During 2017 Whispering Company started a construction job wi

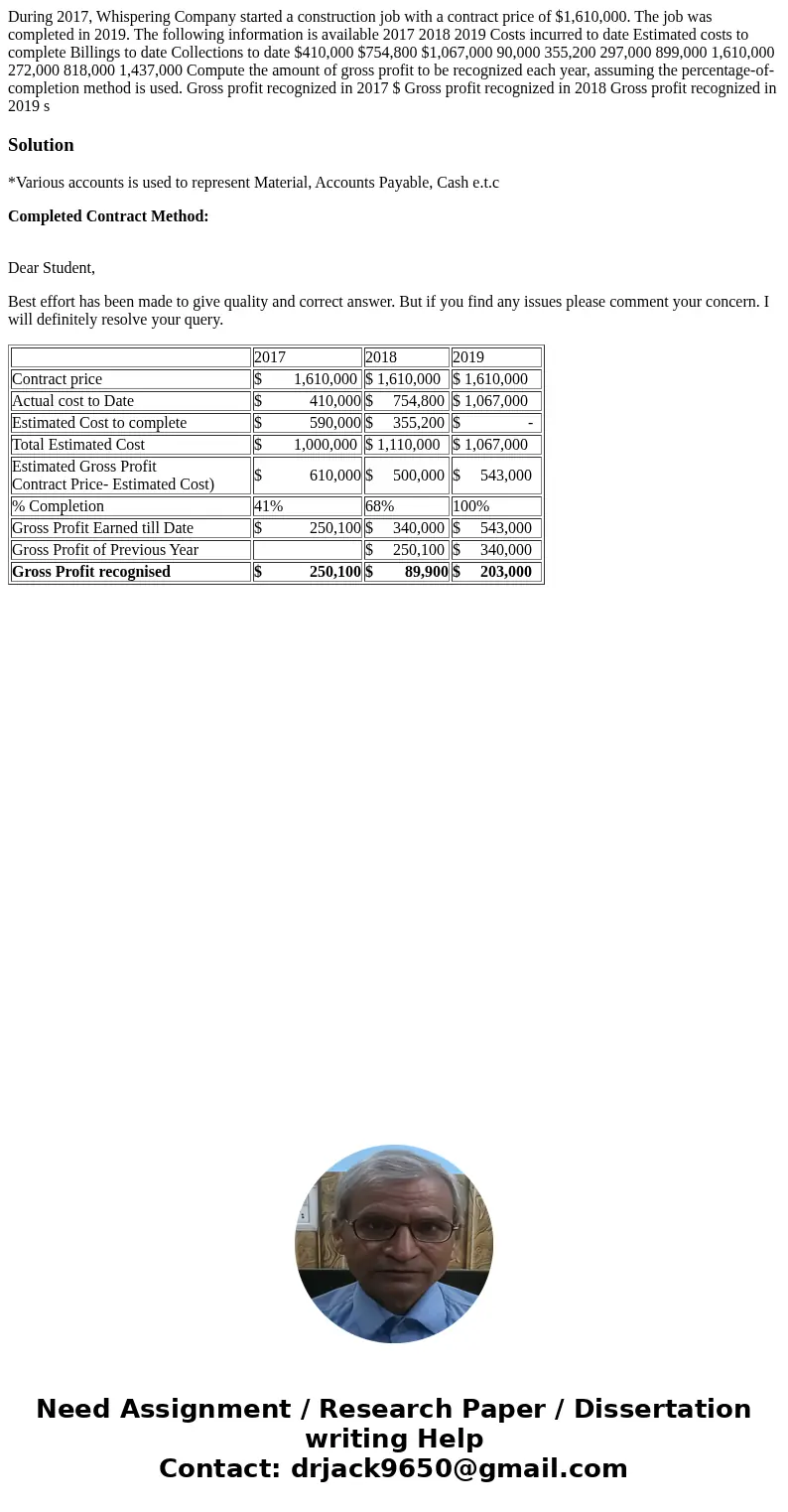

During 2017, Whispering Company started a construction job with a contract price of $1,610,000. The job was completed in 2019. The following information is available 2017 2018 2019 Costs incurred to date Estimated costs to complete Billings to date Collections to date $410,000 $754,800 $1,067,000 90,000 355,200 297,000 899,000 1,610,000 272,000 818,000 1,437,000 Compute the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used. Gross profit recognized in 2017 $ Gross profit recognized in 2018 Gross profit recognized in 2019 s

Solution

*Various accounts is used to represent Material, Accounts Payable, Cash e.t.c

Completed Contract Method:

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

| 2017 | 2018 | 2019 | |

| Contract price | $ 1,610,000 | $ 1,610,000 | $ 1,610,000 |

| Actual cost to Date | $ 410,000 | $ 754,800 | $ 1,067,000 |

| Estimated Cost to complete | $ 590,000 | $ 355,200 | $ - |

| Total Estimated Cost | $ 1,000,000 | $ 1,110,000 | $ 1,067,000 |

| Estimated Gross Profit Contract Price- Estimated Cost) | $ 610,000 | $ 500,000 | $ 543,000 |

| % Completion | 41% | 68% | 100% |

| Gross Profit Earned till Date | $ 250,100 | $ 340,000 | $ 543,000 |

| Gross Profit of Previous Year | $ 250,100 | $ 340,000 | |

| Gross Profit recognised | $ 250,100 | $ 89,900 | $ 203,000 |

Homework Sourse

Homework Sourse