Refer back to the bass question a Rather than depending sole

Refer back to the bass question.

(a) Rather than depending solely on length or girth to get the weight, try to make a model

W(l, g).

(b) Now throw out the worst data point and find a better model.

(c) How would you justify throwing out the point you did?

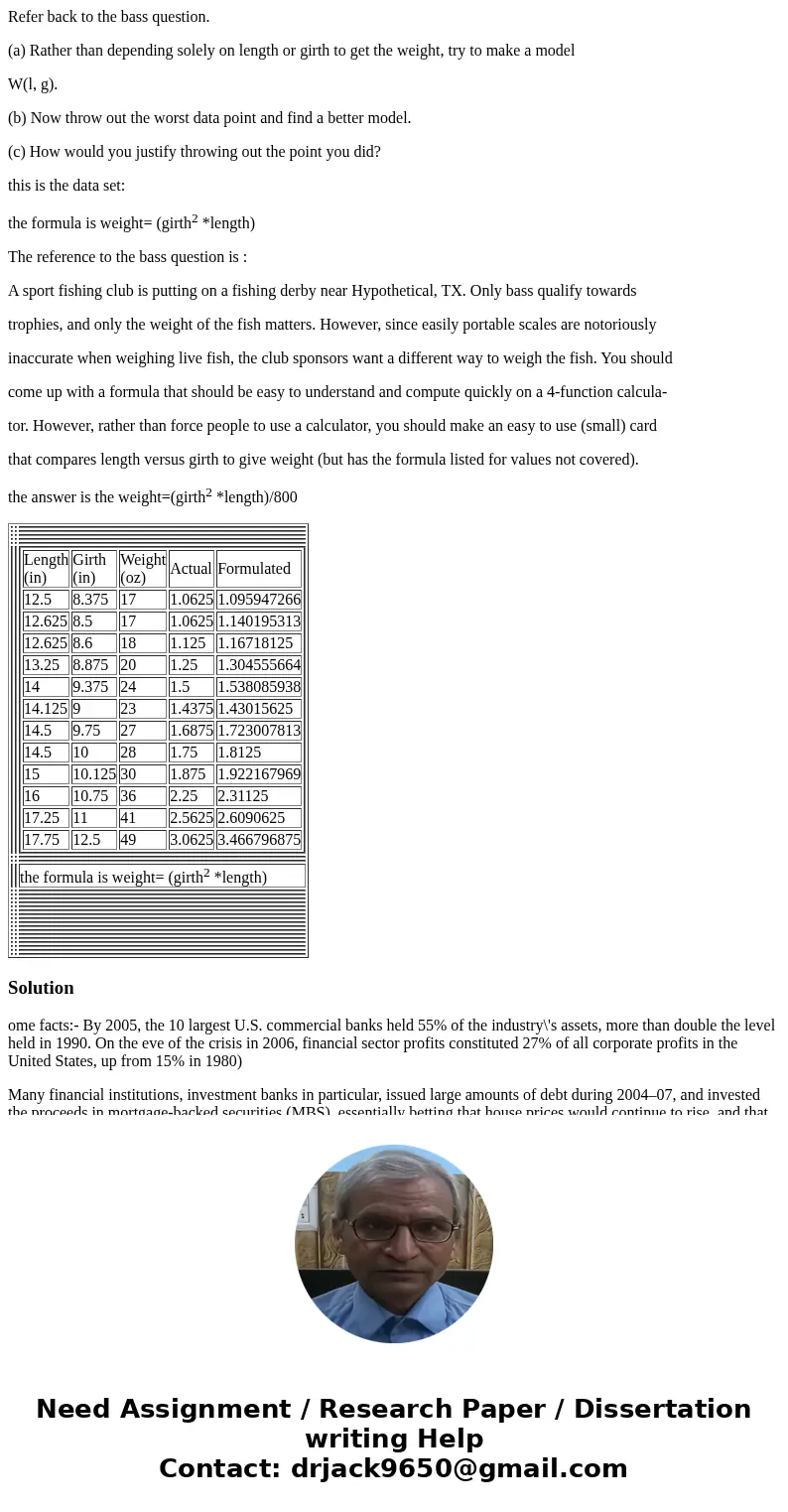

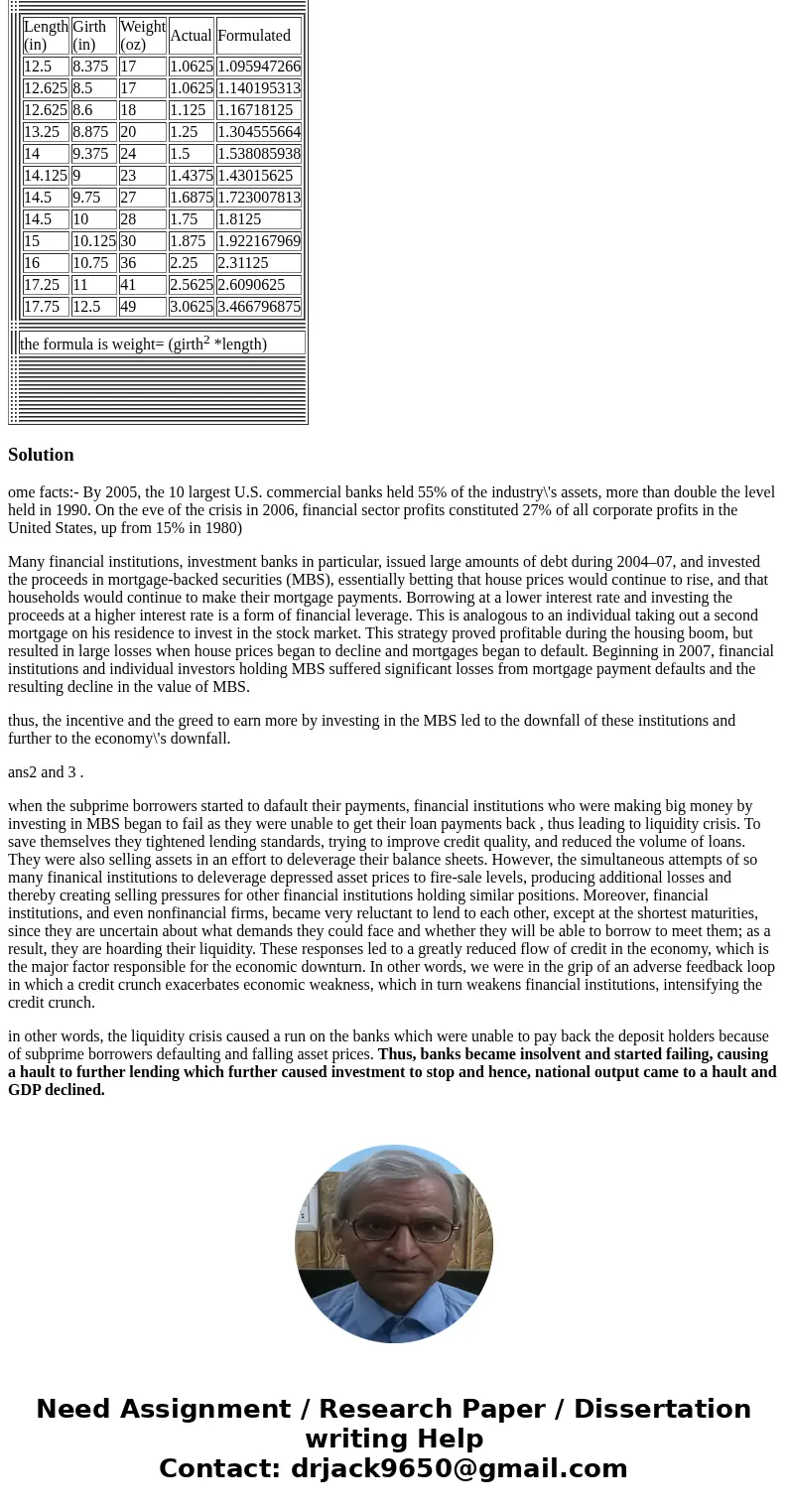

this is the data set:

the formula is weight= (girth2 *length)

The reference to the bass question is :

A sport fishing club is putting on a fishing derby near Hypothetical, TX. Only bass qualify towards

trophies, and only the weight of the fish matters. However, since easily portable scales are notoriously

inaccurate when weighing live fish, the club sponsors want a different way to weigh the fish. You should

come up with a formula that should be easy to understand and compute quickly on a 4-function calcula-

tor. However, rather than force people to use a calculator, you should make an easy to use (small) card

that compares length versus girth to give weight (but has the formula listed for values not covered).

the answer is the weight=(girth2 *length)/800

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| the formula is weight= (girth2 *length) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Solution

ome facts:- By 2005, the 10 largest U.S. commercial banks held 55% of the industry\'s assets, more than double the level held in 1990. On the eve of the crisis in 2006, financial sector profits constituted 27% of all corporate profits in the United States, up from 15% in 1980)

Many financial institutions, investment banks in particular, issued large amounts of debt during 2004–07, and invested the proceeds in mortgage-backed securities (MBS), essentially betting that house prices would continue to rise, and that households would continue to make their mortgage payments. Borrowing at a lower interest rate and investing the proceeds at a higher interest rate is a form of financial leverage. This is analogous to an individual taking out a second mortgage on his residence to invest in the stock market. This strategy proved profitable during the housing boom, but resulted in large losses when house prices began to decline and mortgages began to default. Beginning in 2007, financial institutions and individual investors holding MBS suffered significant losses from mortgage payment defaults and the resulting decline in the value of MBS.

