On January 1 2017 Bridgeport Company purchased 9 bonds havin

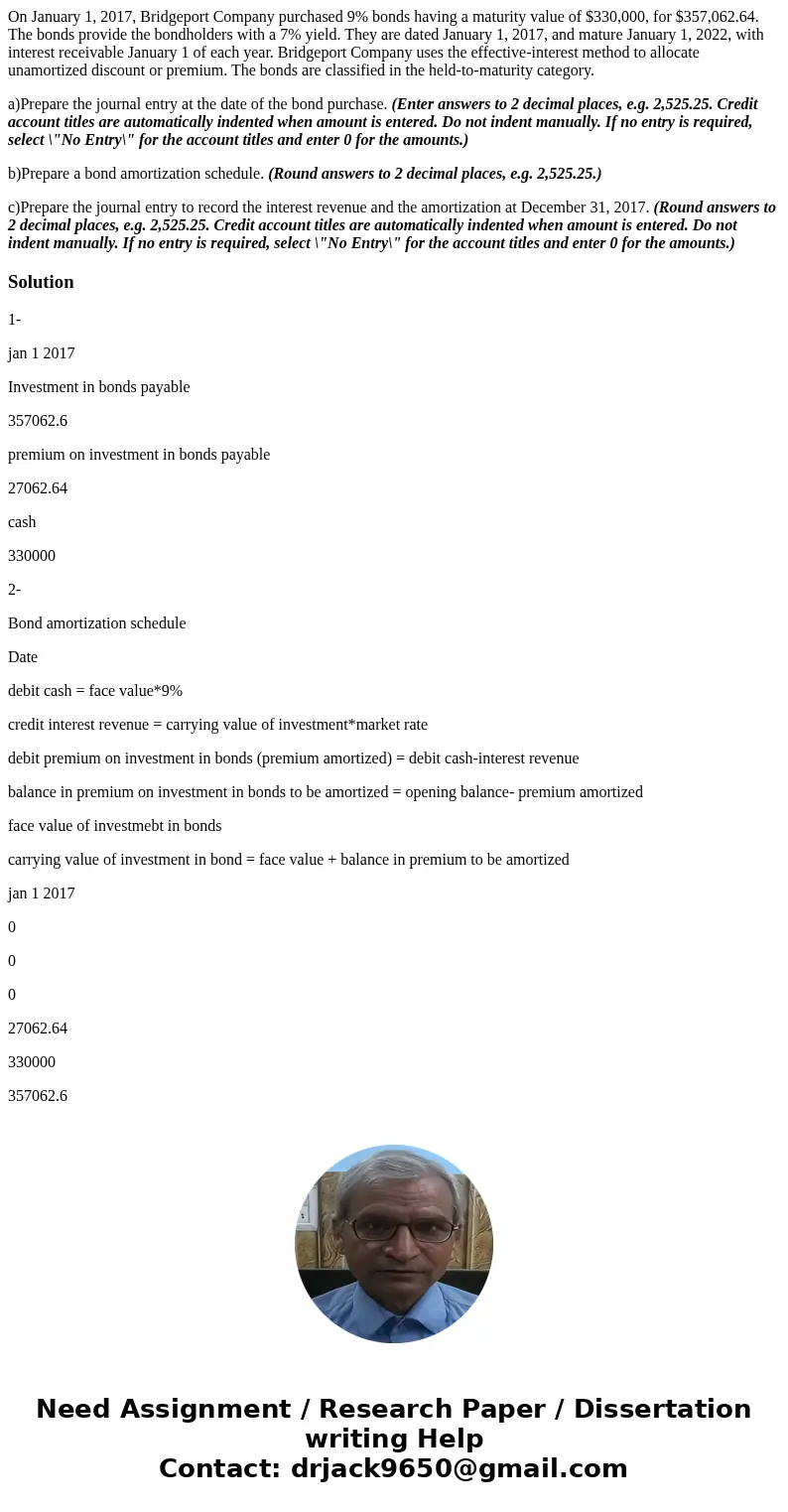

On January 1, 2017, Bridgeport Company purchased 9% bonds having a maturity value of $330,000, for $357,062.64. The bonds provide the bondholders with a 7% yield. They are dated January 1, 2017, and mature January 1, 2022, with interest receivable January 1 of each year. Bridgeport Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category.

