PTA Seminars Inc Federal ID 251234567 purchased all of its

Solution

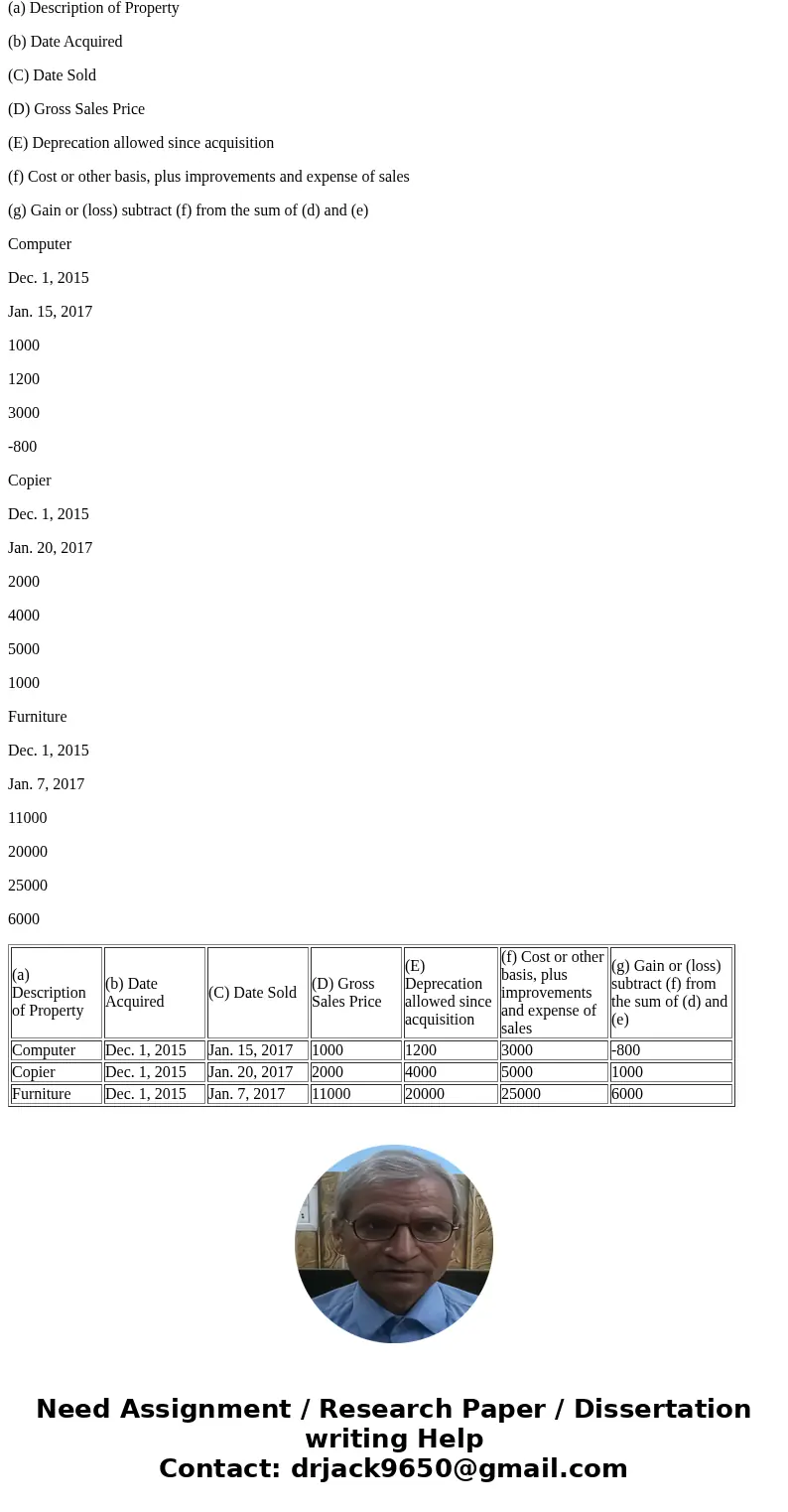

(a) Description of Property

(b) Date Acquired

(C) Date Sold

(D) Gross Sales Price

(E) Deprecation allowed since acquisition

(f) Cost or other basis, plus improvements and expense of sales

(g) Gain or (loss) subtract (f) from the sum of (d) and (e)

Computer

Dec. 1, 2015

Jan. 15, 2017

1000

1200

3000

-800

Copier

Dec. 1, 2015

Jan. 20, 2017

2000

4000

5000

1000

Furniture

Dec. 1, 2015

Jan. 7, 2017

11000

20000

25000

6000

| (a) Description of Property | (b) Date Acquired | (C) Date Sold | (D) Gross Sales Price | (E) Deprecation allowed since acquisition | (f) Cost or other basis, plus improvements and expense of sales | (g) Gain or (loss) subtract (f) from the sum of (d) and (e) |

| Computer | Dec. 1, 2015 | Jan. 15, 2017 | 1000 | 1200 | 3000 | -800 |

| Copier | Dec. 1, 2015 | Jan. 20, 2017 | 2000 | 4000 | 5000 | 1000 |

| Furniture | Dec. 1, 2015 | Jan. 7, 2017 | 11000 | 20000 | 25000 | 6000 |

Homework Sourse

Homework Sourse