5 Kelly took a 13000 loan at 945 APR compounded daily The lo

5) Kelly took a $13,000 loan at 9.45% APR compounded daily. The loan will be paid in 36 equal monthly payments. (a) What is the monthly payment? (b) What is the total amount of interest that Kelly has to pay over the life of the loan? (c) In the 20th payment, how much of it is the interest payment and how much of it pays against the principal? (d) Right after the 20th payment, mainder of the loan amount of that payment?

Solution

5.

Loan Amount = $13000

Nominal interest rate = 9.45% (compounding daily)

Effective annual interest rate = (1+9.45%/365)^365 - 1

Effective annual interest rate = 9.9096%

So, effective monthly interest rate R = 9.9096%/12 = .826%

Time n = 36 months

A.

Let monthly payment = EMI

13000 = EMI*(1-1/(1+.826%)^36)/.00826

13000 = EMI*31.031

EMI = 13000/31.031

EMI = $418.94

B.

Total amount of interest paid = $2081.70 (as per the amortization schedule)

C.

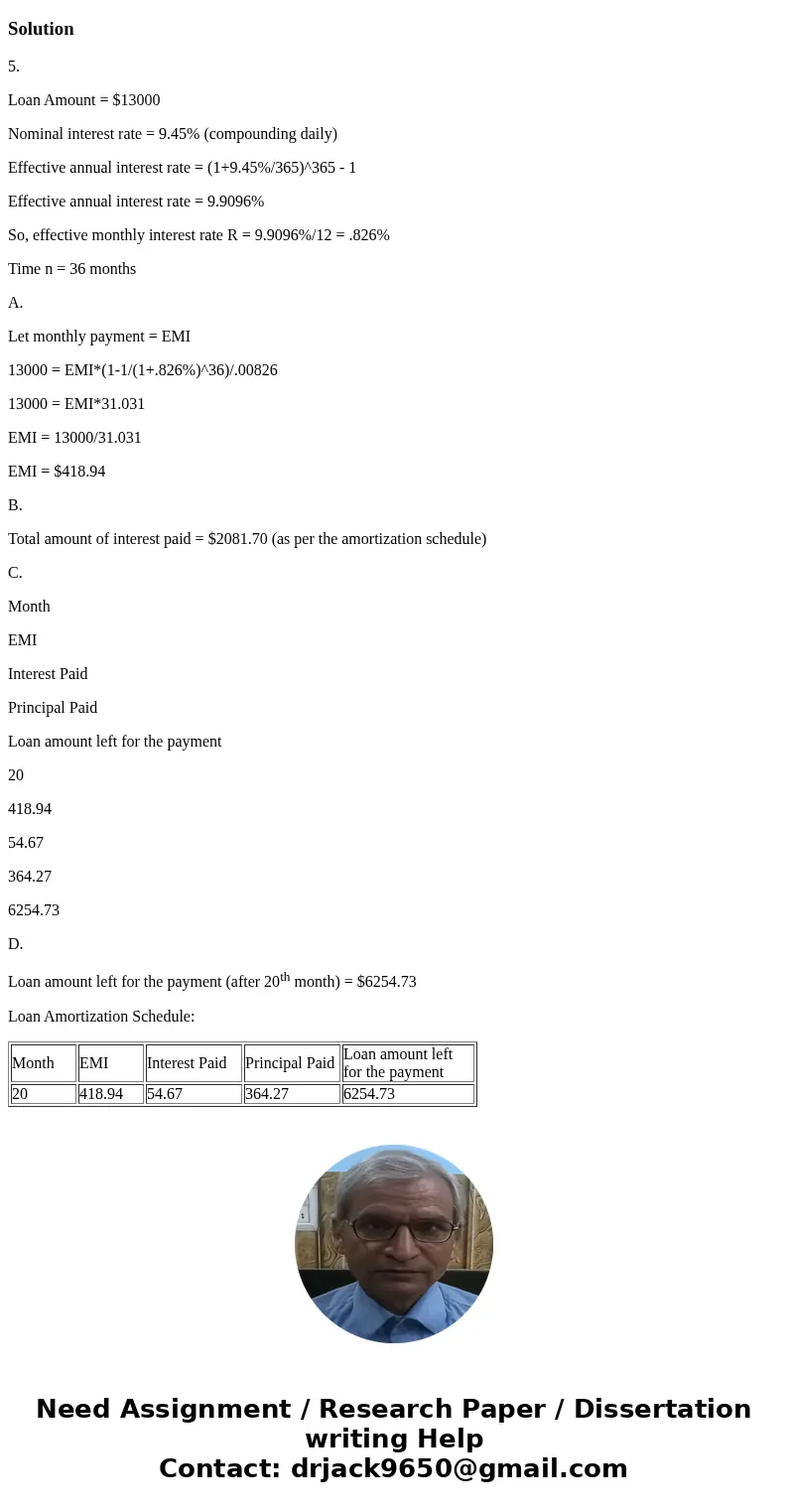

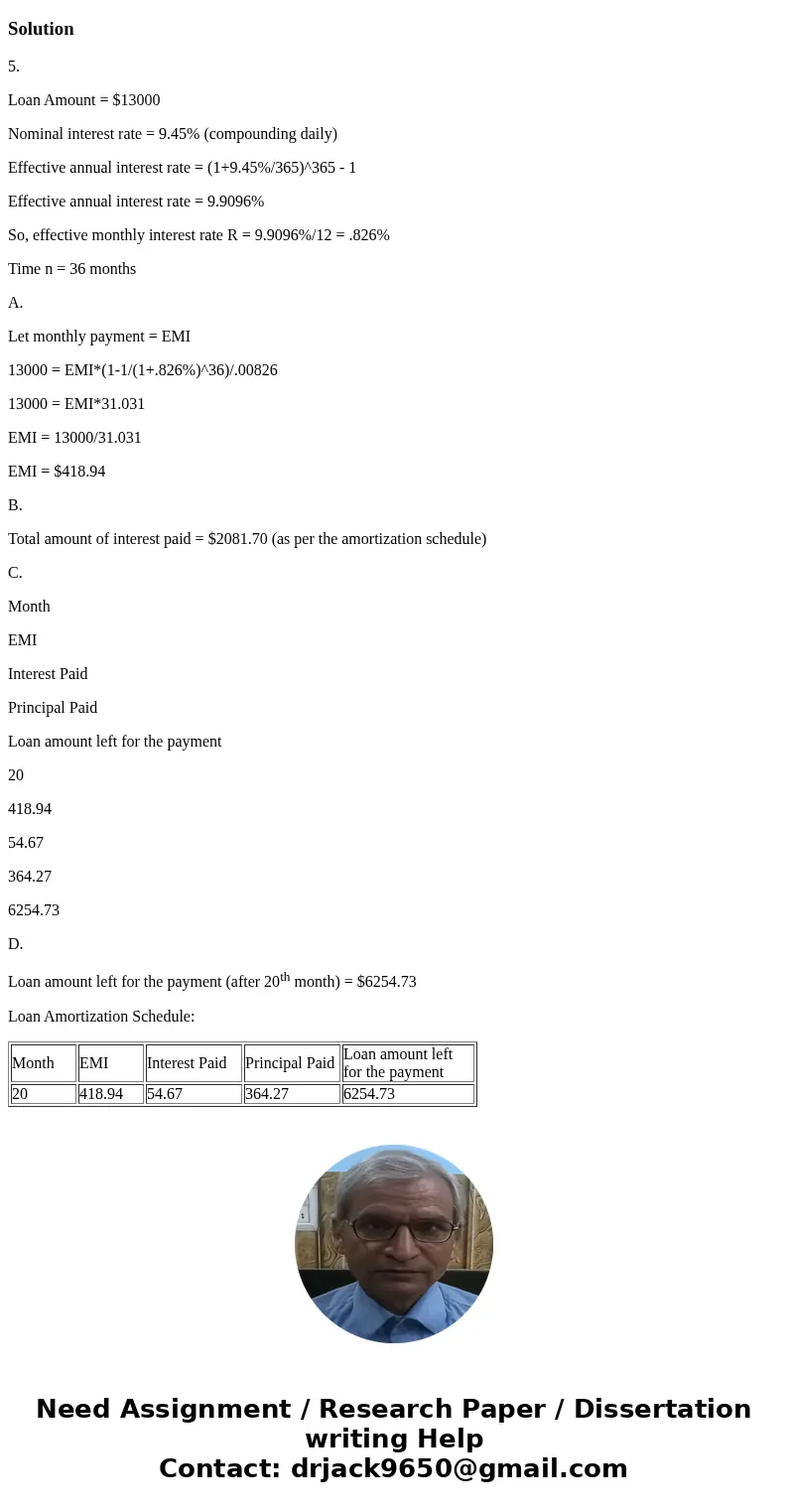

Month

EMI

Interest Paid

Principal Paid

Loan amount left for the payment

20

418.94

54.67

364.27

6254.73

D.

Loan amount left for the payment (after 20th month) = $6254.73

Loan Amortization Schedule:

| Month | EMI | Interest Paid | Principal Paid | Loan amount left for the payment |

| 20 | 418.94 | 54.67 | 364.27 | 6254.73 |

Homework Sourse

Homework Sourse