Prepare IFE and Financial Ratios for Disneys Parks and Resor

Prepare IFE and Financial Ratios for Disney\'s Parks and Resorts division. For the Financial Ratios make sure to use the revenue statement and balance sheet in the exercise portion of the chapter.

Using the IFE and Financial Ratios, as well as your own analysis, describe how Disney is performing internally. Make sure to use important details from your IFE and Financial Ratio results and your critical reflections to draw conclusions. Post your analysis and conclusions in narrative form

Solution

Strengths

Weights

Rating

Weighted Score

Weaknesses

Weights

Rating

Weighted Score

Diverse Portfolio - Disney is spread across many businesses. Hence, it can support individual divisions with cheap money in case of immediate or short term cash requirement.

0.2

4

0.8

High Operating Expenses - New themes would require new setup of everything in the theme parks and resorts which means more expense for every change.

0.6

1

0.6

Brand Reputation - Reputation built up over decades. Its known for its clean family entertainment image

0.1

4

0.4

Heavily dependent on American Market - Since disney has its own hollywood production, themes are mainly american oriented. Which means a lot of global market is still unexplored.

0.4

2

0.8

New Acquasitions - Pixar and Marvel acquasitions helped in adding new themes to disneys parks

0.3

3

0.9

Global Presence - Reduces the risk of demand fluctuations

0.2

3

0.6

2.7

1.4

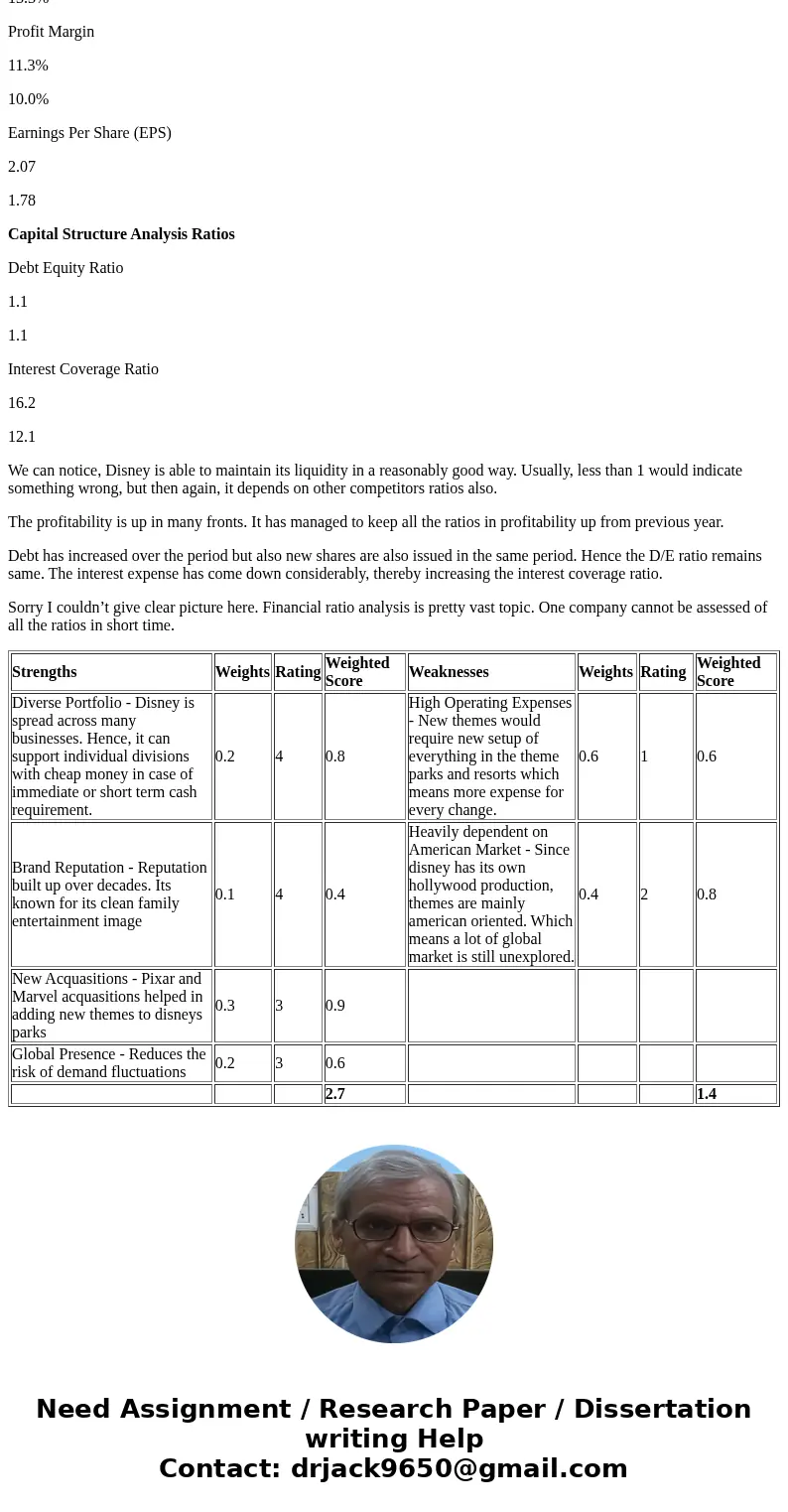

The score of 2.7 in strengths show that the Parks and Resorts division is very strong in these aspects and the concentrations should be more on weakness to improve their score. The operation expenses has to be brought down over a period as the competitors for Parks and resorts are not just other parks but also any other source of leisure of the consumers.

Though Disney parks have presence in many markets, they are still hugely dependent on themes from American market. This means they are leaving out markets like Chinese and Indian where almost a third of world population resides.

The given financial statements are Disney’s consolidated statements. Hence, we cannot strictly comment on the performance of one division (parks and resorts in this case) based on consolidated statement. Even if we want to know how the company is performing on overall level, the best way is to check the ratios and other parameters with that of its competitors. In Disney’s case, the competitors are Universal Studios, Six Flags Entertainment. Comparing with these companies would give a better picture of the company’s performance in the market.

