Land 5100 69 Advertis 5400 for the office and 2580 for the s

Solution

1) adjusted trail balance (where adjustments required)

(w1) R/E

-here dividend decleared and paid so debit decrease in retained earnings

-if it just declared, in balance sheet debit cash dividend decleared (decleared before year end) it is not the case here

(w2) issuing bond

assuming bond issued for cash:

-debit cash for amount of bond

-credit bonds payable

(w3) depreciation

annual depreciation given only to account for 4th quarter\'s so *1/4

office= 5400*(1/4) =1350

sales dep= 2580*(1/4) =645

Debit depreciation and credit Accumulated depreciation)

(w4) advertising

prepaid advertising expense is for 12 months only 1 month belongs to this accounting year.

so 600-600*(11/12)=600-(500)

=100

600(Asset) is already added in trail balance so to reduce by consumed 100 for this year debit advertising expense by 100

(w5) interest on notes payable

8% is annual interest so 1 month rate 8*(1/12) =0.666 =0.67%

int= 29550*0.0067 =198

credit increase in liability

2)Balance sheet

Non Current Asset

land 135,200

equipment(60,260-645(w3) 59,615

building(81,380-1350(w3) 80030

current assets

Receivables 100,090

inventory 15,100

prepaid advertising(4910-100) 4810

cash or bank (-6380+50,000(bonds)-12000(dividend)) 31620

TOTAL ASSETS 426465

Equity

share capital ($1) 69,080

retained earnings(fron statement of RE below) 223767

non current liability

bonds payable (27340+50000(w2) 77340

current liability

int payable 433

notes payable(29550+198(w5) 29748

income tax payable 2970

TOTAL EQUITY AND LIABILITY 426465

Tips:Chance of Balance statement tally is absolute zero. but check for adjustments

3)income statement

Revenue 571,968

less:sales return and allowance (56427)

sales discount (24241)

net SALES REVENUE =491300

Cost of sales(w6) (142,100)

operating profit 349200

interest expense (2333)

utility expense (1300)

advertisind (1560)

selling expense (37,240)

(5000commision+32240 wages)

administration (22980)

(15000wage+depreciation7980(all office+sales))

PROFIT BEFORE TAX 283787

TAX @16% (283787*0.16) (45406)

pat 238381

(w6)cost of sales

opening inventory at 12/2016 -20,220

+ purchases -136980

-closing inventory (15,100)

cos 142100

4) Statement of reteained earning for year ended december 31

opening retained earnings is not given so here required statement of adjusted retained earnings

retained earnings as pet TB : 50366

adj: prior period adjustments net of tax

adjusted RE :50366

net income earned in 12/201 (from above) 238381

less: dividend paid (12000+52980) (64980)

RE at end of 12/2017 223767

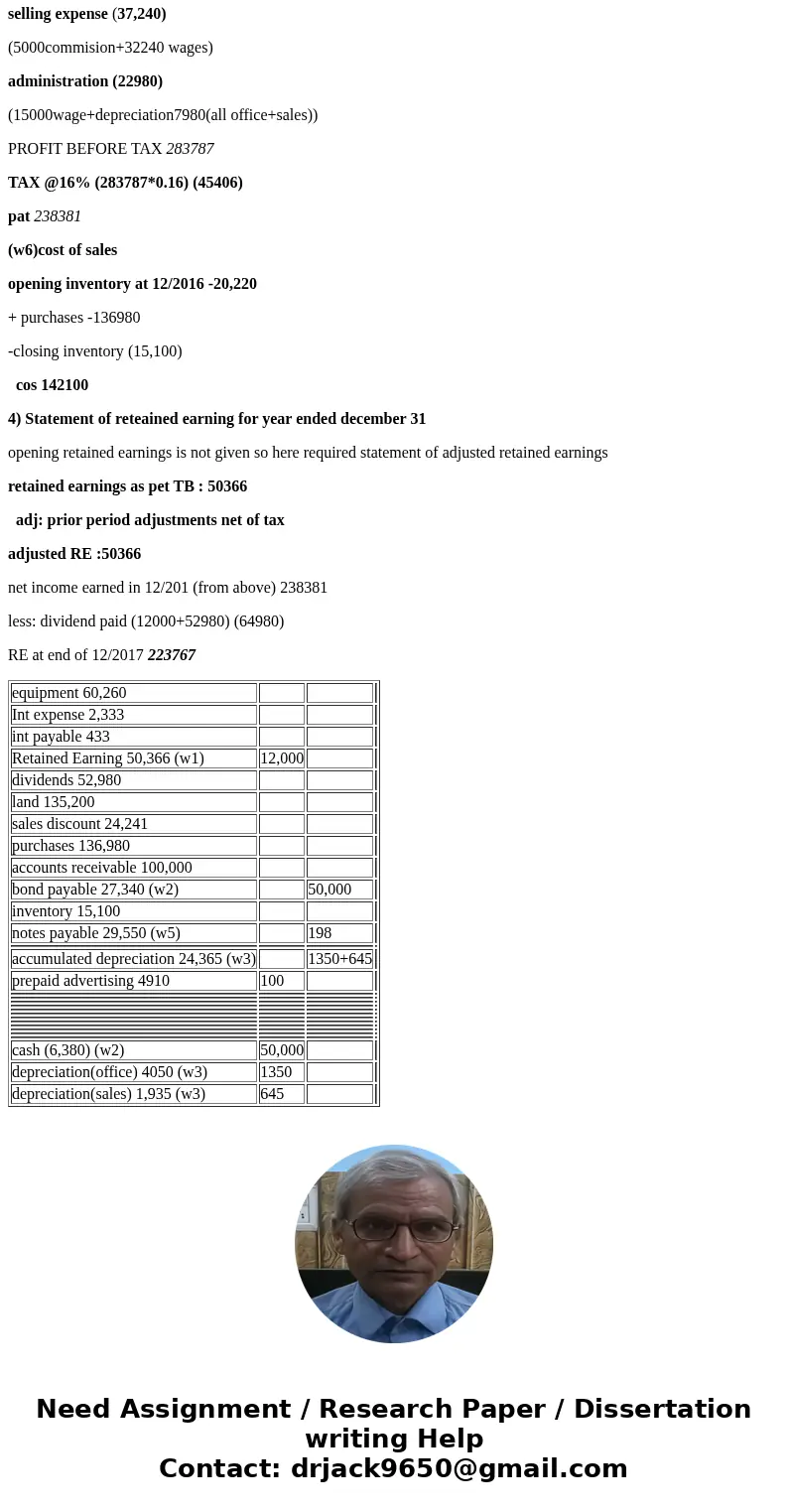

| equipment 60,260 | |||

| Int expense 2,333 | |||

| int payable 433 | |||

| Retained Earning 50,366 (w1) | 12,000 | ||

| dividends 52,980 | |||

| land 135,200 | |||

| sales discount 24,241 | |||

| purchases 136,980 | |||

| accounts receivable 100,000 | |||

| bond payable 27,340 (w2) | 50,000 | ||

| inventory 15,100 | |||

| notes payable 29,550 (w5) | 198 | ||

| accumulated depreciation 24,365 (w3) | 1350+645 | ||

| prepaid advertising 4910 | 100 | ||

| cash (6,380) (w2) | 50,000 | ||

| depreciation(office) 4050 (w3) | 1350 | ||

| depreciation(sales) 1,935 (w3) | 645 |

Homework Sourse

Homework Sourse