Question 2 Lodh Ltd commenced business operations on 1 Janua

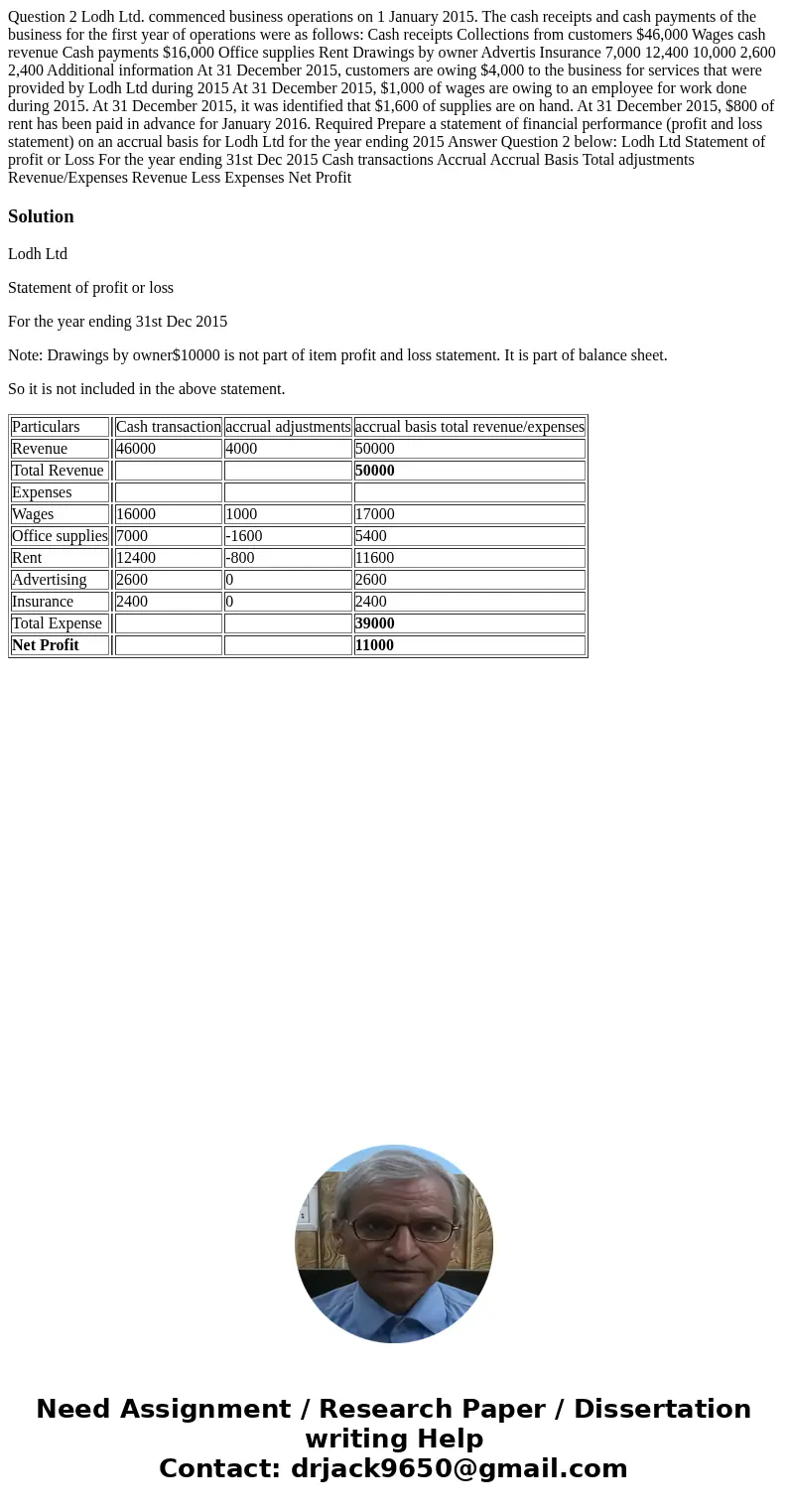

Question 2 Lodh Ltd. commenced business operations on 1 January 2015. The cash receipts and cash payments of the business for the first year of operations were as follows: Cash receipts Collections from customers $46,000 Wages cash revenue Cash payments $16,000 Office supplies Rent Drawings by owner Advertis Insurance 7,000 12,400 10,000 2,600 2,400 Additional information At 31 December 2015, customers are owing $4,000 to the business for services that were provided by Lodh Ltd during 2015 At 31 December 2015, $1,000 of wages are owing to an employee for work done during 2015. At 31 December 2015, it was identified that $1,600 of supplies are on hand. At 31 December 2015, $800 of rent has been paid in advance for January 2016. Required Prepare a statement of financial performance (profit and loss statement) on an accrual basis for Lodh Ltd for the year ending 2015 Answer Question 2 below: Lodh Ltd Statement of profit or Loss For the year ending 31st Dec 2015 Cash transactions Accrual Accrual Basis Total adjustments Revenue/Expenses Revenue Less Expenses Net Profit

Solution

Lodh Ltd

Statement of profit or loss

For the year ending 31st Dec 2015

Note: Drawings by owner$10000 is not part of item profit and loss statement. It is part of balance sheet.

So it is not included in the above statement.

| Particulars | Cash transaction | accrual adjustments | accrual basis total revenue/expenses | |

| Revenue | 46000 | 4000 | 50000 | |

| Total Revenue | 50000 | |||

| Expenses | ||||

| Wages | 16000 | 1000 | 17000 | |

| Office supplies | 7000 | -1600 | 5400 | |

| Rent | 12400 | -800 | 11600 | |

| Advertising | 2600 | 0 | 2600 | |

| Insurance | 2400 | 0 | 2400 | |

| Total Expense | 39000 | |||

| Net Profit | 11000 |

Homework Sourse

Homework Sourse