Calculate interest expense for 20X2 based on the following i

Calculate interest expense for 20X2 based on the following information:

Accrued interest expense at 31 December 20X1: $10,000

Accrued interest expense at 31 December 20X2: $5,000

Interest paid in cash in 20X2: $95,000

Interest capitalized into construction in progress in 20X2: $0

Select one:

a. $90,000

b. $100,000

c. $85,000

d. $95,000

e. $105,000

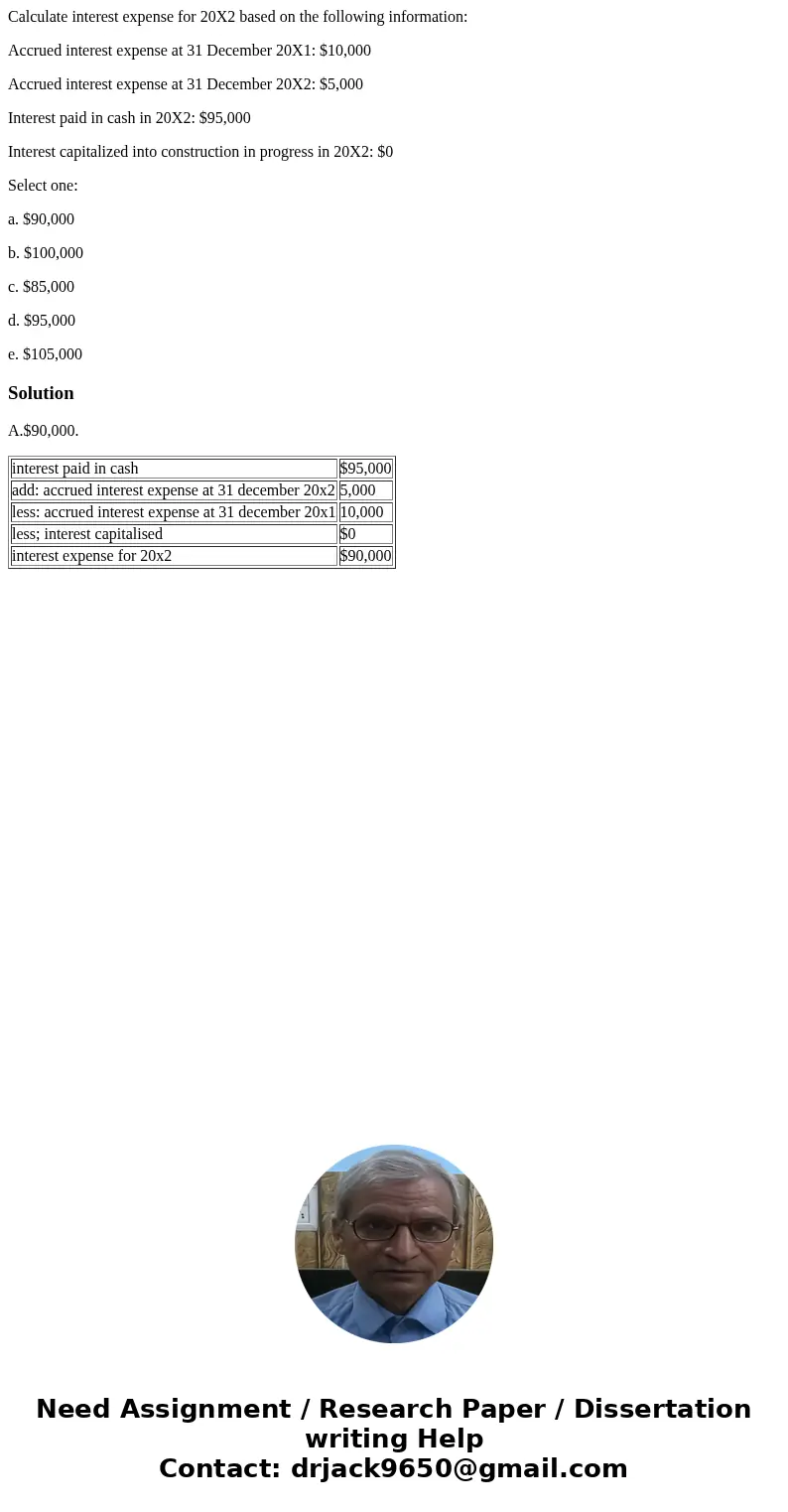

Solution

A.$90,000.

| interest paid in cash | $95,000 |

| add: accrued interest expense at 31 december 20x2 | 5,000 |

| less: accrued interest expense at 31 december 20x1 | 10,000 |

| less; interest capitalised | $0 |

| interest expense for 20x2 | $90,000 |

Homework Sourse

Homework Sourse