Natural Taste is a new startup company that is specialized i

Natural Taste is a new startup company that is specialized in water purifying industry has the following costs:

Safety instrument= $3,000

Materials waste = $1,000

Electricity cost in offices = $500

Periodic replacement parts after 10,000 bottles produced = $750 Cost of equipment and installation = $50,000

Minerals used at purification = $20,000

Clerical Salaries = $4,500

Material used in Bottles = $1,500

Administrative expenses = $2,900

Labor used in production = $11,500

Fixed manufacturing costs used in production = $10,500

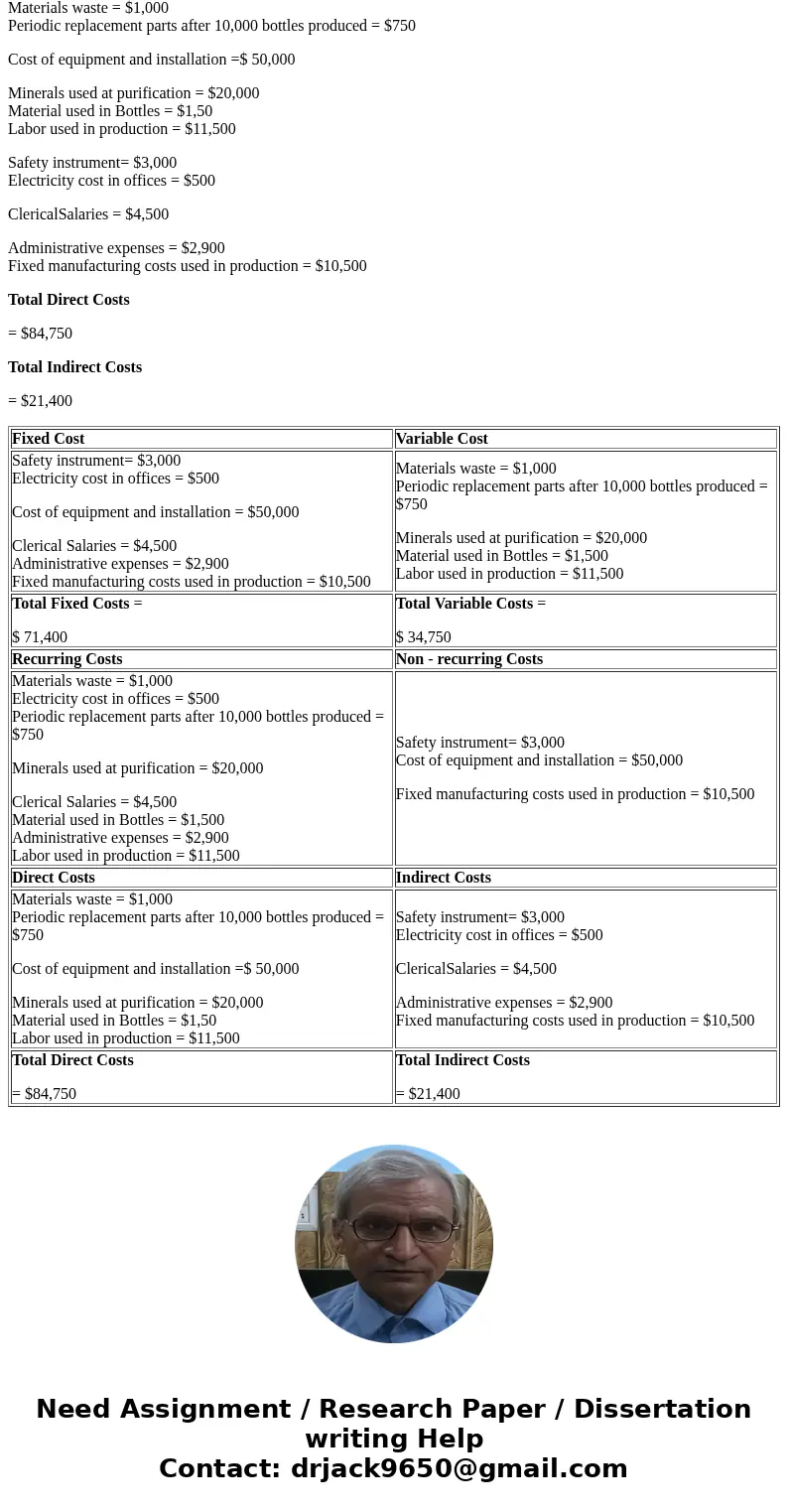

Categorize the costs given into fixed or variable costs, recurring or nonrecurring costs, and direct or indirect costs?

What is the total fixed cost, the total variable cost and total direct cost in dollars?

Solution

Safety instrument= $3,000

Electricity cost in offices = $500

Cost of equipment and installation = $50,000

Clerical Salaries = $4,500

Administrative expenses = $2,900

Fixed manufacturing costs used in production = $10,500

Materials waste = $1,000

Periodic replacement parts after 10,000 bottles produced = $750

Minerals used at purification = $20,000

Material used in Bottles = $1,500

Labor used in production = $11,500

Total Fixed Costs =

$ 71,400

Total Variable Costs =

$ 34,750

Materials waste = $1,000

Electricity cost in offices = $500

Periodic replacement parts after 10,000 bottles produced = $750

Minerals used at purification = $20,000

Clerical Salaries = $4,500

Material used in Bottles = $1,500

Administrative expenses = $2,900

Labor used in production = $11,500

Safety instrument= $3,000

Cost of equipment and installation = $50,000

Fixed manufacturing costs used in production = $10,500

Materials waste = $1,000

Periodic replacement parts after 10,000 bottles produced = $750

Cost of equipment and installation =$ 50,000

Minerals used at purification = $20,000

Material used in Bottles = $1,50

Labor used in production = $11,500

Safety instrument= $3,000

Electricity cost in offices = $500

ClericalSalaries = $4,500

Administrative expenses = $2,900

Fixed manufacturing costs used in production = $10,500

Total Direct Costs

= $84,750

Total Indirect Costs

= $21,400

| Fixed Cost | Variable Cost |

| Safety instrument= $3,000 Cost of equipment and installation = $50,000 Clerical Salaries = $4,500 | Materials waste = $1,000 Minerals used at purification = $20,000 |

| Total Fixed Costs = $ 71,400 | Total Variable Costs = $ 34,750 |

| Recurring Costs | Non - recurring Costs |

| Materials waste = $1,000 Minerals used at purification = $20,000 Clerical Salaries = $4,500 | Safety instrument= $3,000 Fixed manufacturing costs used in production = $10,500 |

| Direct Costs | Indirect Costs |

| Materials waste = $1,000 Cost of equipment and installation =$ 50,000 Minerals used at purification = $20,000 | Safety instrument= $3,000 ClericalSalaries = $4,500 Administrative expenses = $2,900 |

| Total Direct Costs = $84,750 | Total Indirect Costs = $21,400 |

Homework Sourse

Homework Sourse