write an introduction overview of a company listed on the st

write an introduction/ overview of a company listed on the stock exchange (check to be sure they have annual reports available online). Describe the company and their product(s)/service(s), a brief history, their vision and mission (if they do not have formal statements describe what you feel they might be) the industry they are in, their size (sales, income, number of employees), and your perception of their competitive advantage(s). State what the company’s goal may be ($xx sale for the coming year, for instance, or a certain percentage of profit).

Problem Statement: After doing background reading on the company, write a Problem Statement consisting of a single sentence describing a problem at the organization (it can be related to marketing, operations, finances, personnel). State the problem in a sentence: The problem at xxx is xxxx. Provide a short background about the problem.

Solution

Solution:

Introduction:

The Adani Group is one of India’s leading business houses with revenue of over $11 billion. Adani Enterprises Limited is the flagship entity of the Adani group which was the erstwhile Adani Exports Limited and was the first of the listed companies.

Founded in 1988, led by Chairman Mr. Gautam adani. Adani has grown to become a global integrated infrastructure player with businesses in key industry verticals - resources, logistics, energy and agro. The integrated model is well adapted to the infrastructure challenges of the emerging economies.

Businesses:

The Group enjoys significant interests across resources (coal mining and trading), logistics (ports and logistics, shipping and rail), energy (power generation and transmission) and ancillary industries. Through these businesses, the Adani Group is integrated to the core of the world’s largest democracy, touching millions of lives.

It also has business interests in solar cells and module manufacturing, agri-storage infrastructure and services as well as edible oil and gas distribution.

This business mix - business-to-business and business-to-consumer – is directed at enhancing access to basic services (electricity through timely coal availability), creating a less polluted world, delivering quality food grain and providing healthy cooking media. In doing so, the Company contributes to create a better world.

Vision and Mission:

Their vision: One vision one brand: Their vision statement meaning is to become globally admired leader in integrated infrastructure businesses with a deep commitment to nation building. They committed to be known for the scale of their ambition, spped of execution and quality of operation.

Their mission: Thinking big doing better: Their mission statements meaning is to achieve the ambition by acting as one organization with one brand. For that purpose a new visual identity is designed to help tell the story of integration in a simple and modern style.

Industry in which they have major presence:

They have major presence in import coal trading, mining and Port businesses: The major revenue comes from these three areas. In other areas company is also doing better.

According to their website they have following income statement for the past few years

Income Statement (in ? crores)

Particulars

FY17

FY16

FY15

FY14

FY13

FY12

FY11

Revenue

38,056

35,131

65,520

56,226

47,352

39,904

26,827

Profit Before Tax (PBT)

878

1,118

2,663

1,614

2,005

2,496

3,273

Profit After Tax (PAT)

988

1,011

1,948

2,221

1,613

1,839

2,476

Dividend (incl tax on dividend)

53

44

194

189

181

153

130

EPS (in )

9

9

18

20

15

17

23

Also they have following balance sheet for the past few years

Balance Sheet(in ? crores)