a)Prepare the journal entry at the date of the bond purchase. (Enter answers to 2 decimal places, e.g. 2,525.25. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.)

b)Prepare a bond amortization schedule. (Round answers to 2 decimal places, e.g. 2,525.25.)

c)Prepare the journal entry to record the interest revenue and the amortization at December 31, 2017. (Round answers to 2 decimal places, e.g. 2,525.25. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.)

Solution

1-

jan 1 2017

Investment in bonds payable

357062.6

premium on investment in bonds payable

27062.64

cash

330000

2-

Bond amortization schedule

Date

debit cash = face value*9%

credit interest revenue = carrying value of investment*market rate

debit premium on investment in bonds (premium amortized) = debit cash-interest revenue

balance in premium on investment in bonds to be amortized = opening balance- premium amortized

face value of investmebt in bonds

carrying value of investment in bond = face value + balance in premium to be amortized

jan 1 2017

0

0

0

27062.64

330000

357062.6

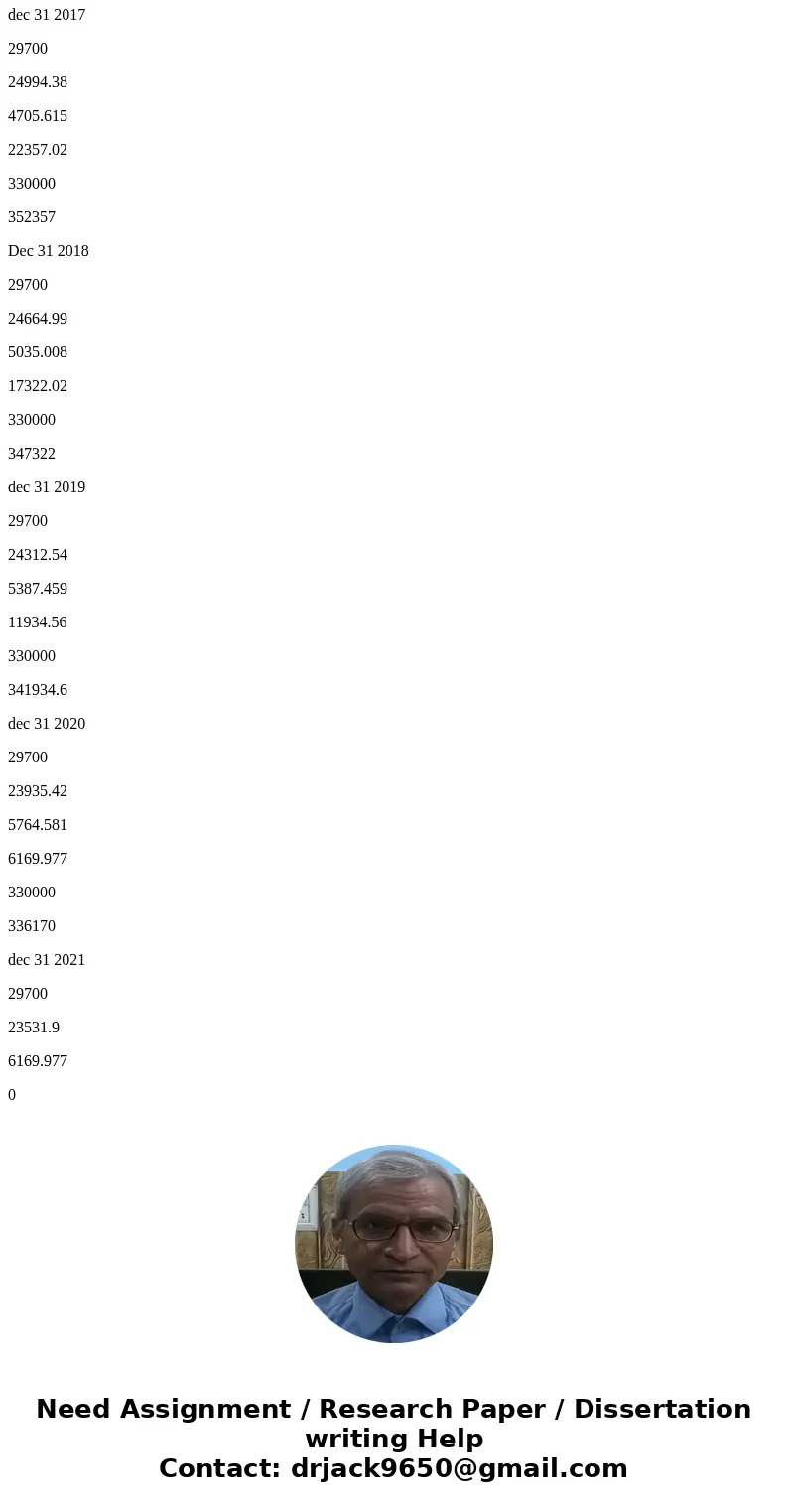

dec 31 2017

29700

24994.38

4705.615

22357.02

330000

352357

Dec 31 2018

29700

24664.99

5035.008

17322.02

330000

347322

dec 31 2019

29700

24312.54

5387.459

11934.56

330000

341934.6

dec 31 2020

29700

23935.42

5764.581

6169.977

330000

336170

dec 31 2021

29700

23531.9

6169.977

0

330000

330000

6169.97 is adjusted for making the sum in balance in premium on bonds payable to zero this difference of 1.87 is due to decimal point calculation

