CHAPTER 19JOB ORDER COSTING Study 0 Progress Submit Quiz Pre

CHAPTER 19-JOB ORDER COSTING Study 0 Progress Submit Quiz Previous 0 Page 3 of 9 E0 Next o0 During July, Jamal Company incurred factory overhead as follows: utilities, $6,500; accumulated depreciation, $2,500; and indirect salaries, $3,600. Which of the following journal entries is correct? a. Utilities Expense, $6,500 Dr; Depreciation Expense, $2,500 Dr.; Wages Expense, $3,600 Dr.; b. Accounts Payable, $12,600 Dr.; Utilities Expense, $6,500 Cr: Depreciation Expense, $2.500 Ci c. Factory Overhead, $12,600 Dr.; Utilities Payable, $6,500 Cr.; Accumulated Depreciation, $2.500 Cr; d. Work in Process, $12,600 Dr; Utilities Expense, $6,500 Cr; Accumulated Depreciation, $2,500 Cr.; Accounts Payable, $12,600 Cr Wages Payable, $3,600 Cr Wages Payable, $3,600 Cr Wages Payable, $3,600 Cr CHAPTER 19-JOB ORDER COSTING G Previous 0 Page 2 of 90 Next 0 All of the following statements are true regarding cost accounting systems except Study 0Progress Submit Quiz a. a company must use either a job order cost system for all of its products/services or a process cost system for all of its products/services-it cannot use both. b. a company may use a job order cost system for some of its products and a process cost system for c. managers use product costs from cost accounting systems for setting product prices, controlling d. a job order cost system provides product costs for each quantity of product that is manufactured. other products. operations, and developing financial statements.

Solution

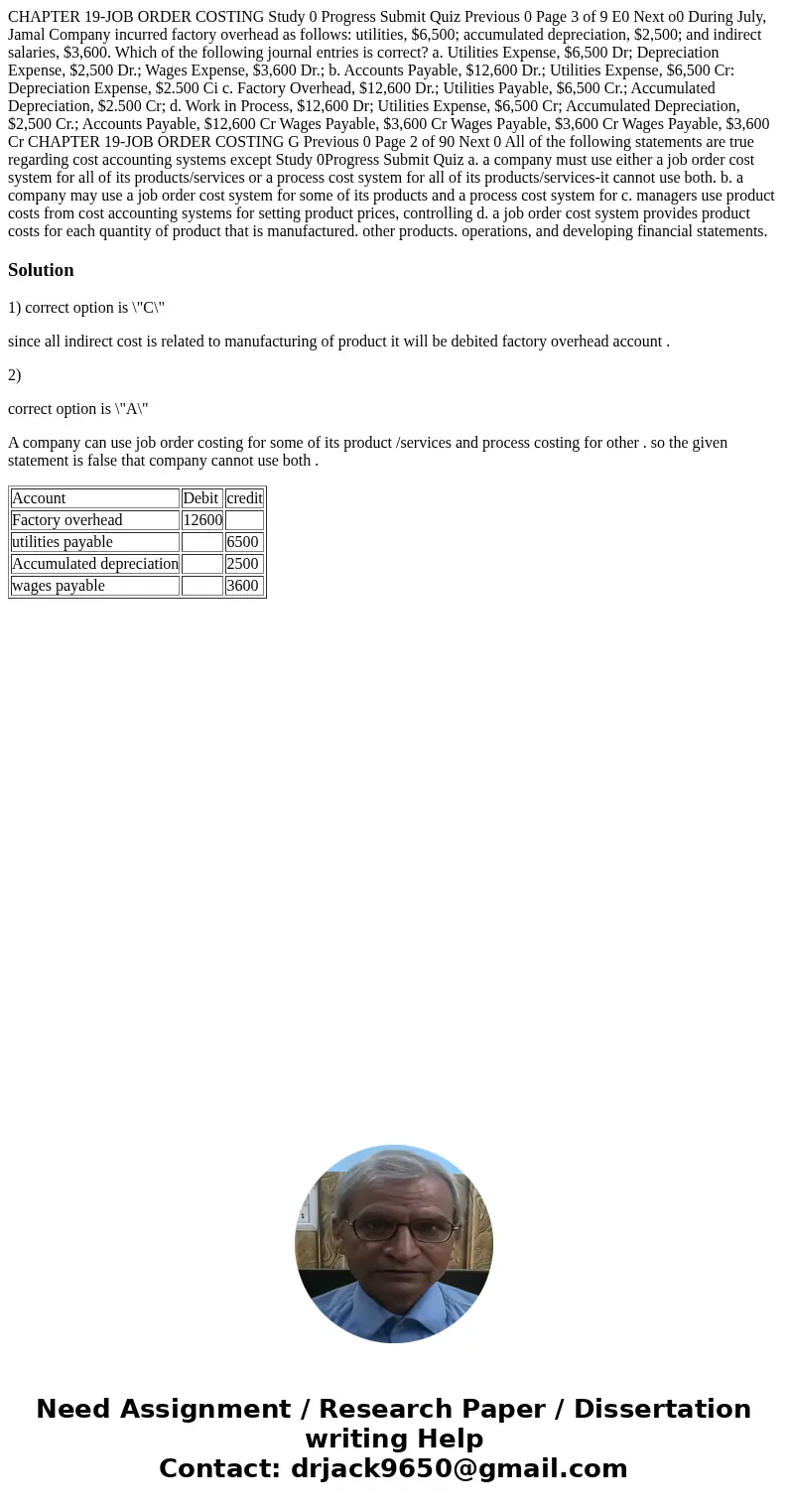

1) correct option is \"C\"

since all indirect cost is related to manufacturing of product it will be debited factory overhead account .

2)

correct option is \"A\"

A company can use job order costing for some of its product /services and process costing for other . so the given statement is false that company cannot use both .

| Account | Debit | credit |

| Factory overhead | 12600 | |

| utilities payable | 6500 | |

| Accumulated depreciation | 2500 | |

| wages payable | 3600 |

Homework Sourse

Homework Sourse