Particulars

FY17

FY16

FY15

FY14

FY13

FY12

FY11

ASSETS

Net Fixed Assets

21,363

18,178

88,550

84,060

77,926

73,967

46,226

Net current assets

11,604

13,226

17,934

12,582

6,891

12,181

8,483

Investments

982

774

153

144

132

442

322

Other assets

3,186

1,467

9,430

7,148

6,177

6,831

73

Total

37,135

33,685

1,16,067

1,03,934

91,126

93,421

55,105

LIABILITIES

Shareholder\'s funds

14,136

13,378

25,728

23,757

21,459

19,472

17,514

Minority interest

562

85

4,102

4,481

3,234

3,457

3,509

Loan funds

20,846

18,909

83,571

71,980

61,762

65,231

32,763

Other liabilities

1,591

1,313

2,667

3,716

4,671

5,261

1,319

Total

37,135

33,685

1,16,067

1,03,934

91,126

93,421

55,105

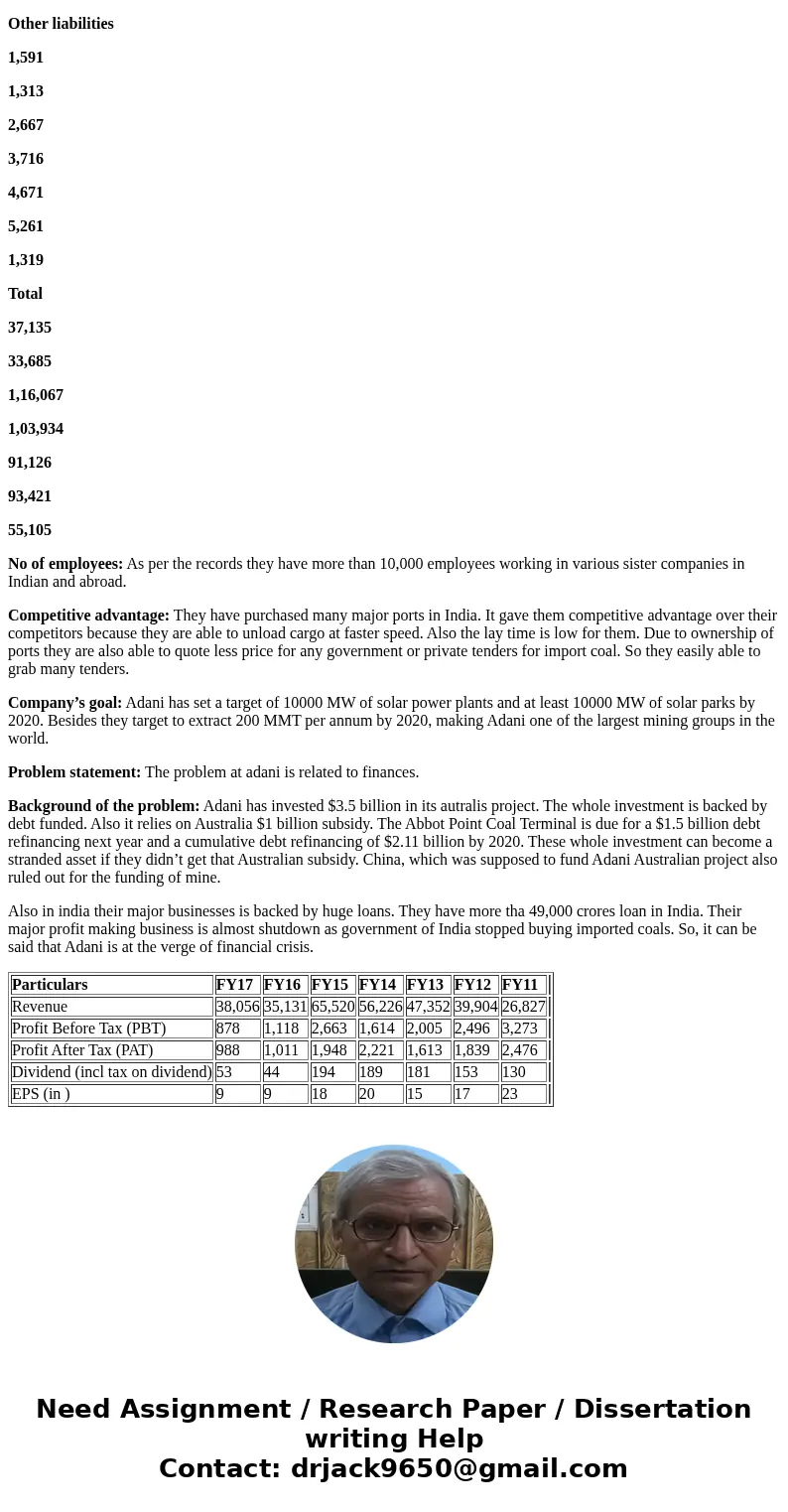

No of employees: As per the records they have more than 10,000 employees working in various sister companies in Indian and abroad.

Competitive advantage: They have purchased many major ports in India. It gave them competitive advantage over their competitors because they are able to unload cargo at faster speed. Also the lay time is low for them. Due to ownership of ports they are also able to quote less price for any government or private tenders for import coal. So they easily able to grab many tenders.

Company’s goal: Adani has set a target of 10000 MW of solar power plants and at least 10000 MW of solar parks by 2020. Besides they target to extract 200 MMT per annum by 2020, making Adani one of the largest mining groups in the world.

Problem statement: The problem at adani is related to finances.

Background of the problem: Adani has invested $3.5 billion in its autralis project. The whole investment is backed by debt funded. Also it relies on Australia $1 billion subsidy. The Abbot Point Coal Terminal is due for a $1.5 billion debt refinancing next year and a cumulative debt refinancing of $2.11 billion by 2020. These whole investment can become a stranded asset if they didn’t get that Australian subsidy. China, which was supposed to fund Adani Australian project also ruled out for the funding of mine.

Also in india their major businesses is backed by huge loans. They have more tha 49,000 crores loan in India. Their major profit making business is almost shutdown as government of India stopped buying imported coals. So, it can be said that Adani is at the verge of financial crisis.

| Particulars | FY17 | FY16 | FY15 | FY14 | FY13 | FY12 | FY11 | |

| Revenue | 38,056 | 35,131 | 65,520 | 56,226 | 47,352 | 39,904 | 26,827 | |

| Profit Before Tax (PBT) | 878 | 1,118 | 2,663 | 1,614 | 2,005 | 2,496 | 3,273 | |

| Profit After Tax (PAT) | 988 | 1,011 | 1,948 | 2,221 | 1,613 | 1,839 | 2,476 | |

| Dividend (incl tax on dividend) | 53 | 44 | 194 | 189 | 181 | 153 | 130 | |

| EPS (in ) | 9 | 9 | 18 | 20 | 15 | 17 | 23 |

Homework Sourse

Homework Sourse