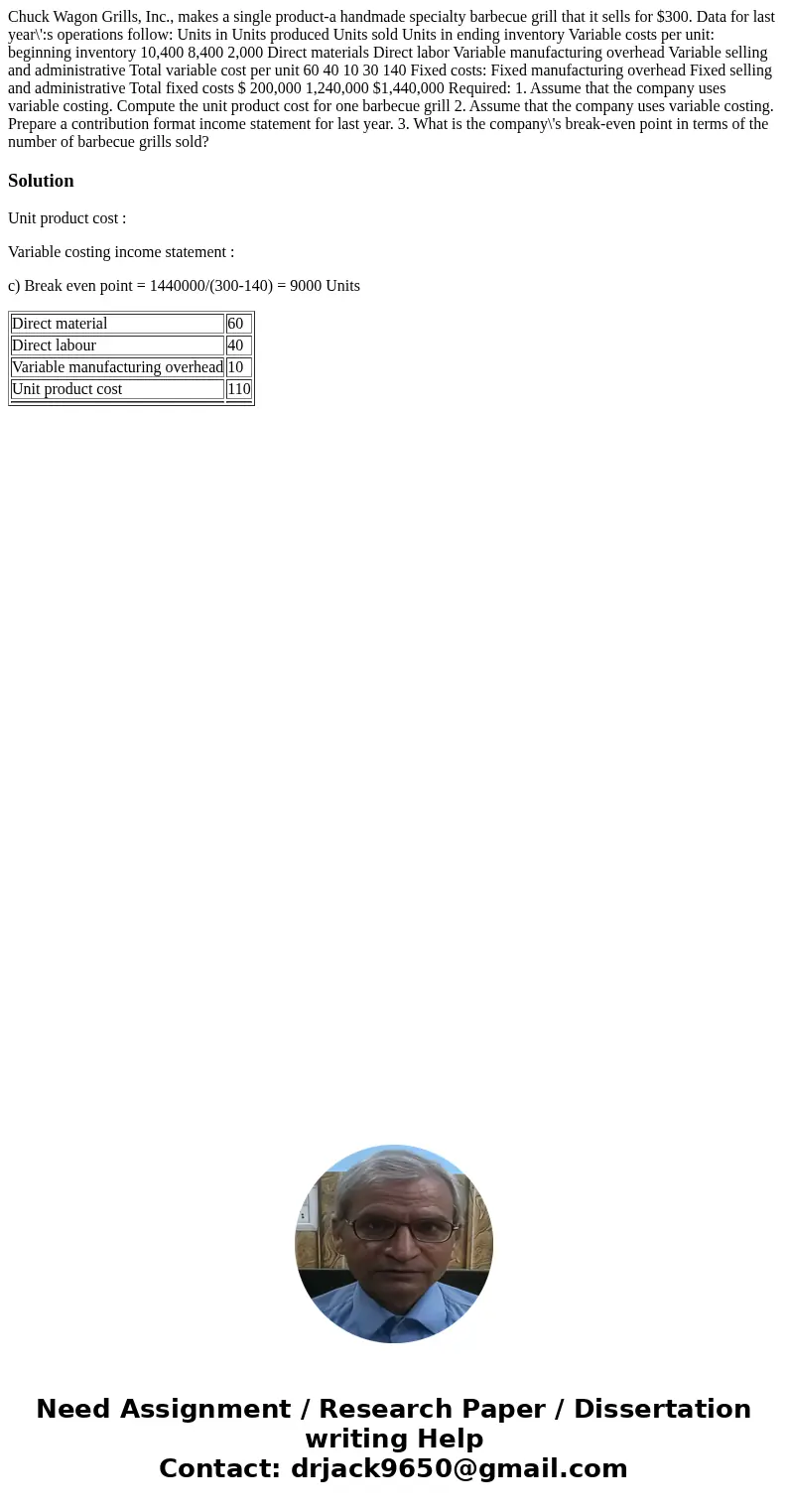

Unit product cost :

Variable costing income statement :

c) Break even point = 1440000/(300-140) = 9000 Units

| Direct material | 60 |

| Direct labour | 40 |

| Variable manufacturing overhead | 10 |

| Unit product cost | 110 |

Homework Sourse

Homework Sourse