On March 31 2016 Canseco Plumbing Fixtures purchased equipme

On March 31, 2016, Canseco Plumbing Fixtures purchased equipment for $66,000. Residual value at the end of an estimated four-year service life is expected to be $6,000. The company expects the machine to operate for 15,000 hours.

Calculate depreciation expense for 2016 and 2017 using straight line method.

Calculate depreciation expense for 2016 and 2017 using sum-of-the-years’-digits method.

Calculate depreciation expense for 2016 and 2017 using double-declining balance method.

| On March 31, 2016, Canseco Plumbing Fixtures purchased equipment for $66,000. Residual value at the end of an estimated four-year service life is expected to be $6,000. The company expects the machine to operate for 15,000 hours. |

Solution

Answer a

Depreciation using Straight Line Method (SLM)

Cost of the eqipment = $66,000

Residual value = $6,000

Useful life of asset = 4 years

Annual depreciation under SLM = (Cost - Residual value) / useful life in years

= ($66,000 - $6,000) / 4

= $15,000

Answer -b

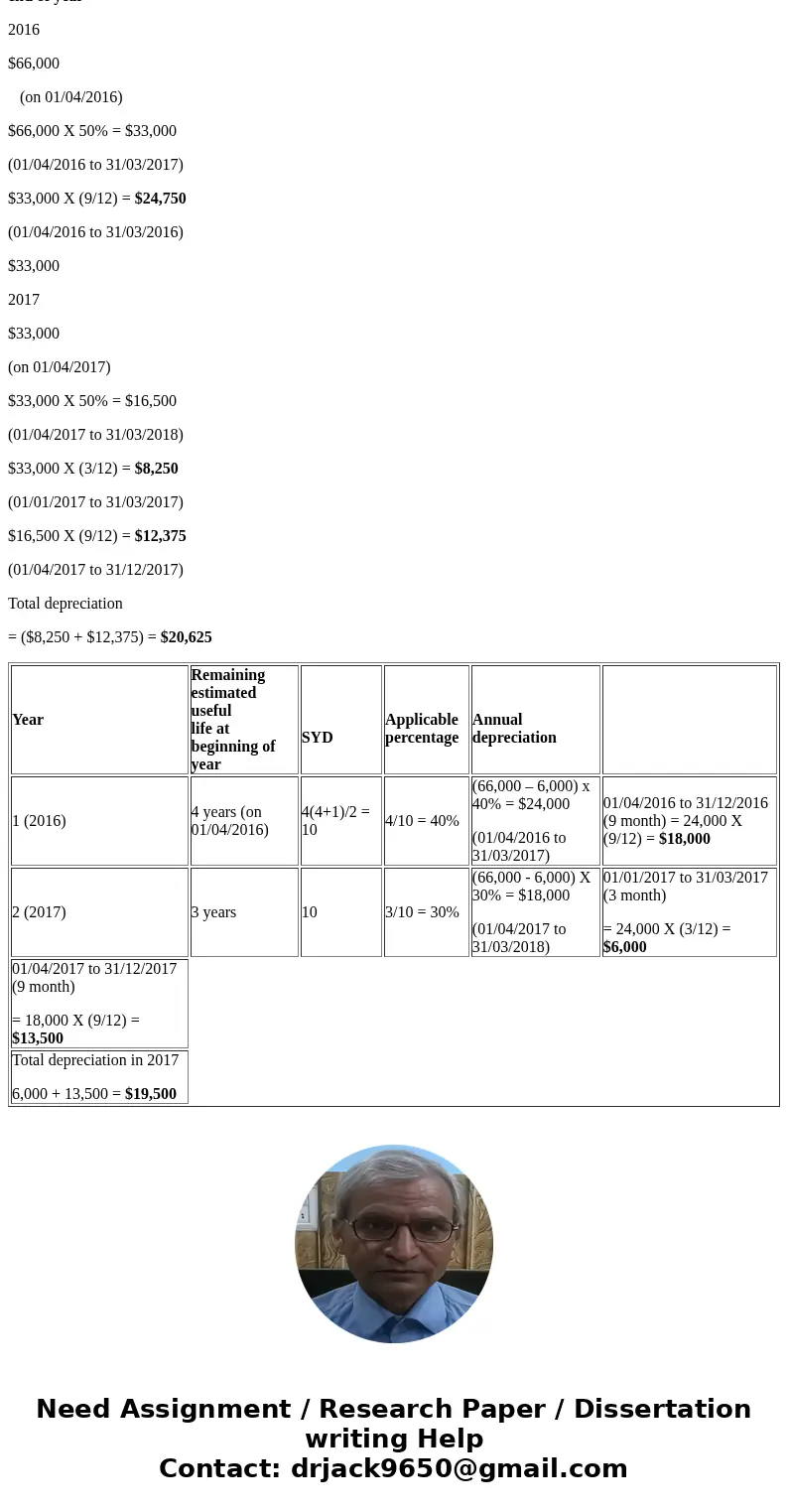

Calculation of depreciation using sum of years digit method:

Applicable percentage = Number of years of estimated life remaining at the beginning of the year

SYD

SYD = n(n+1)/2 where n is the estimated useful life of the asset.

Year

Remaining

estimated useful

life at beginning of year

SYD

Applicable

percentage

Annual

depreciation

1 (2016)

4 years (on 01/04/2016)

4(4+1)/2 = 10

4/10 = 40%

(66,000 – 6,000) x 40% = $24,000

(01/04/2016 to 31/03/2017)

