The net profit has been calculated for five investment oppor

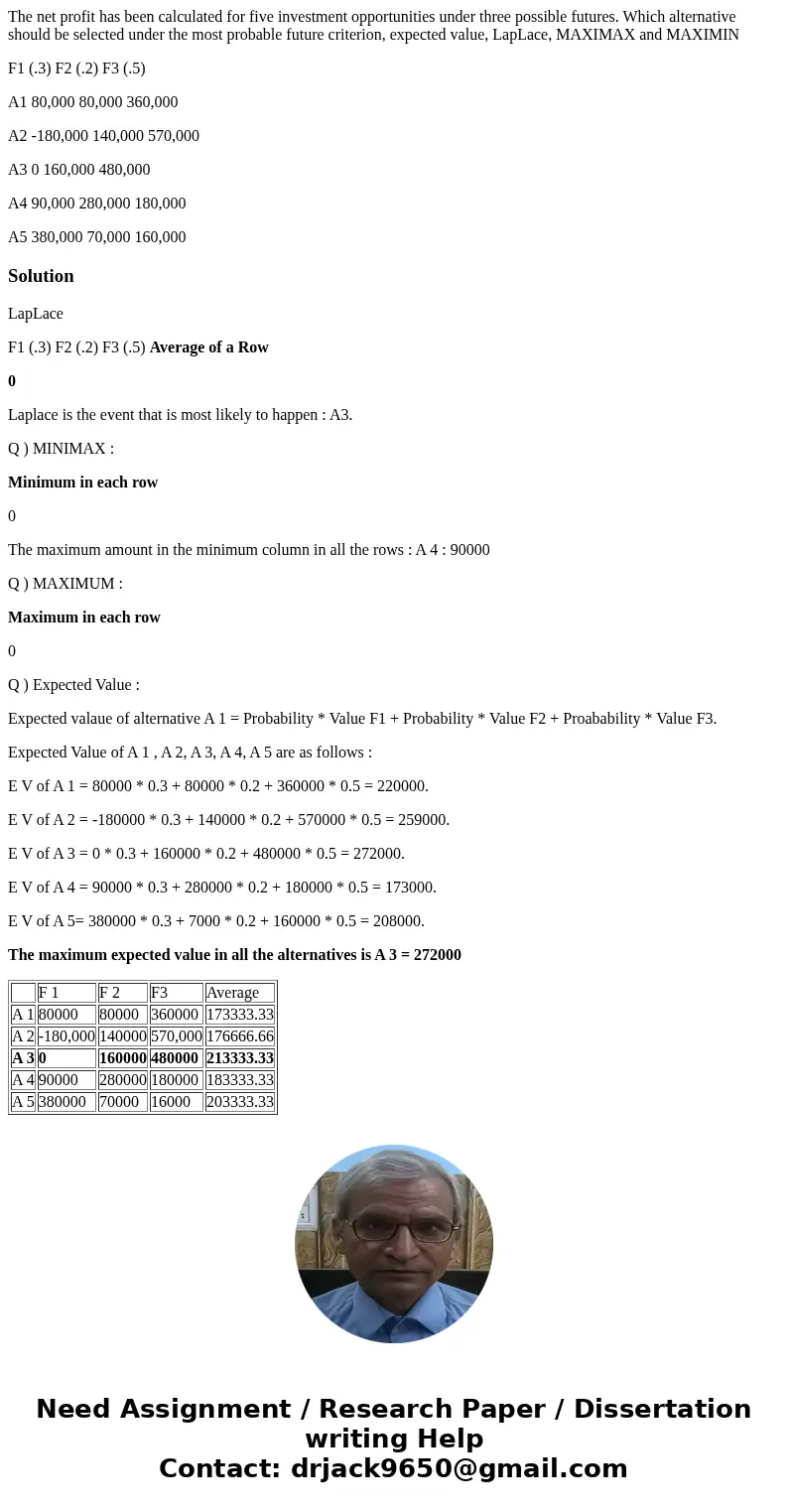

The net profit has been calculated for five investment opportunities under three possible futures. Which alternative should be selected under the most probable future criterion, expected value, LapLace, MAXIMAX and MAXIMIN

F1 (.3) F2 (.2) F3 (.5)

A1 80,000 80,000 360,000

A2 -180,000 140,000 570,000

A3 0 160,000 480,000

A4 90,000 280,000 180,000

A5 380,000 70,000 160,000

Solution

LapLace

F1 (.3) F2 (.2) F3 (.5) Average of a Row

0

Laplace is the event that is most likely to happen : A3.

Q ) MINIMAX :

Minimum in each row

0

The maximum amount in the minimum column in all the rows : A 4 : 90000

Q ) MAXIMUM :

Maximum in each row

0

Q ) Expected Value :

Expected valaue of alternative A 1 = Probability * Value F1 + Probability * Value F2 + Proabability * Value F3.

Expected Value of A 1 , A 2, A 3, A 4, A 5 are as follows :

E V of A 1 = 80000 * 0.3 + 80000 * 0.2 + 360000 * 0.5 = 220000.

E V of A 2 = -180000 * 0.3 + 140000 * 0.2 + 570000 * 0.5 = 259000.

E V of A 3 = 0 * 0.3 + 160000 * 0.2 + 480000 * 0.5 = 272000.

E V of A 4 = 90000 * 0.3 + 280000 * 0.2 + 180000 * 0.5 = 173000.

E V of A 5= 380000 * 0.3 + 7000 * 0.2 + 160000 * 0.5 = 208000.

The maximum expected value in all the alternatives is A 3 = 272000

| F 1 | F 2 | F3 | Average | |

| A 1 | 80000 | 80000 | 360000 | 173333.33 |

| A 2 | -180,000 | 140000 | 570,000 | 176666.66 |

| A 3 | 0 | 160000 | 480000 | 213333.33 |

| A 4 | 90000 | 280000 | 180000 | 183333.33 |

| A 5 | 380000 | 70000 | 16000 | 203333.33 |

Homework Sourse

Homework Sourse