15 An aging of a companys accounts receivable indicates that

15. An aging of a company\'s accounts receivable indicates that $13,000 is estimated to be uncollectible. If the unadjusted balance for the Allowance for Doubtful Accounts is $2,400 debit, the adjustment a) debit to Bad Debts Expense for $15,400. b) debit to Bad Debts Expense for $13,000. c) debit to Bad Debts Expense for S10,600. d) debit to Allowance for Doubtful Accounts for $13,000. e) None of the above to record bad debts for the period will requirea Use the following information for questions 16-17 Under the aging of a company\'s accounts receivable, the uncollectible accounts are estimated to be $12,000. The unadjusted balance for the Allowance for Doubtful Accounts is $2,000 credit. 16. What is the balance in the Allowance for Doubtful Accounts account after adjustment? a) $14,000 b) $12,000 c) $2,000 d) $10,000 e) None of the above 17. What is the amount of bad debts expense for the year? a) $14,000 b) $12,000 c) $2,000 d) $10,000 e) None of the above 18. Under the aging of a company\'s accounts receivable, the uncollectible accounts are estimated to be $26,000. If the unadjusted balance for the Allowance for Doubtful Accounts is $9,000 debit, what is the amount of bad debts expense for the year? a) $17,000 b) $18,000 c) $26,000 d) $35,000 e) None of the above. 19. Equipment with a cost of $160,000, an estimated residual value of $10,000, and an estimated life of 4 years, was purchased on April 1, 2015. If the straight-line method is used, the depreciation expense for calendar 2015 is (a) $40,000 (b) $37,500 (c) $30,000. (d) $28,125, (e) None of the above. 20. A truck was purchased for $40,000 and it was estimated to have a $4,000 residual value. Using the straight-line method, monthly depreciation expense of $600 was recorded. Therefore, the annual depreciation rate expressed as a percentage is (a) 2%. (b) 17%. (C) 18%. (d) 20%. (e) None of the above.

Solution

15. (a) debit to bad debts expense for $15400 , unajusted Balance for allowance has Dr. balance which is to be added back for calculating total bad debts expense

Adjustment Balance for bad debts = $13000 - (- $2400) Unadjusted allowance

= 13000 + 2400

= $15400

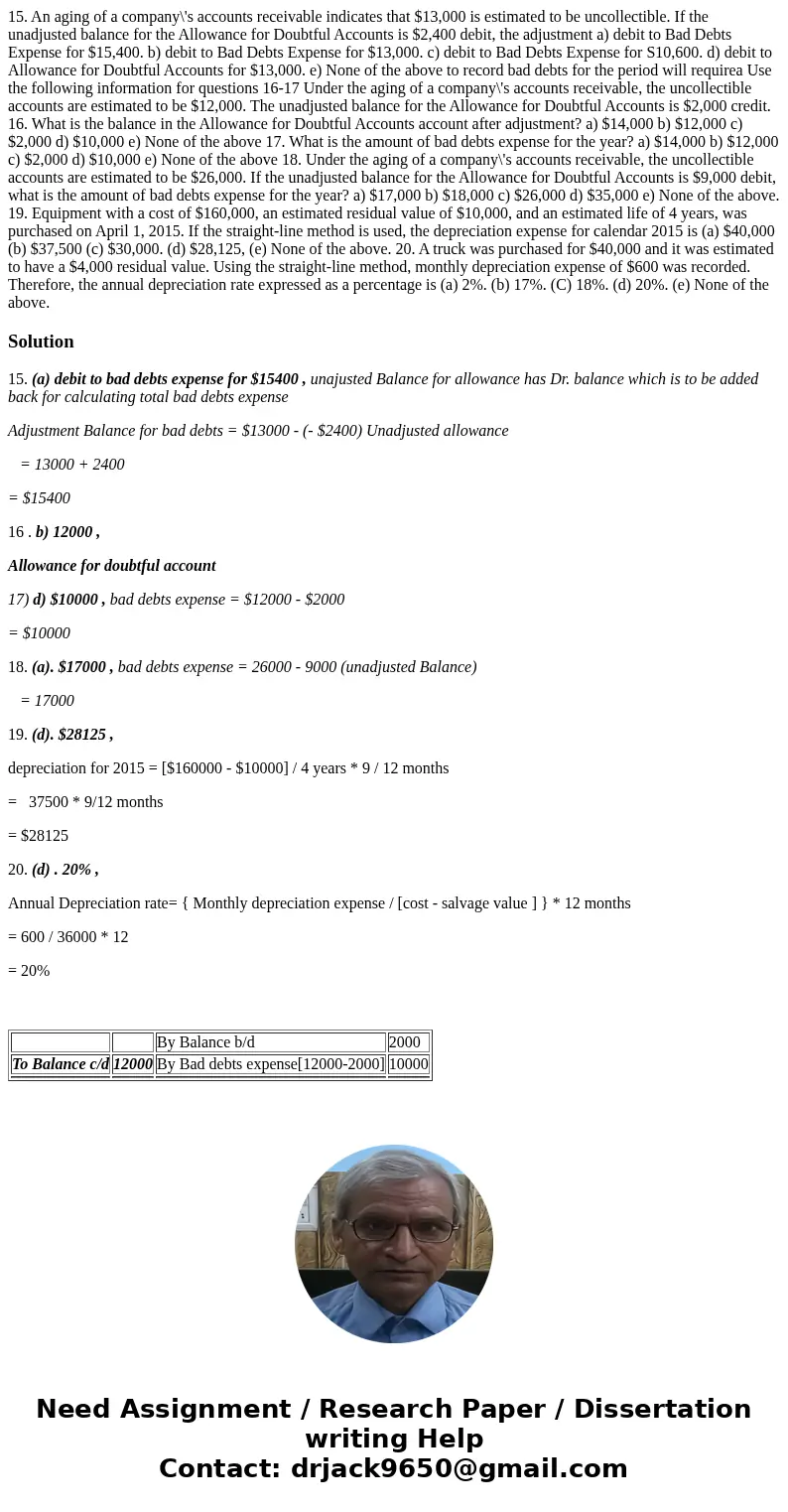

16 . b) 12000 ,

Allowance for doubtful account

17) d) $10000 , bad debts expense = $12000 - $2000

= $10000

18. (a). $17000 , bad debts expense = 26000 - 9000 (unadjusted Balance)

= 17000

19. (d). $28125 ,

depreciation for 2015 = [$160000 - $10000] / 4 years * 9 / 12 months

= 37500 * 9/12 months

= $28125

20. (d) . 20% ,

Annual Depreciation rate= { Monthly depreciation expense / [cost - salvage value ] } * 12 months

= 600 / 36000 * 12

= 20%

| By Balance b/d | 2000 | ||

| To Balance c/d | 12000 | By Bad debts expense[12000-2000] | 10000 |

Homework Sourse

Homework Sourse