Question 1 of 9 Award955 out of 1111 points Exercise 16 Dist

Question 1 (of 9) Award:9.55 out of 11.11 points Exercise 1-6 Distinguishing business organizations LO C4 Consider the following separate situations, identify each as being a sole proprietorship, partnership or corporation. ther Dougias Corporation Douglas and Logan own Financial Services, a financial services provider. Neither Douglas nor Logan has personal responsibility for the debts of Financial Services Riley and Kay own Speedy Packages, a courier service. Both are personally liable for the debts of the business. Derr Company does not have separate legal existence apart from the one person who owns it Sole proprietorship d. Trent Company is owned by Trent Topaz, who is personally liable for the company\'s debts. Sole proprietorship e Ownership of Zander Company is divided into 1,000 shares of stock f. Puma Products does not pay income taxes and has one owner g. Celia Company pays its own income taxes and has two owners eBook & Resources References Worksheet Difficulty: 1 Easy Exercise 1-6 Learning Objective; 01-C4 8 6 8 9 0

Solution

1) Puma Products does not pay income taxes and has one owner = Sole Proprietorship

A sole proprietorship, also known as the sole trader or simply a proprietorship, is a type of enterprise that is owned and run by one natural person and in which there is no legal distinction between the owner and the business entity.

2)

Cash

Equipment

+60,000

+15,000

Cash

Equipment

-6,000

+6,000

Cash

Accounts Receivables

+5,000

-5,000

Assets:

Cash = 46,000

Equipment = 31,000

Accounts Receivables = 3,000

Liabilities:

Accounts Payables = 0

Common Stock = 75,000

Retained Earnings = 5,000

Provide Feedback........................

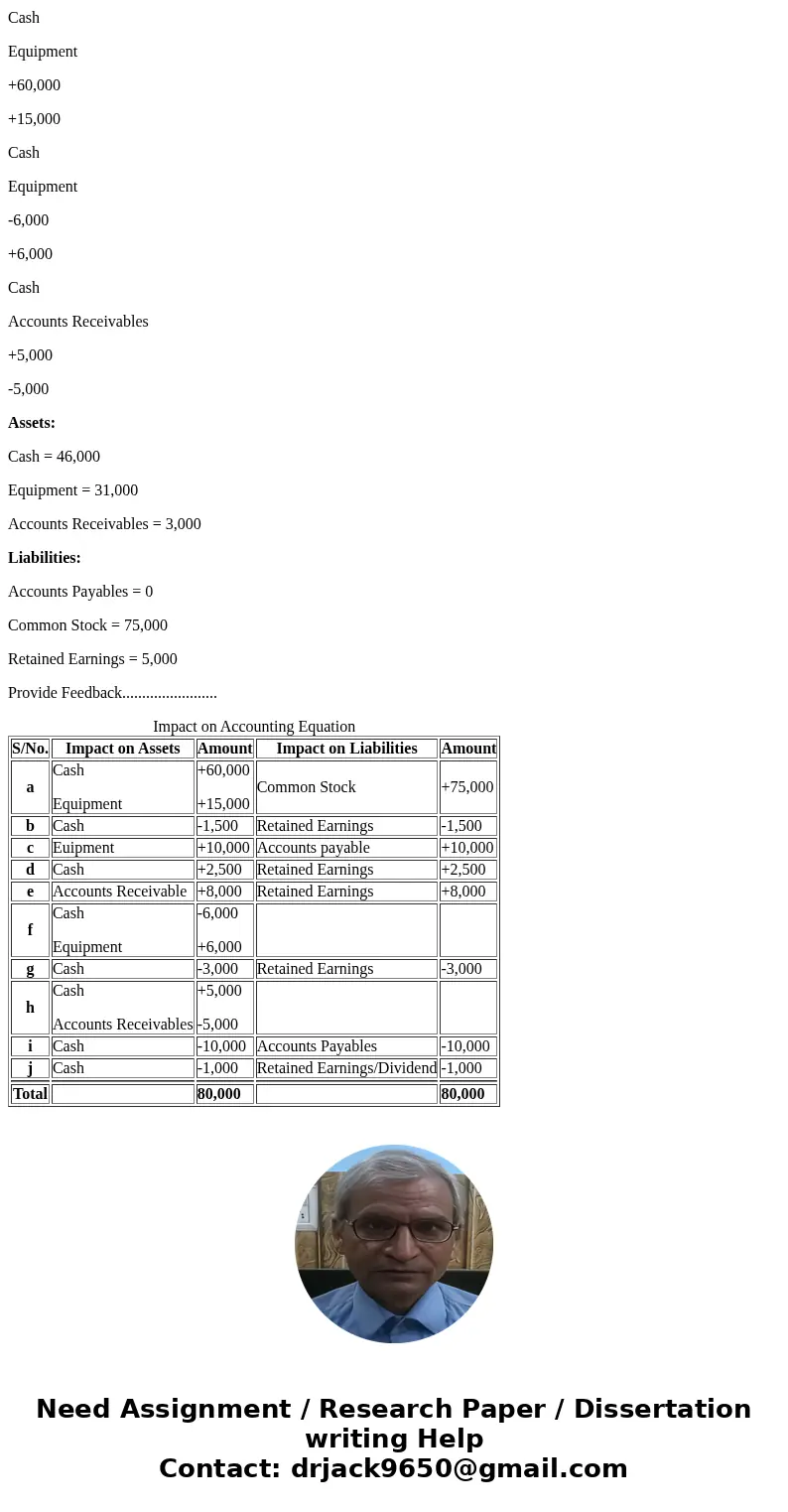

| S/No. | Impact on Assets | Amount | Impact on Liabilities | Amount |

|---|---|---|---|---|

| a | Cash Equipment | +60,000 +15,000 | Common Stock | +75,000 |

| b | Cash | -1,500 | Retained Earnings | -1,500 |

| c | Euipment | +10,000 | Accounts payable | +10,000 |

| d | Cash | +2,500 | Retained Earnings | +2,500 |

| e | Accounts Receivable | +8,000 | Retained Earnings | +8,000 |

| f | Cash Equipment | -6,000 +6,000 | ||

| g | Cash | -3,000 | Retained Earnings | -3,000 |

| h | Cash Accounts Receivables | +5,000 -5,000 | ||

| i | Cash | -10,000 | Accounts Payables | -10,000 |

| j | Cash | -1,000 | Retained Earnings/Dividend | -1,000 |

| Total | 80,000 | 80,000 |

Homework Sourse

Homework Sourse