Remaining Time 31 minutes 22 seconds QUESTION 1 Question Com

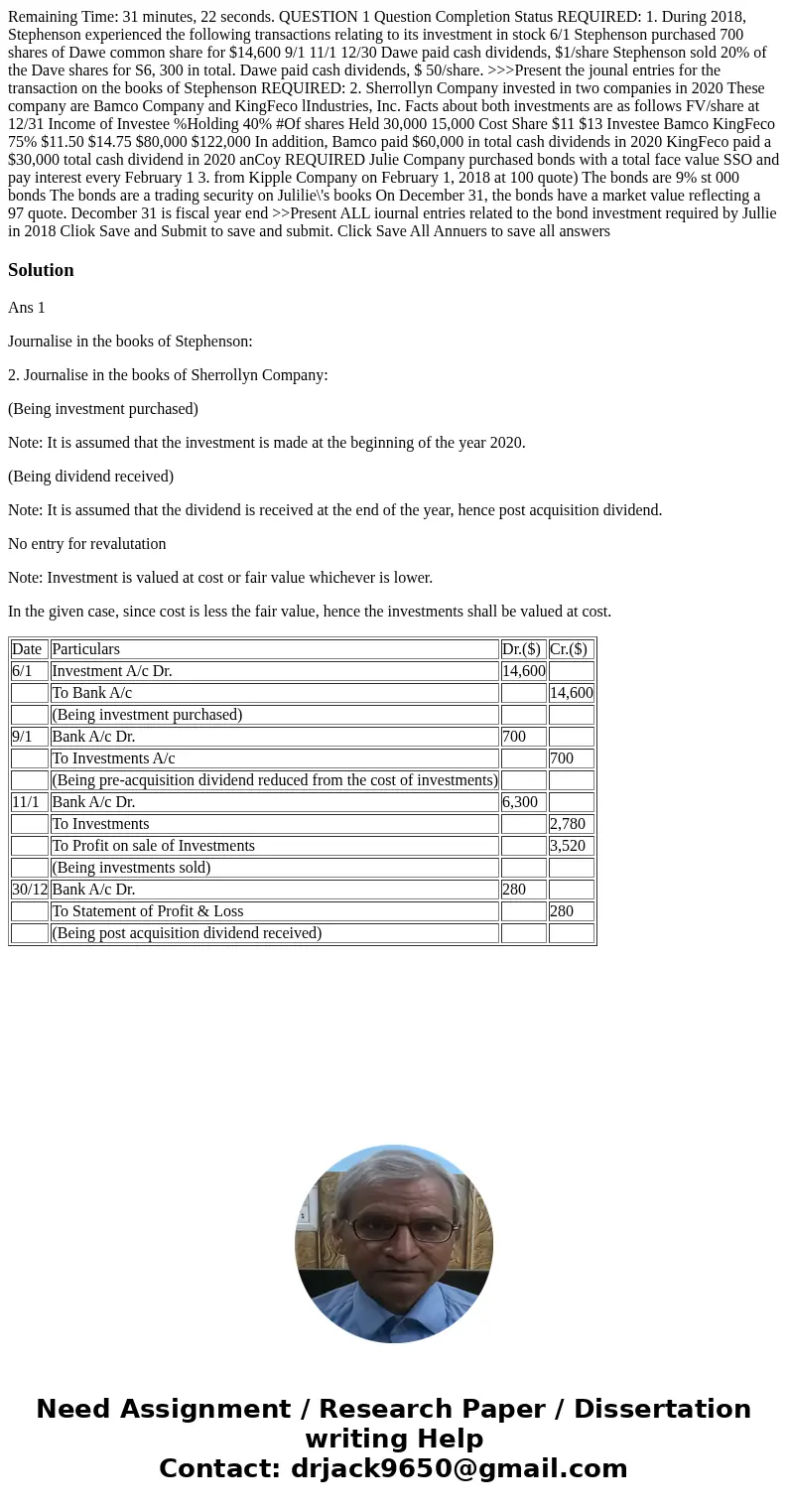

Remaining Time: 31 minutes, 22 seconds. QUESTION 1 Question Completion Status REQUIRED: 1. During 2018, Stephenson experienced the following transactions relating to its investment in stock 6/1 Stephenson purchased 700 shares of Dawe common share for $14,600 9/1 11/1 12/30 Dawe paid cash dividends, $1/share Stephenson sold 20% of the Dave shares for S6, 300 in total. Dawe paid cash dividends, $ 50/share. >>>Present the jounal entries for the transaction on the books of Stephenson REQUIRED: 2. Sherrollyn Company invested in two companies in 2020 These company are Bamco Company and KingFeco lIndustries, Inc. Facts about both investments are as follows FV/share at 12/31 Income of Investee %Holding 40% #Of shares Held 30,000 15,000 Cost Share $11 $13 Investee Bamco KingFeco 75% $11.50 $14.75 $80,000 $122,000 In addition, Bamco paid $60,000 in total cash dividends in 2020 KingFeco paid a $30,000 total cash dividend in 2020 anCoy REQUIRED Julie Company purchased bonds with a total face value SSO and pay interest every February 1 3. from Kipple Company on February 1, 2018 at 100 quote) The bonds are 9% st 000 bonds The bonds are a trading security on Julilie\'s books On December 31, the bonds have a market value reflecting a 97 quote. Decomber 31 is fiscal year end >>Present ALL iournal entries related to the bond investment required by Jullie in 2018 Cliok Save and Submit to save and submit. Click Save All Annuers to save all answers

Solution

Ans 1

Journalise in the books of Stephenson:

2. Journalise in the books of Sherrollyn Company:

(Being investment purchased)

Note: It is assumed that the investment is made at the beginning of the year 2020.

(Being dividend received)

Note: It is assumed that the dividend is received at the end of the year, hence post acquisition dividend.

No entry for revalutation

Note: Investment is valued at cost or fair value whichever is lower.

In the given case, since cost is less the fair value, hence the investments shall be valued at cost.

| Date | Particulars | Dr.($) | Cr.($) |

| 6/1 | Investment A/c Dr. | 14,600 | |

| To Bank A/c | 14,600 | ||

| (Being investment purchased) | |||

| 9/1 | Bank A/c Dr. | 700 | |

| To Investments A/c | 700 | ||

| (Being pre-acquisition dividend reduced from the cost of investments) | |||

| 11/1 | Bank A/c Dr. | 6,300 | |

| To Investments | 2,780 | ||

| To Profit on sale of Investments | 3,520 | ||

| (Being investments sold) | |||

| 30/12 | Bank A/c Dr. | 280 | |

| To Statement of Profit & Loss | 280 | ||

| (Being post acquisition dividend received) |

Homework Sourse

Homework Sourse