Develop an estimated regression equation using trade price a

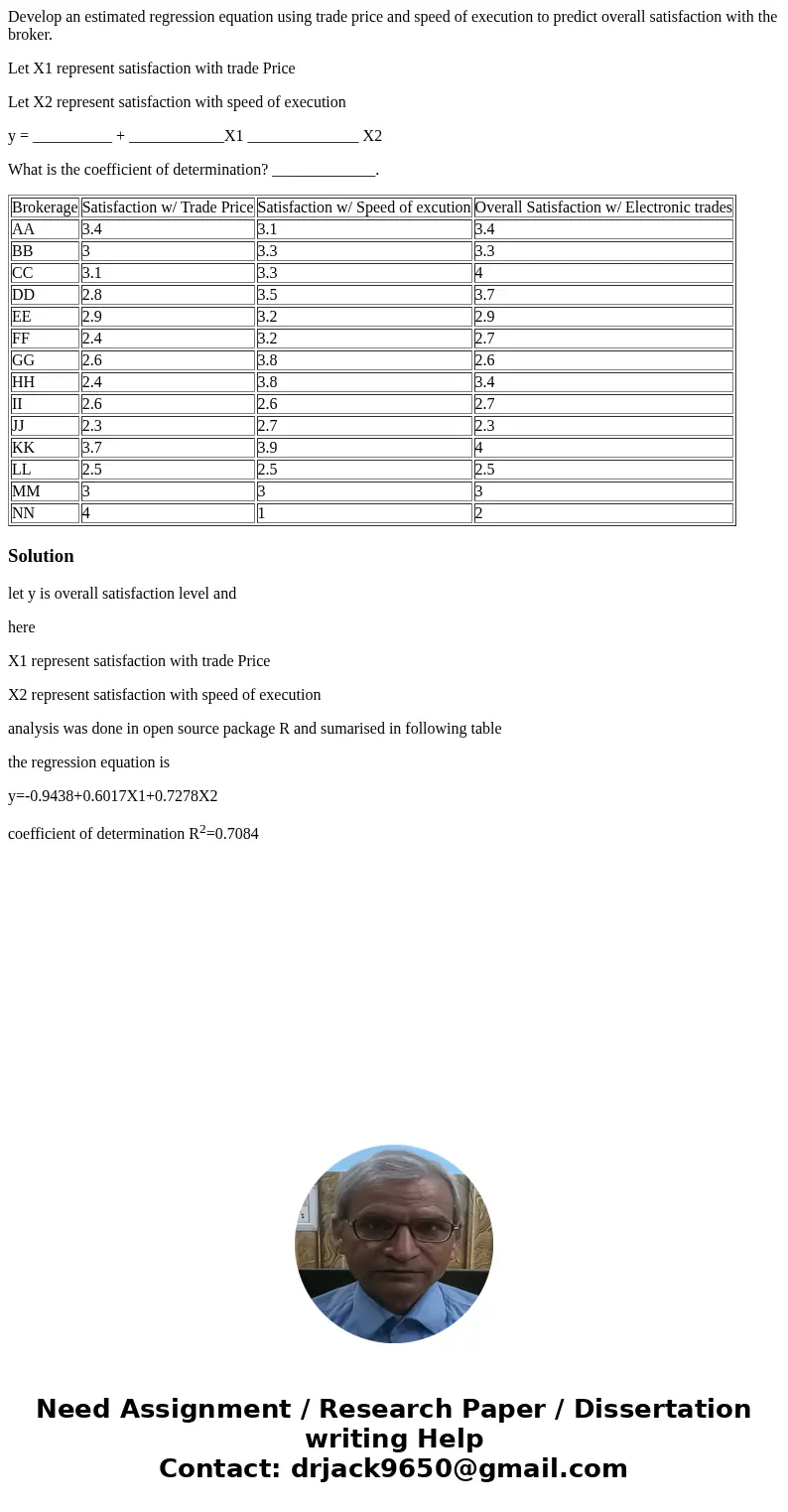

Develop an estimated regression equation using trade price and speed of execution to predict overall satisfaction with the broker.

Let X1 represent satisfaction with trade Price

Let X2 represent satisfaction with speed of execution

y = __________ + ____________X1 ______________ X2

What is the coefficient of determination? _____________.

| Brokerage | Satisfaction w/ Trade Price | Satisfaction w/ Speed of excution | Overall Satisfaction w/ Electronic trades |

| AA | 3.4 | 3.1 | 3.4 |

| BB | 3 | 3.3 | 3.3 |

| CC | 3.1 | 3.3 | 4 |

| DD | 2.8 | 3.5 | 3.7 |

| EE | 2.9 | 3.2 | 2.9 |

| FF | 2.4 | 3.2 | 2.7 |

| GG | 2.6 | 3.8 | 2.6 |

| HH | 2.4 | 3.8 | 3.4 |

| II | 2.6 | 2.6 | 2.7 |

| JJ | 2.3 | 2.7 | 2.3 |

| KK | 3.7 | 3.9 | 4 |

| LL | 2.5 | 2.5 | 2.5 |

| MM | 3 | 3 | 3 |

| NN | 4 | 1 | 2 |

Solution

let y is overall satisfaction level and

here

X1 represent satisfaction with trade Price

X2 represent satisfaction with speed of execution

analysis was done in open source package R and sumarised in following table

the regression equation is

y=-0.9438+0.6017X1+0.7278X2

coefficient of determination R2=0.7084

Homework Sourse

Homework Sourse