Given the following data for 2017 Administrative costs 35000

Given the following data for 2017:

Administrative costs $35,000

Current liabilities 18,000

Building depreciation (80% for plant) 25,000

Indirect materials and supplies 4,000

Sales commission expenses 12,000

Accounts receivable 15,000

Direct materials inventory, Jan 1, 2017 15,000

Direct labor 32,000

Direct materials inventory, Dec 31, 2017 16,000

Finished goods inventory, Jan 1, 2017 8,000

Finished goods inventory, Dec 31, 2017 7,000

Materials purchases 20,000

Work in process inventory, Dec 31, 2017 10,000

Supervisory and indirect labor 12,000

Accounts payable 9,000

Property taxes (80% for plant) 10,000

Utilities and power (90% for plant) 30,000

Work in process inventory, Jan 1, 2017 12,000

Sales revenue 200,000

Stockholders’ equity 75,000

Determine:

a) The cost of goods manufactured.

b) The operating income.

c) Give an example of:

i. Direct cost

i. Product cost

i. Period cost

i. Variable cost

Solution

2)

cost of goods sold =beginning FG+cost of goods manufactured-ending FG

= 8000+124000-7000

= 125000

OPerating expense= Administrative costs +building depreciation+ Sales commission expenses +property taxes+utilities and power

35000+[25000*.20]+12000+[10000*.20]+[30000*.10]

35000+ 5000+12000+2000+3000

57000

operating income = sales- cost of goods sold -operating expense

= 200000-125000-57000

= 18000

3)a )Direct cost = direct labor

product cost= Direct material used

period cost= sales commission.

variable cost = direct labor

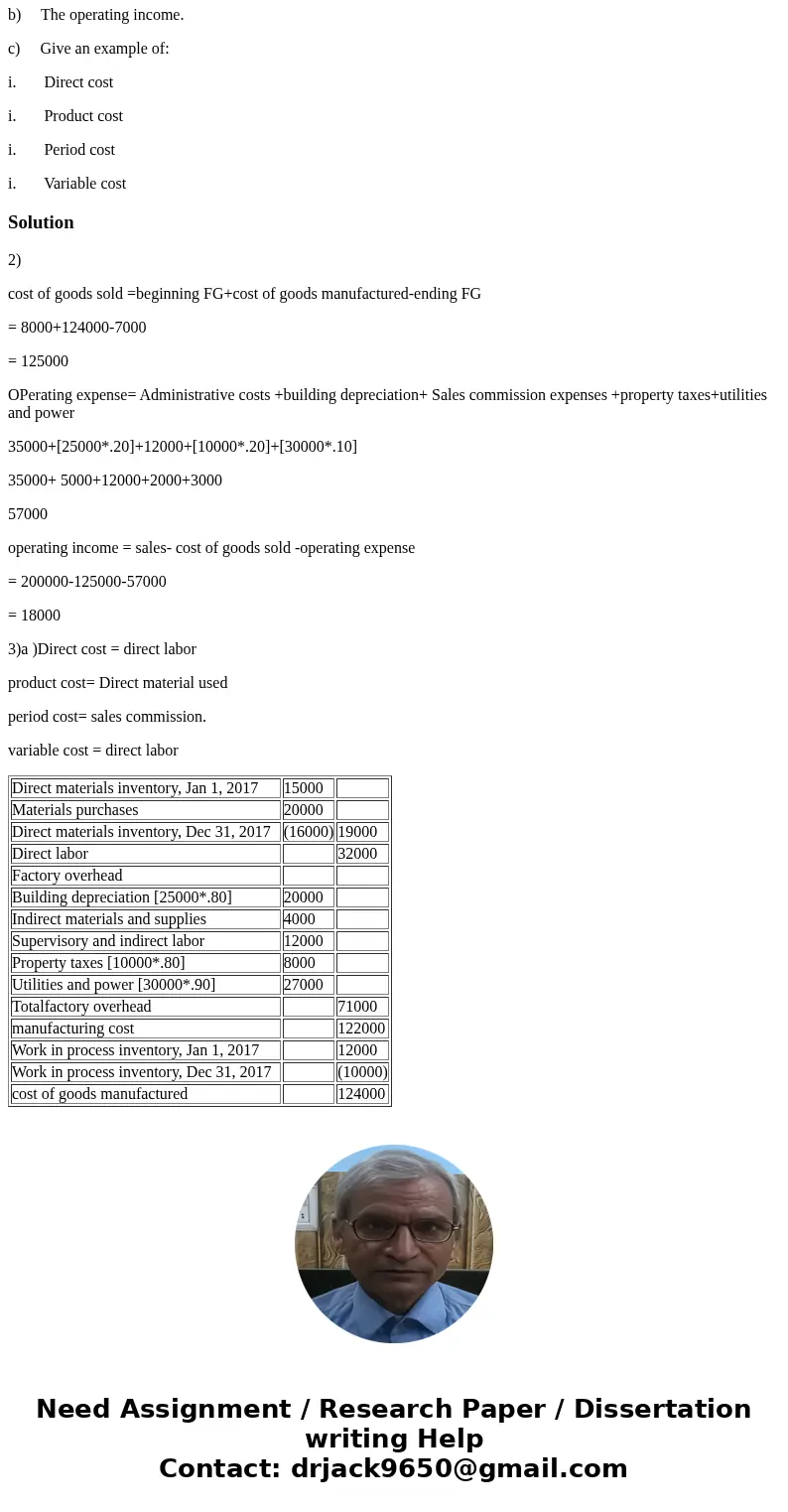

| Direct materials inventory, Jan 1, 2017 | 15000 | |

| Materials purchases | 20000 | |

| Direct materials inventory, Dec 31, 2017 | (16000) | 19000 |

| Direct labor | 32000 | |

| Factory overhead | ||

| Building depreciation [25000*.80] | 20000 | |

| Indirect materials and supplies | 4000 | |

| Supervisory and indirect labor | 12000 | |

| Property taxes [10000*.80] | 8000 | |

| Utilities and power [30000*.90] | 27000 | |

| Totalfactory overhead | 71000 | |

| manufacturing cost | 122000 | |

| Work in process inventory, Jan 1, 2017 | 12000 | |

| Work in process inventory, Dec 31, 2017 | (10000) | |

| cost of goods manufactured | 124000 |

Homework Sourse

Homework Sourse