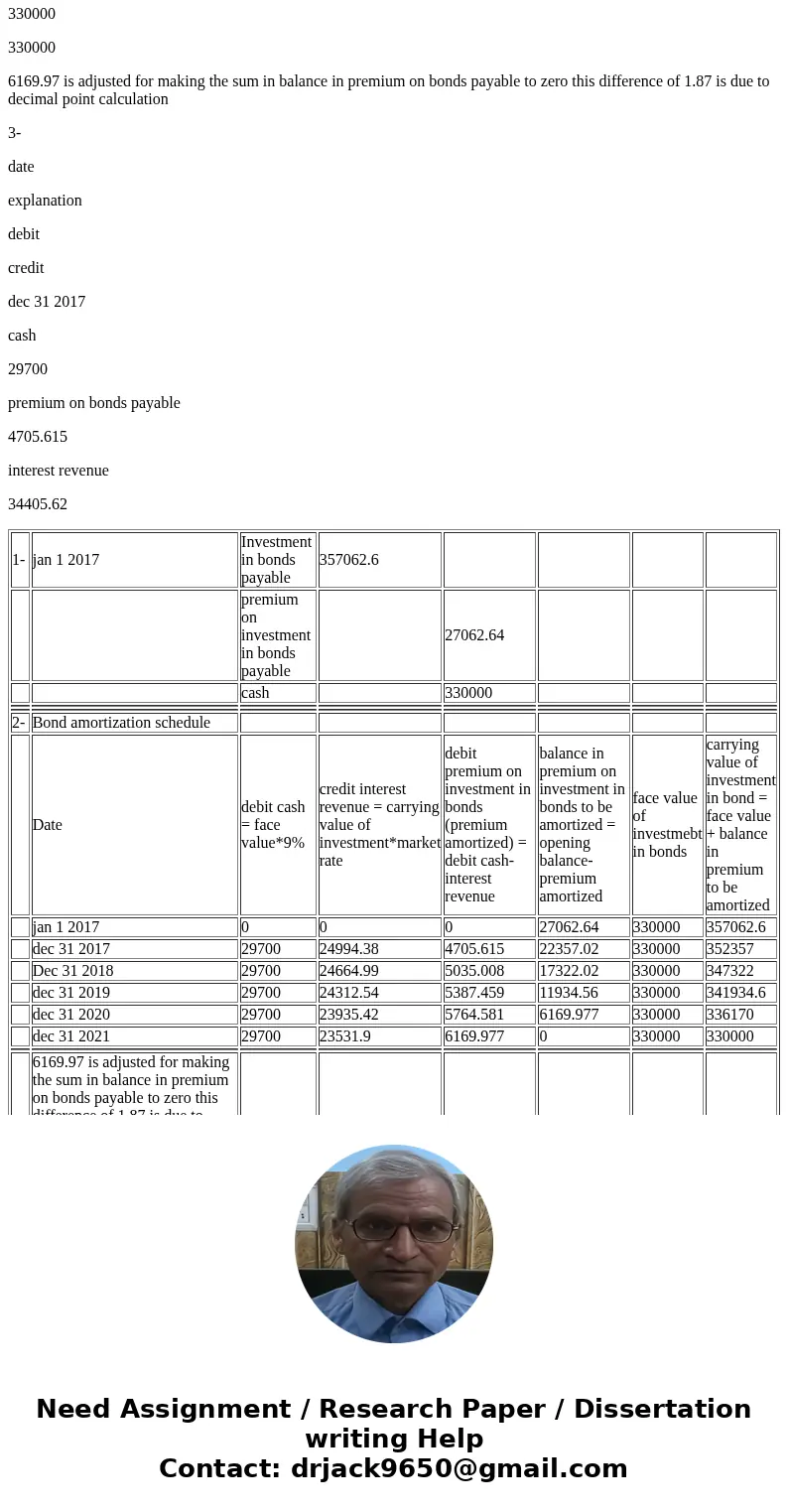

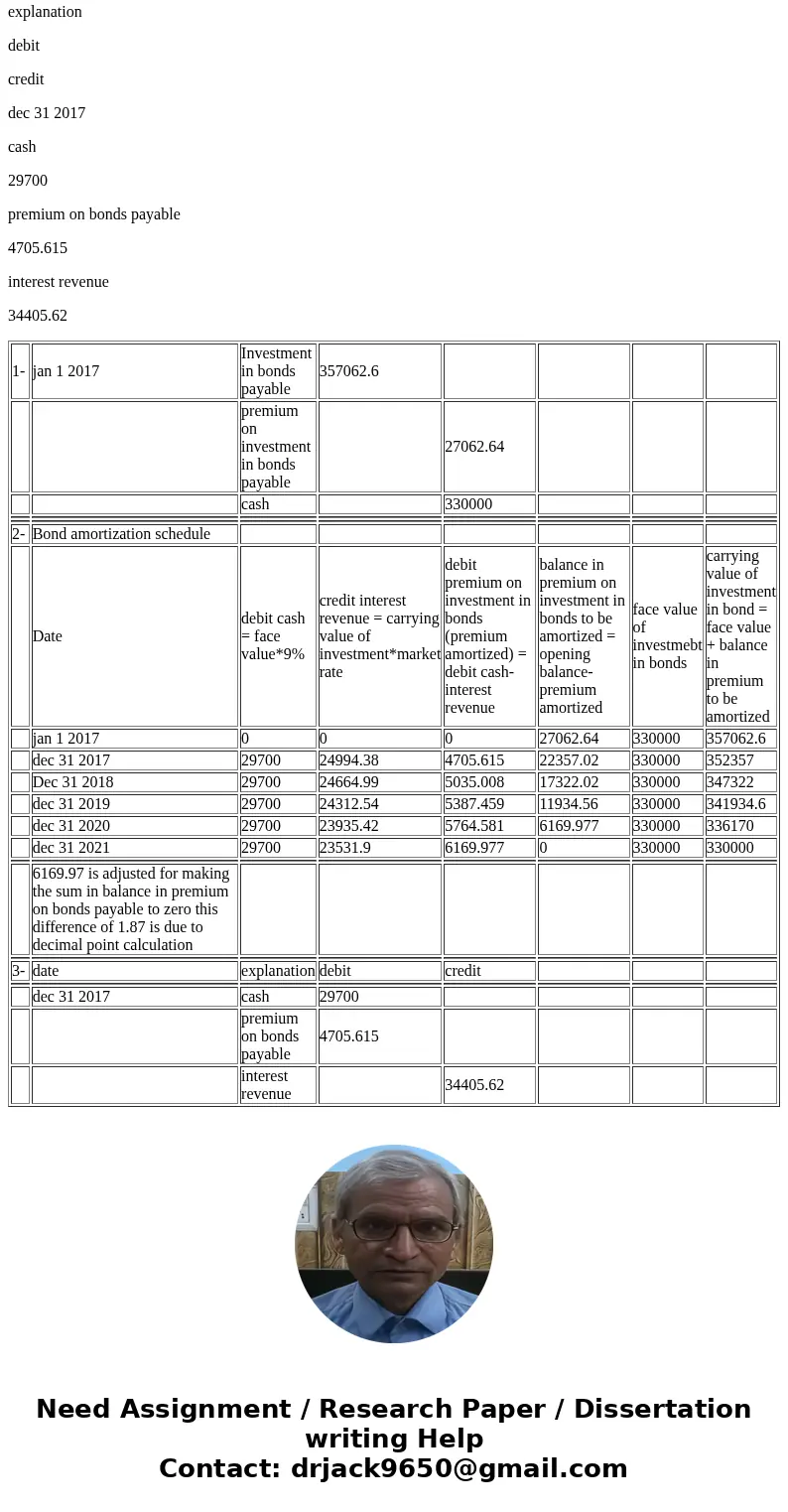

3-

date

explanation

debit

credit

dec 31 2017

cash

29700

premium on bonds payable

4705.615

interest revenue

34405.62

| 1- | jan 1 2017 | Investment in bonds payable | 357062.6 | ||||

| premium on investment in bonds payable | 27062.64 | ||||||

| cash | 330000 | ||||||

| 2- | Bond amortization schedule | ||||||

| Date | debit cash = face value*9% | credit interest revenue = carrying value of investment*market rate | debit premium on investment