A machine that cost 400000 has an estimated residual value o

A machine that cost $400,000 has an estimated residual value of $40,000 and an estimated useful life of four years. The company uses double-declining-balance depreciation. Required:

1. Calculate the machine\'s depreciable cost.

2. Calculate the machine\'s depreciation expense for each year.

3. Calculate the machine\'s accumulated depreciation and book value at the end of each year.

Solution

(1) Depreciable cost is the basis for Depreciation,is the amount of cost that can be depreciated on an asset over time

In double declining balance method, we are not deduct salvage value while calculating depreciation

Hence depreciable cost = $ 400000

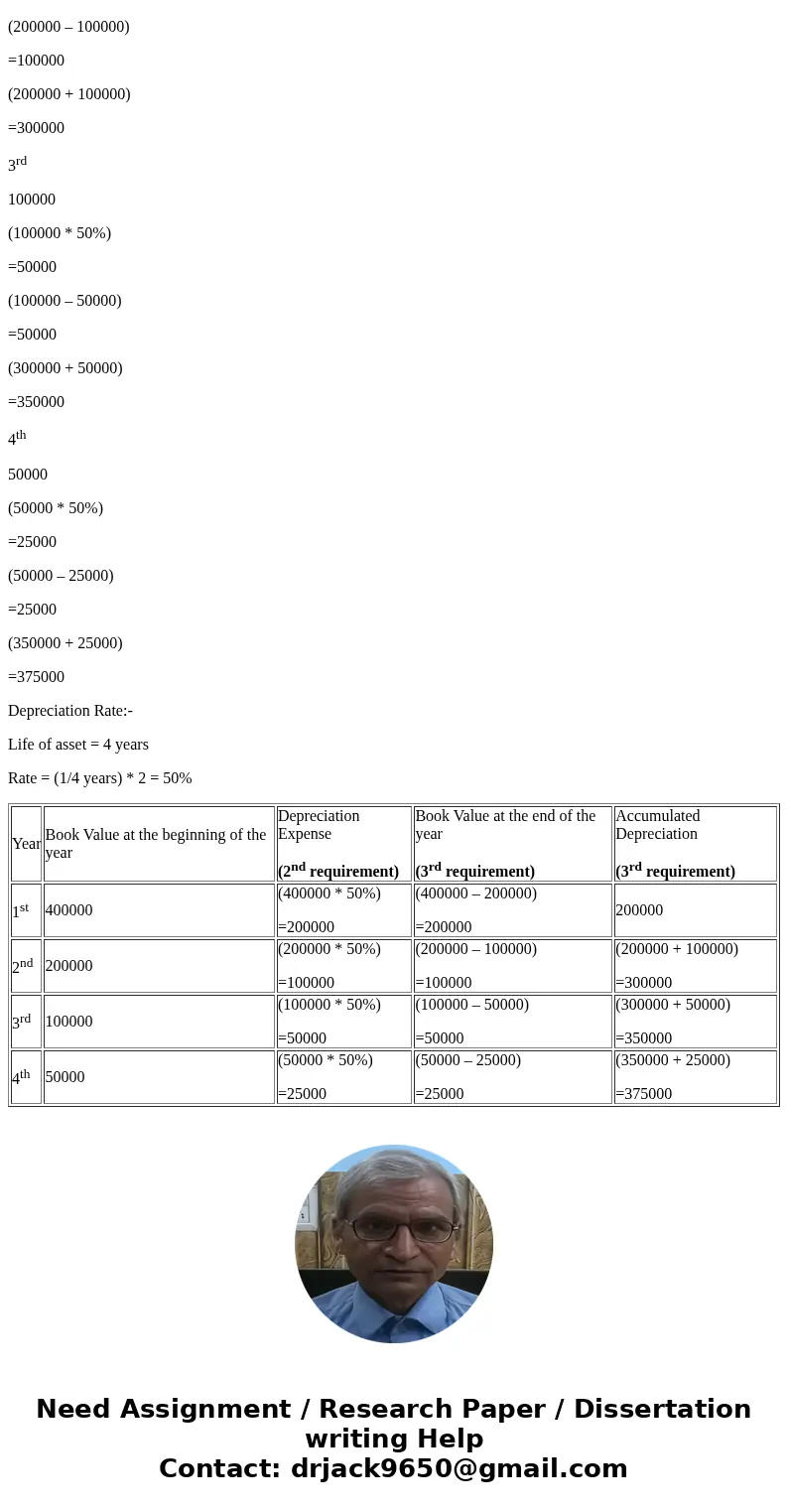

(2 & 3) Machine depreciation Exp over year, Accumulated Depreciation, Book Value-

Year

Book Value at the beginning of the year

Depreciation Expense

(2nd requirement)

Book Value at the end of the year

(3rd requirement)

Accumulated Depreciation

(3rd requirement)

1st

400000

(400000 * 50%)

=200000

(400000 – 200000)

=200000

200000

2nd

200000

(200000 * 50%)

=100000

(200000 – 100000)

=100000

(200000 + 100000)

=300000

3rd

100000

(100000 * 50%)

=50000

(100000 – 50000)

=50000

(300000 + 50000)

=350000

4th

50000

(50000 * 50%)

=25000

(50000 – 25000)

=25000

(350000 + 25000)

=375000

Depreciation Rate:-

Life of asset = 4 years

Rate = (1/4 years) * 2 = 50%

| Year | Book Value at the beginning of the year | Depreciation Expense (2nd requirement) | Book Value at the end of the year (3rd requirement) | Accumulated Depreciation (3rd requirement) |

| 1st | 400000 | (400000 * 50%) =200000 | (400000 – 200000) =200000 | 200000 |

| 2nd | 200000 | (200000 * 50%) =100000 | (200000 – 100000) =100000 | (200000 + 100000) =300000 |

| 3rd | 100000 | (100000 * 50%) =50000 | (100000 – 50000) =50000 | (300000 + 50000) =350000 |

| 4th | 50000 | (50000 * 50%) =25000 | (50000 – 25000) =25000 | (350000 + 25000) =375000 |

Homework Sourse

Homework Sourse