MANAGERIAL ACCOUNTING HANDOUT PROBLEM 14 Score Name Section

Solution

Cash Flow from Operating Activities :-

Net Income (Note 1)

20750

Adjustments:-

Loss on sale of Equipment (11000 * 60%) - 2500

4100

Gain on sale of Long term Investment

-2500

Gain on Building Destroy and Insurance claim recd (net of tax)

(33000 – [29750 – 6000])

-9250

Depreciation Exp

[Accumulated Dep Ending bal (2000) - Acc Dep Beg Bal (4500) + Acc Dep on Equipment sold (11000 * 40%)]

1900

Patent Ammortisation

1250

Increase in A/c Receivable

-2250

Decrease Allowance for Doubtful Debts

-1500

Increase Inventory

-3000

Increase A/c Payable

2000

Decrease Short term Note Payable

-1000

Cash Flow from Operating Activities (A)

10500

10500

Cash Flow from Investing Activities :-

Sale of Equipment

2500

Sale of Long term Investment (3000 + 2500)

5500

Purchase Equipment [Ending Equipment (40000) + Equipment Sold (11000) – Beginning Equipment (20000) – Note payable issue (16000)]

-15000

Building Destroy (29750 – 6000 + 9250)

33000

Cash Flow from Investing Activities (B)

26000

26000

Cash Flow from Financing Activities :-

Note Payable Long Term (Note 2 )

5000

Dividend Paid (10000 + 6000)

-16000

Cash Flow from Financing Activities (C)

