comparative balance sheet of Livers Inc for December 31 20Y3

comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is shown as follows Dec. 31, 20Y3 Dec. 31, 20Y2 Assets Cash 625.,650.00 $586.340.00 208,030.00 Accounts receivable (net) 5 Inventornes 6 Investments 7 Land 8 Equipment 228,170.00 64148000 617,130.00 240,290.00 0.00 552.300.00 (165.580.00) (147,010.00) 2363,960.00 $2.057.080.00 0.00 328,170.00 706,070.00 10 Total assets Liabilities and Stootholders\' Equity

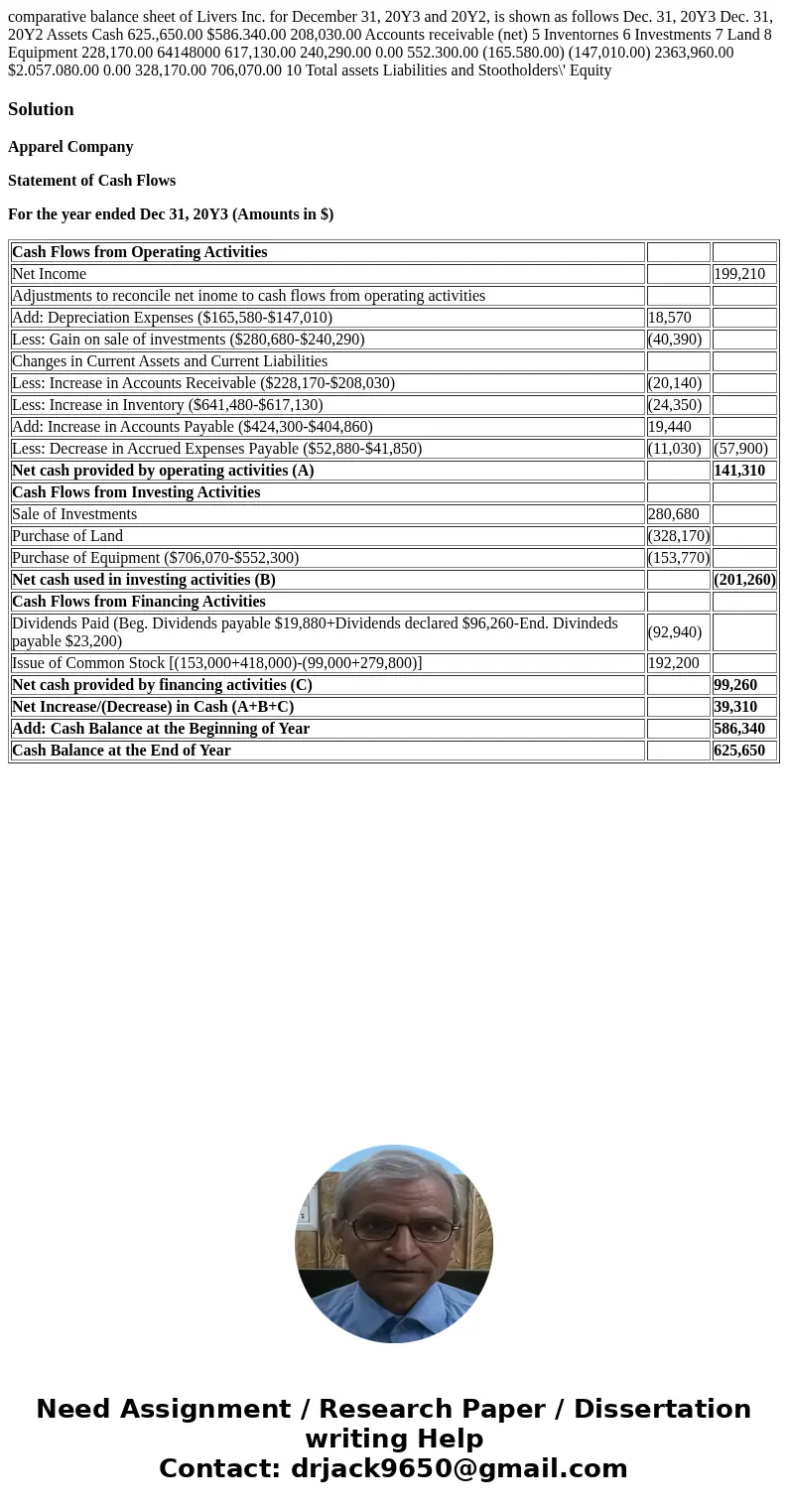

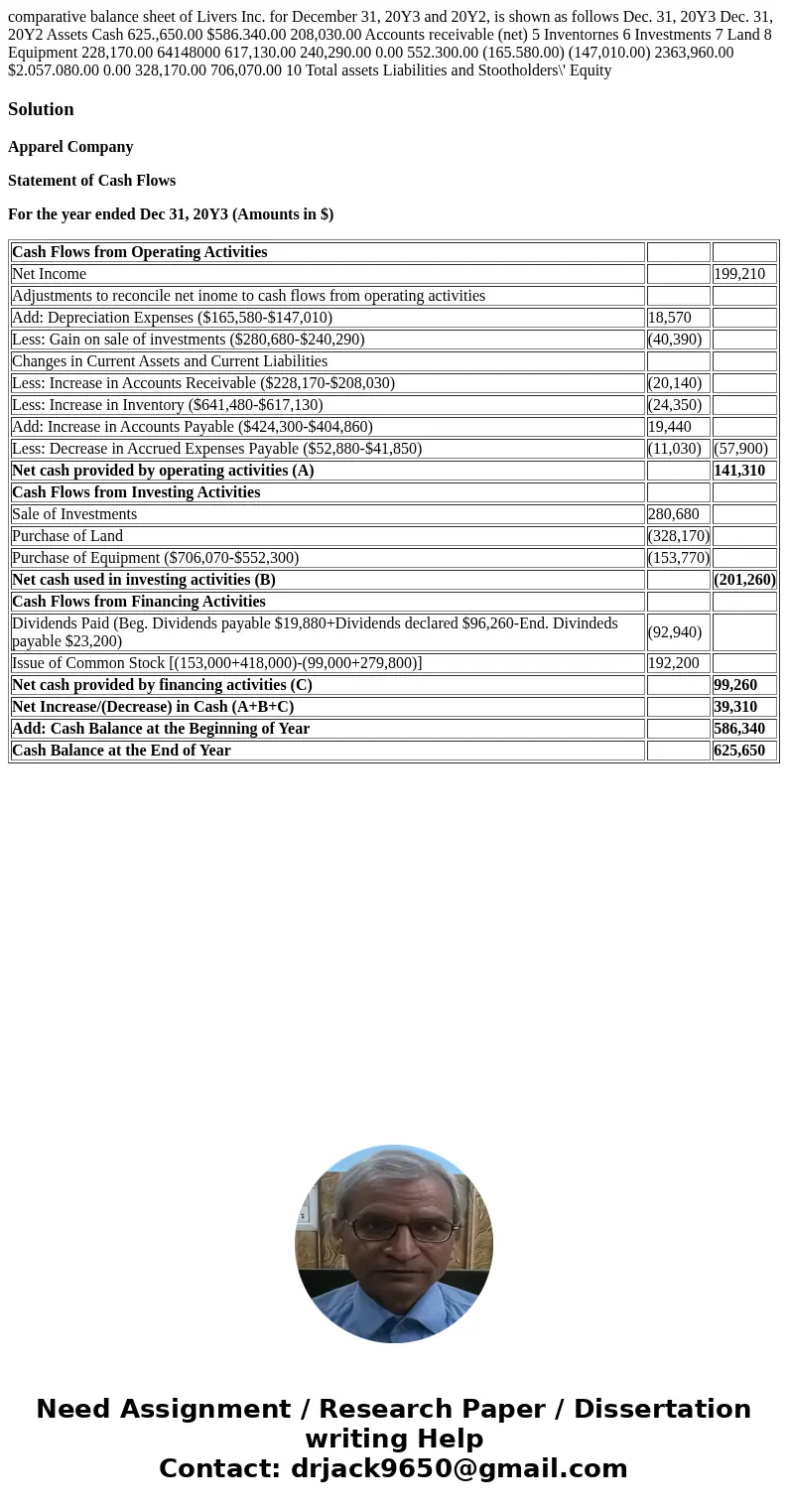

Solution

Apparel Company

Statement of Cash Flows

For the year ended Dec 31, 20Y3 (Amounts in $)

| Cash Flows from Operating Activities | ||

| Net Income | 199,210 | |

| Adjustments to reconcile net inome to cash flows from operating activities | ||

| Add: Depreciation Expenses ($165,580-$147,010) | 18,570 | |

| Less: Gain on sale of investments ($280,680-$240,290) | (40,390) | |

| Changes in Current Assets and Current Liabilities | ||

| Less: Increase in Accounts Receivable ($228,170-$208,030) | (20,140) | |

| Less: Increase in Inventory ($641,480-$617,130) | (24,350) | |

| Add: Increase in Accounts Payable ($424,300-$404,860) | 19,440 | |

| Less: Decrease in Accrued Expenses Payable ($52,880-$41,850) | (11,030) | (57,900) |

| Net cash provided by operating activities (A) | 141,310 | |

| Cash Flows from Investing Activities | ||

| Sale of Investments | 280,680 | |

| Purchase of Land | (328,170) | |

| Purchase of Equipment ($706,070-$552,300) | (153,770) | |

| Net cash used in investing activities (B) | (201,260) | |

| Cash Flows from Financing Activities | ||

| Dividends Paid (Beg. Dividends payable $19,880+Dividends declared $96,260-End. Divindeds payable $23,200) | (92,940) | |

| Issue of Common Stock [(153,000+418,000)-(99,000+279,800)] | 192,200 | |

| Net cash provided by financing activities (C) | 99,260 | |

| Net Increase/(Decrease) in Cash (A+B+C) | 39,310 | |

| Add: Cash Balance at the Beginning of Year | 586,340 | |

| Cash Balance at the End of Year | 625,650 |

Homework Sourse

Homework Sourse