However, given the financial statements, we can compare its own performance over the two years and see if the company is doing good or not and in what aspect it is better than not. Some of the important ratios are given as below for comparison between 2009 and 2010.

Liquidity Ratios

2010

2009

Current Ratio

1.1

1.3

Quick Ratio

0.3

0.4

Net Working Capital Ratio

0.0

0.0

Profitability Ratios

Return on Assets (ROA)

6.5%

5.7%

Return on Equity (ROE)

15.0%

13.3%

Profit Margin

11.3%

10.0%

Earnings Per Share (EPS)

2.07

1.78

Capital Structure Analysis Ratios

Debt Equity Ratio

1.1

1.1

Interest Coverage Ratio

16.2

12.1

We can notice, Disney is able to maintain its liquidity in a reasonably good way. Usually, less than 1 would indicate something wrong, but then again, it depends on other competitors ratios also.

The profitability is up in many fronts. It has managed to keep all the ratios in profitability up from previous year.

Debt has increased over the period but also new shares are also issued in the same period. Hence the D/E ratio remains same. The interest expense has come down considerably, thereby increasing the interest coverage ratio.

Sorry I couldn’t give clear picture here. Financial ratio analysis is pretty vast topic. One company cannot be assessed of all the ratios in short time.

| Strengths | Weights | Rating | Weighted Score | Weaknesses | Weights | Rating | Weighted Score |

| Diverse Portfolio - Disney is spread across many businesses. Hence, it can support individual divisions with cheap money in case of immediate or short term cash requirement. | 0.2 | 4 | 0.8 | High Operating Expenses - New themes would require new setup of everything in the theme parks and resorts which means more expense for every change. | 0.6 | 1 | 0.6 |

| Brand Reputation - Reputation built up over decades. Its known for its clean family entertainment image | 0.1 | 4 | 0.4 | Heavily dependent on American Market - Since disney has its own hollywood production, themes are mainly american oriented. Which means a lot of global market is still unexplored. | 0.4 | 2 | 0.8 |

| New Acquasitions - Pixar and Marvel acquasitions helped in adding new themes to disneys parks | 0.3 | 3 | 0.9 | ||||

| Global Presence - Reduces the risk of demand fluctuations | 0.2 | 3 | 0.6 | ||||

| 2.7 | 1.4 |

Homework Sourse

Homework Sourse