-11000

-11000

Net cash Inflow

25500

(+) Beginning cash Balance

13000

Ending Cash Balance

38500

Schedule of Non Cash Investing & Financing Activities :-

Purchase of Equipment by issuing Long term Note Payable

16000

Repaid Long Term Note Payable by issuing common stock

15000

Note1 :-Net Income :-

Retained Earning Ending Balance

15750

(+) Dividend Declared

10000

(-) Retained Earning Beginning Balance

5000

Net Income

20750

Note1 :-Long Term Note Payable :-

Ending Note Payable

31000

(+) Paid by common stock

15000

(-) Issue for Equipment

16000

(-) Beginning Note Payable

25000

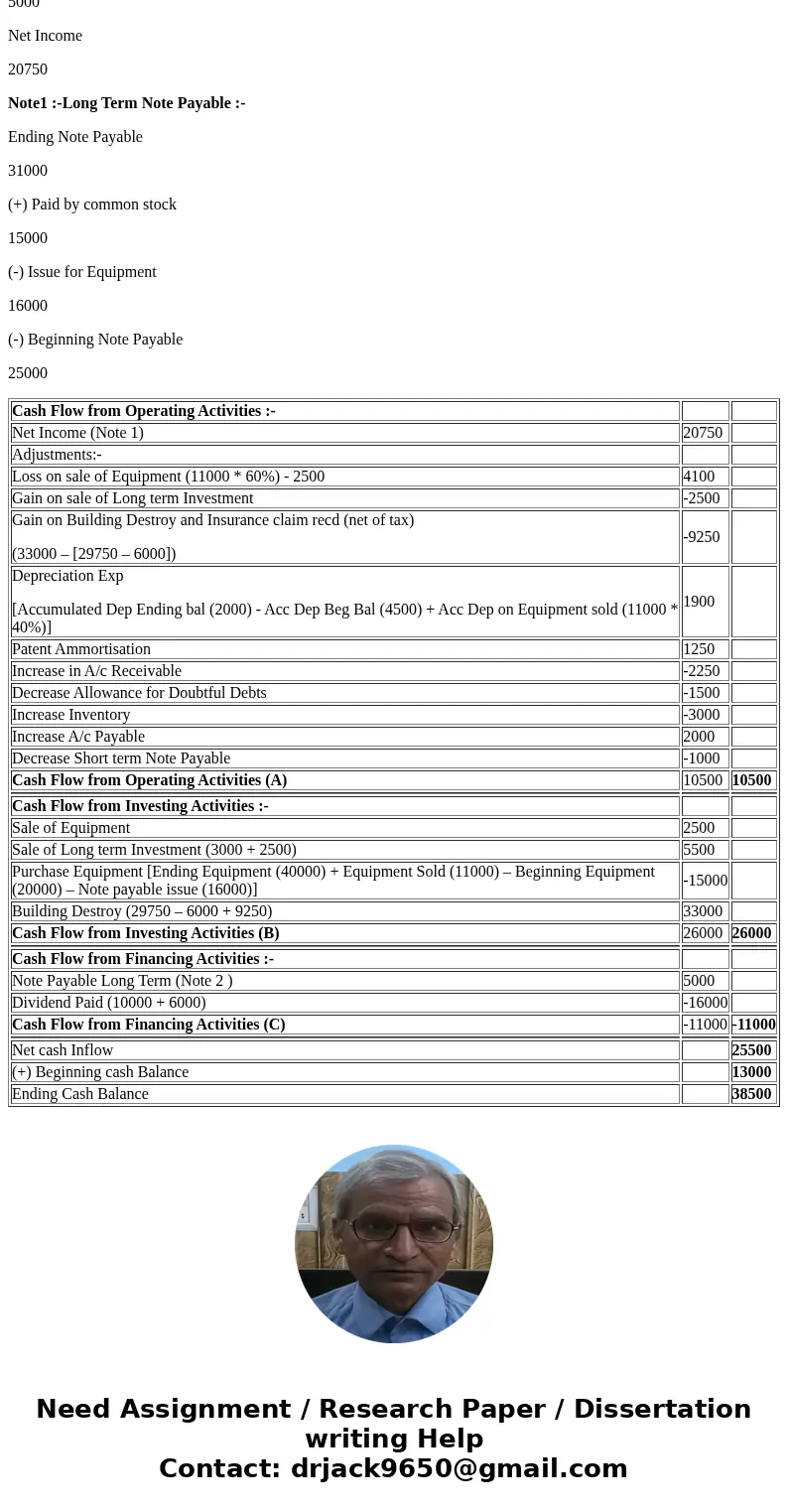

| Cash Flow from Operating Activities :- | ||

| Net Income (Note 1) | 20750 | |

| Adjustments:- | ||

| Loss on sale of Equipment (11000 * 60%) - 2500 | 4100 | |

| Gain on sale of Long term Investment | -2500 | |

| Gain on Building Destroy and Insurance claim recd (net of tax) (33000 – [29750 – 6000]) | -9250 | |

| Depreciation Exp [Accumulated Dep Ending bal (2000) - Acc Dep Beg Bal (4500) + Acc Dep on Equipment sold (11000 * 40%)] | 1900 | |

| Patent Ammortisation | 1250 | |

| Increase in A/c Receivable | -2250 | |

| Decrease Allowance for Doubtful Debts | -1500 | |

| Increase Inventory | -3000 | |

| Increase A/c Payable | 2000 | |

| Decrease Short term Note Payable | -1000 | |

| Cash Flow from Operating Activities (A) | 10500 | 10500 |

| Cash Flow from Investing Activities :- | ||

| Sale of Equipment | 2500 | |

| Sale of Long term Investment (3000 + 2500) | 5500 | |

| Purchase Equipment [Ending Equipment (40000) + Equipment Sold (11000) – Beginning Equipment (20000) – Note payable issue (16000)] | -15000 | |

| Building Destroy (29750 – 6000 + 9250) | 33000 | |

| Cash Flow from Investing Activities (B) | 26000 | 26000 |

| Cash Flow from Financing Activities :- | ||

| Note Payable Long Term (Note 2 ) | 5000 | |

| Dividend Paid (10000 + 6000) | -16000 | |

| Cash Flow from Financing Activities (C) | -11000 | -11000 |

| Net cash Inflow | 25500 | |

| (+) Beginning cash Balance | 13000 | |

| Ending Cash Balance | 38500 |

Homework Sourse

Homework Sourse