ing costs when its production level is 100000 units tshirts

ing costs when its production level is 100,000 units (t-shirts): Data Table Total costs for 100,000 units Direct materials Direct labor Variable manufacturing overhead 320,000 40,000 85,000 120,000 565,000 er Fixed manufacturing overhead Total manufacturing costs Print Done n continue to the next question. What to Work on Next

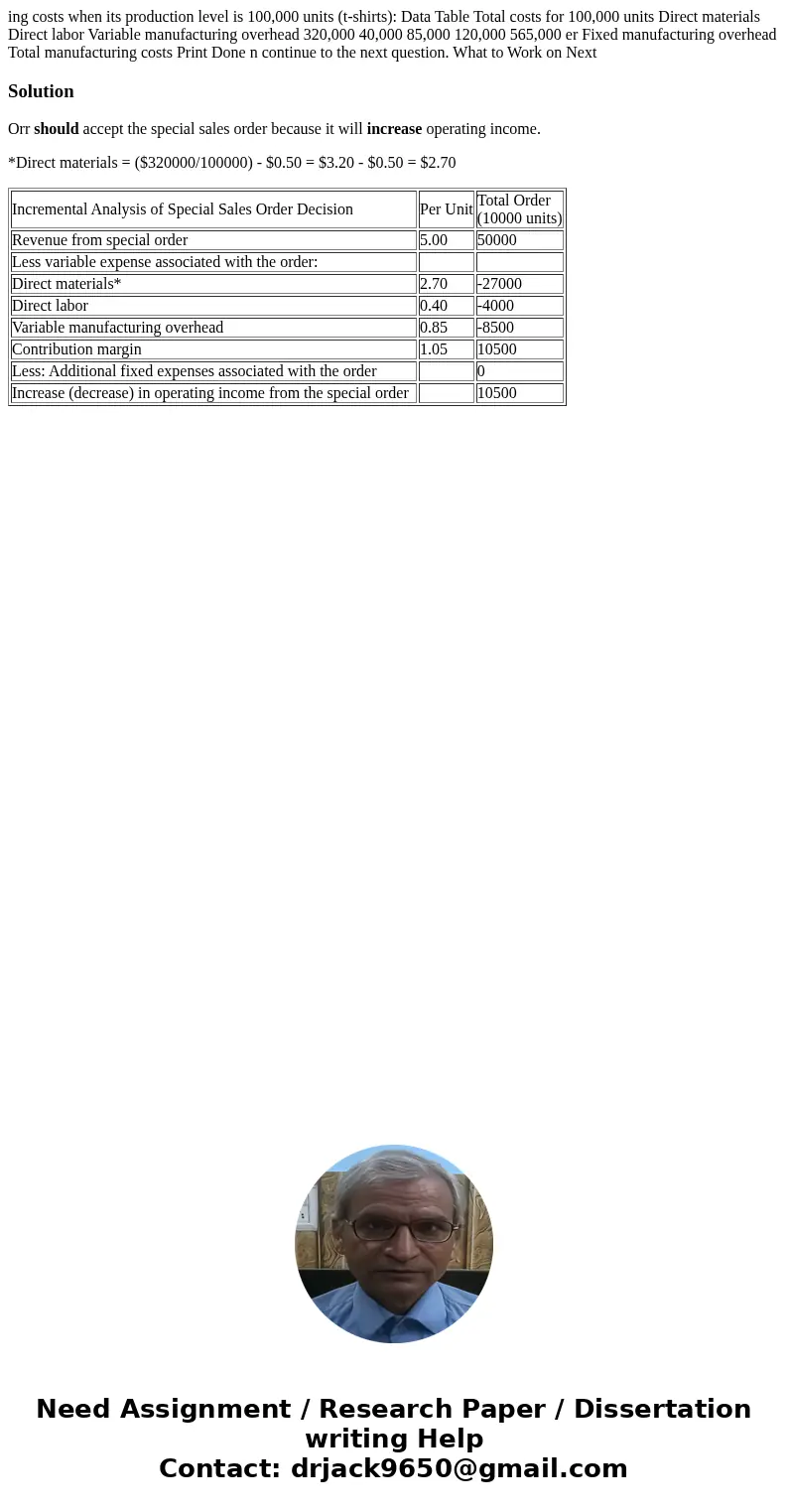

Solution

Orr should accept the special sales order because it will increase operating income.

*Direct materials = ($320000/100000) - $0.50 = $3.20 - $0.50 = $2.70

| Incremental Analysis of Special Sales Order Decision | Per Unit | Total Order (10000 units) |

| Revenue from special order | 5.00 | 50000 |

| Less variable expense associated with the order: | ||

| Direct materials* | 2.70 | -27000 |

| Direct labor | 0.40 | -4000 |

| Variable manufacturing overhead | 0.85 | -8500 |

| Contribution margin | 1.05 | 10500 |

| Less: Additional fixed expenses associated with the order | 0 | |

| Increase (decrease) in operating income from the special order | 10500 |

Homework Sourse

Homework Sourse