in bonds (premium amortized) = debit cash-interest revenue | balance in premium on investment in bonds to be amortized = opening balance- premium amortized | face value of investmebt in bonds | carrying value of investment in bond = face value + balance in premium to be amortized | |

| jan 1 2017 | 0 | 0 | 0 | 27062.64 | 330000 | 357062.6 | |

| dec 31 2017 | 29700 | 24994.38 | 4705.615 | 22357.02 | 330000 | 352357 | |

| Dec 31 2018 | 29700 | 24664.99 | 5035.008 | 17322.02 | 330000 | 347322 | |

| dec 31 2019 | 29700 | 24312.54 | 5387.459 | 11934.56 | 330000 | 341934.6 | |

| dec 31 2020 | 29700 | 23935.42 | 5764.581 | 6169.977 | 330000 | 336170 | |

| dec 31 2021 | 29700 | 23531.9 | 6169.977 | 0 | 330000 | 330000 | |

| 6169.97 is adjusted for making the sum in balance in premium on bonds payable to zero this difference of 1.87 is due to decimal point calculation | |||||||

| 3- | date | explanation | debit | credit | |||

| dec 31 2017 | cash | 29700 | |||||

| premium on bonds payable | 4705.615 | ||||||

| interest revenue | 34405.62 |

Homework Sourse

Homework Sourse