The contribution margin income statement of Westlake Coffee

Solution

Requirement 1 :

Monthly breakeven point in the number of small coffees and large coffees:

Formula for Breakeven Point in sales unit =

(Fixed Cost + Target Income ) / Weighted Avg CM per unit

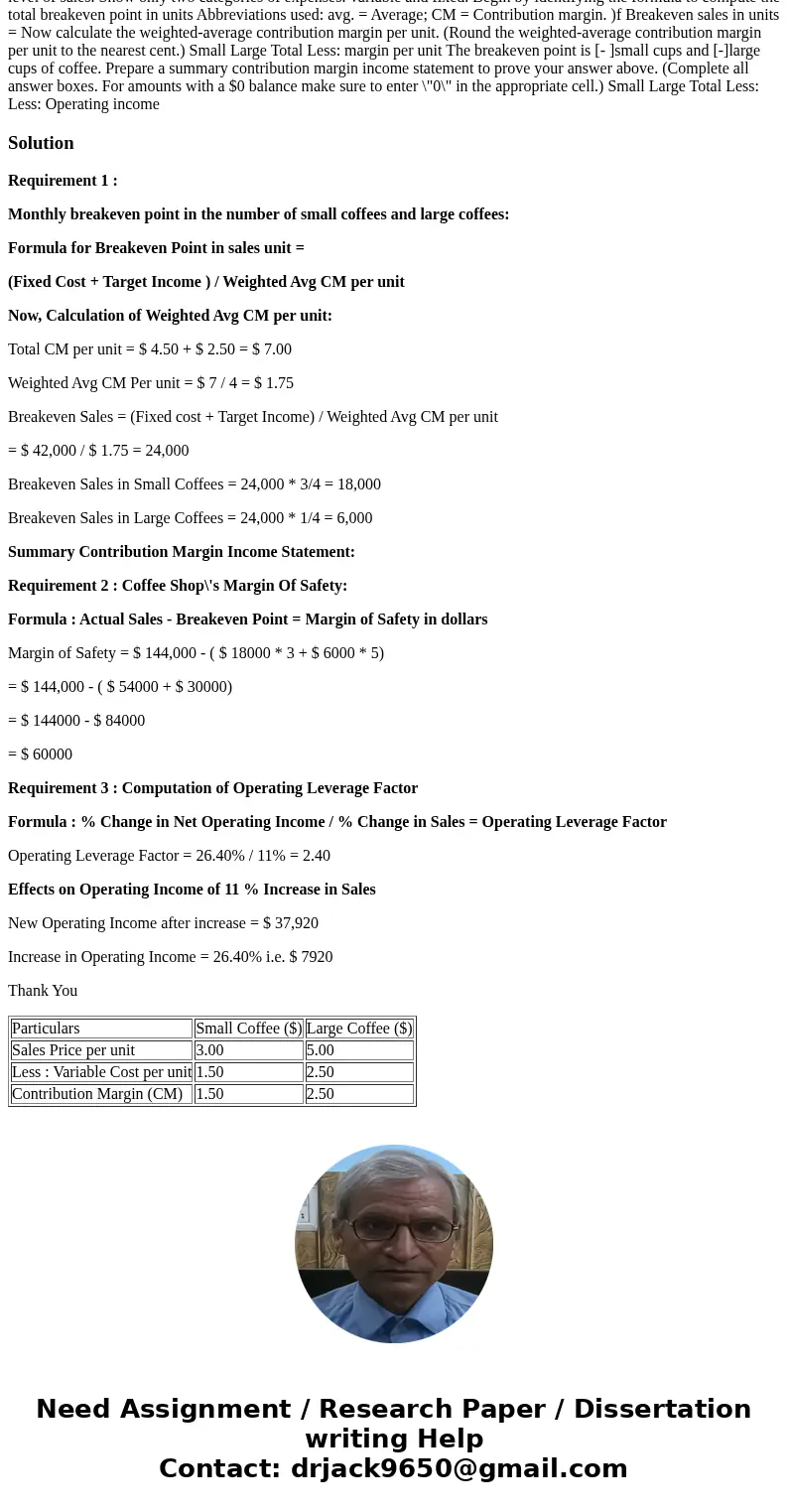

Now, Calculation of Weighted Avg CM per unit:

Total CM per unit = $ 4.50 + $ 2.50 = $ 7.00

Weighted Avg CM Per unit = $ 7 / 4 = $ 1.75

Breakeven Sales = (Fixed cost + Target Income) / Weighted Avg CM per unit

= $ 42,000 / $ 1.75 = 24,000

Breakeven Sales in Small Coffees = 24,000 * 3/4 = 18,000

Breakeven Sales in Large Coffees = 24,000 * 1/4 = 6,000

Summary Contribution Margin Income Statement:

Requirement 2 : Coffee Shop\'s Margin Of Safety:

Formula : Actual Sales - Breakeven Point = Margin of Safety in dollars

Margin of Safety = $ 144,000 - ( $ 18000 * 3 + $ 6000 * 5)

= $ 144,000 - ( $ 54000 + $ 30000)

= $ 144000 - $ 84000

= $ 60000

Requirement 3 : Computation of Operating Leverage Factor

Formula : % Change in Net Operating Income / % Change in Sales = Operating Leverage Factor

Operating Leverage Factor = 26.40% / 11% = 2.40

Effects on Operating Income of 11 % Increase in Sales

New Operating Income after increase = $ 37,920

Increase in Operating Income = 26.40% i.e. $ 7920

Thank You

| Particulars | Small Coffee ($) | Large Coffee ($) |

| Sales Price per unit | 3.00 | 5.00 |

| Less : Variable Cost per unit | 1.50 | 2.50 |

| Contribution Margin (CM) | 1.50 | 2.50 |

Homework Sourse

Homework Sourse