thus, the incentive and the greed to earn more by investing in the MBS led to the downfall of these institutions and further to the economy\'s downfall.

ans2 and 3 .

when the subprime borrowers started to dafault their payments, financial institutions who were making big money by investing in MBS began to fail as they were unable to get their loan payments back , thus leading to liquidity crisis. To save themselves they tightened lending standards, trying to improve credit quality, and reduced the volume of loans. They were also selling assets in an effort to deleverage their balance sheets. However, the simultaneous attempts of so many finanical institutions to deleverage depressed asset prices to fire-sale levels, producing additional losses and thereby creating selling pressures for other financial institutions holding similar positions. Moreover, financial institutions, and even nonfinancial firms, became very reluctant to lend to each other, except at the shortest maturities, since they are uncertain about what demands they could face and whether they will be able to borrow to meet them; as a result, they are hoarding their liquidity. These responses led to a greatly reduced flow of credit in the economy, which is the major factor responsible for the economic downturn. In other words, we were in the grip of an adverse feedback loop in which a credit crunch exacerbates economic weakness, which in turn weakens financial institutions, intensifying the credit crunch.

in other words, the liquidity crisis caused a run on the banks which were unable to pay back the deposit holders because of subprime borrowers defaulting and falling asset prices. Thus, banks became insolvent and started failing, causing a hault to further lending which further caused investment to stop and hence, national output came to a hault and GDP declined.

Homework Sourse

Homework Sourse