Problem 2 Hubbard Company purchased a truck on January 1 200

Problem 2 Hubbard Company purchased a truck on January 1, 2009, at a that the truck would have a useful life of 4 years and a re Required cost of $34,000. The company estimated A. Calculate depreci declining balance method for 2009. ation expense and record the journal entry under straight line and the double B. What is the accumulated depreciation at the end of year 2 under each depreciation method

Solution

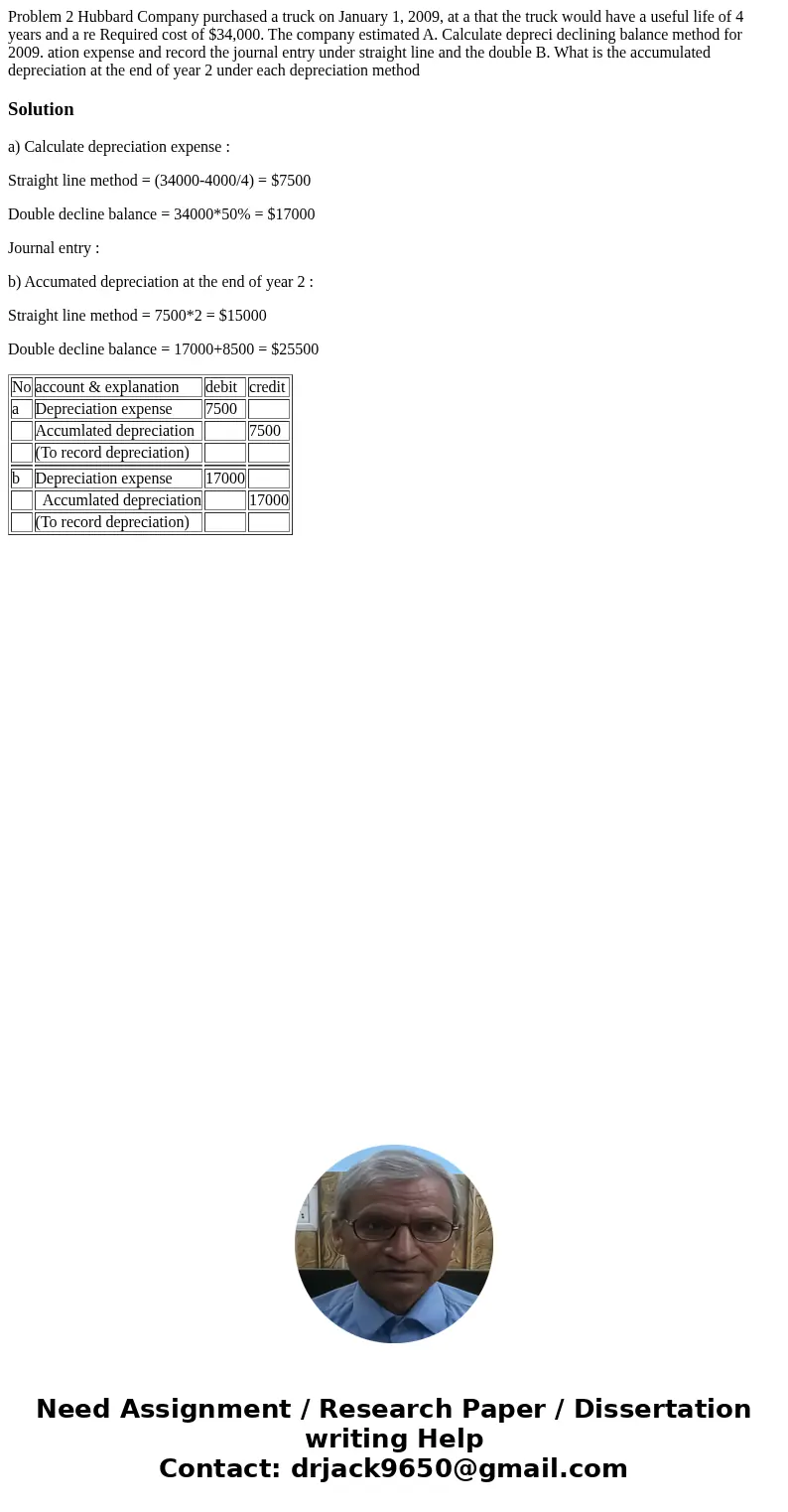

a) Calculate depreciation expense :

Straight line method = (34000-4000/4) = $7500

Double decline balance = 34000*50% = $17000

Journal entry :

b) Accumated depreciation at the end of year 2 :

Straight line method = 7500*2 = $15000

Double decline balance = 17000+8500 = $25500

| No | account & explanation | debit | credit |

| a | Depreciation expense | 7500 | |

| Accumlated depreciation | 7500 | ||

| (To record depreciation) | |||

| b | Depreciation expense | 17000 | |

| Accumlated depreciation | 17000 | ||

| (To record depreciation) |

Homework Sourse

Homework Sourse