01/04/2016 to 31/12/2016 (9 month) = 24,000 X (9/12) = $18,000

2 (2017)

3 years

10

3/10 = 30%

(66,000 - 6,000) X 30% = $18,000

(01/04/2017 to 31/03/2018)

01/01/2017 to 31/03/2017 (3 month)

= 24,000 X (3/12) = $6,000

01/04/2017 to 31/12/2017 (9 month)

= 18,000 X (9/12) = $13,500

Total depreciation in 2017

6,000 + 13,500 = $19,500

Answer-c:

Calculation of depreciation using double-declining balance method:

Straight line method rate (SL rate) = ¼ X 100 = 25%

Declining balance rate = 2 X 25% = 50%

Year

Net book value (NBV),

beginning of year

Double-declining balance depreciation (beginning NBV X Declining balance rate)

Net book value,

end of year

2016

$66,000

(on 01/04/2016)

$66,000 X 50% = $33,000

(01/04/2016 to 31/03/2017)

$33,000 X (9/12) = $24,750

(01/04/2016 to 31/03/2016)

$33,000

2017

$33,000

(on 01/04/2017)

$33,000 X 50% = $16,500

(01/04/2017 to 31/03/2018)

$33,000 X (3/12) = $8,250

(01/01/2017 to 31/03/2017)

$16,500 X (9/12) = $12,375

(01/04/2017 to 31/12/2017)

Total depreciation

= ($8,250 + $12,375) = $20,625

| Year | Remaining |

|

|

| |

| 1 (2016) | 4 years (on 01/04/2016) | 4(4+1)/2 = 10 | 4/10 = 40% | (66,000 – 6,000) x 40% = $24,000 (01/04/2016 to 31/03/2017) | 01/04/2016 to 31/12/2016 (9 month) = 24,000 X (9/12) = $18,000 |

| 2 (2017) | 3 years | 10 | 3/10 = 30% | (66,000 - 6,000) X 30% = $18,000 (01/04/2017 to 31/03/2018) | 01/01/2017 to 31/03/2017 (3 month) = 24,000 X (3/12) = $6,000 |

| 01/04/2017 to 31/12/2017 (9 month) = 18,000 X (9/12) = $13,500 | |||||

| Total depreciation in 2017 6,000 + 13,500 = $19,500 |

Homework Sourse

Homework Sourse