Score 0 of 1 pt 10of13 7 complete HW Score 3462 45 of 13 pts

Score: 0 of 1 pt 10of13 (7 complete) HW Score: 34.62%, 4.5 of 13 pts Problem 5-39 (algorithmic) Question Help * Consider the cash flow data in the table below for two competing investment projects At 1-14%, which of the two projects would be a better cho Click the icon to view the cash flows for the investment projects More Info Click the icon to vie w the interest factors for discrete compounding when i= 14% per year The Pw value for project A is (Round to the nearest dollar.) Cash Flow Data (Unit: S thousand) Project A Project B -$1,300 -1,000 - 425 905 905 1,455 1.735 575 575 435 850 $3,800 -800 750 910 1,330 1,910 1,540 800 770 320 1,040 Enter your answer in the answer box and then click Check Answer Print Done parts

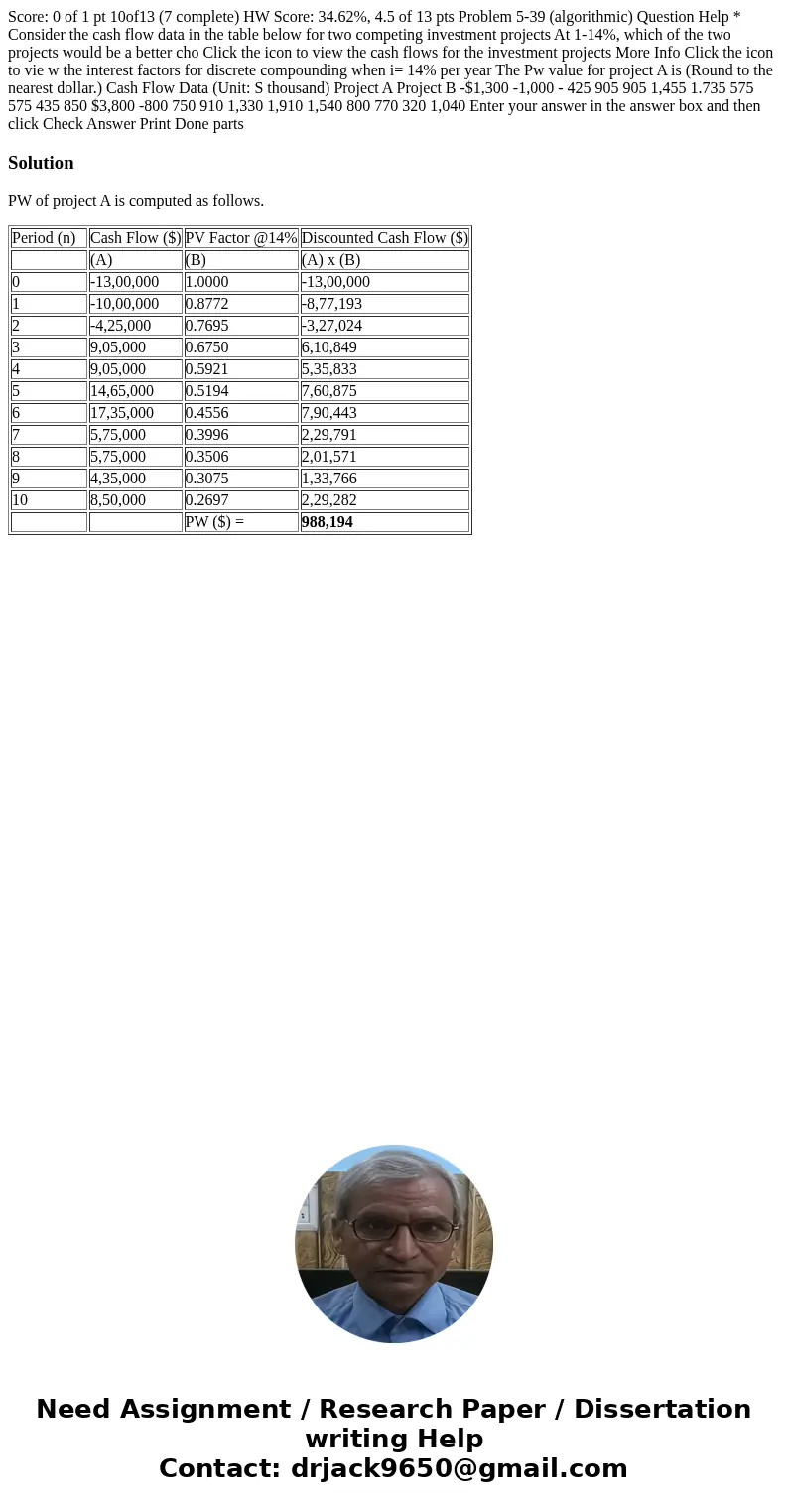

Solution

PW of project A is computed as follows.

| Period (n) | Cash Flow ($) | PV Factor @14% | Discounted Cash Flow ($) |

| (A) | (B) | (A) x (B) | |

| 0 | -13,00,000 | 1.0000 | -13,00,000 |

| 1 | -10,00,000 | 0.8772 | -8,77,193 |

| 2 | -4,25,000 | 0.7695 | -3,27,024 |

| 3 | 9,05,000 | 0.6750 | 6,10,849 |

| 4 | 9,05,000 | 0.5921 | 5,35,833 |

| 5 | 14,65,000 | 0.5194 | 7,60,875 |

| 6 | 17,35,000 | 0.4556 | 7,90,443 |

| 7 | 5,75,000 | 0.3996 | 2,29,791 |

| 8 | 5,75,000 | 0.3506 | 2,01,571 |

| 9 | 4,35,000 | 0.3075 | 1,33,766 |

| 10 | 8,50,000 | 0.2697 | 2,29,282 |

| PW ($) = | 988,194 |

Homework Sourse

Homework Sourse