Date Sept 1 Sept 12 Sept 19 Sept 26 Explanation Units Unit C

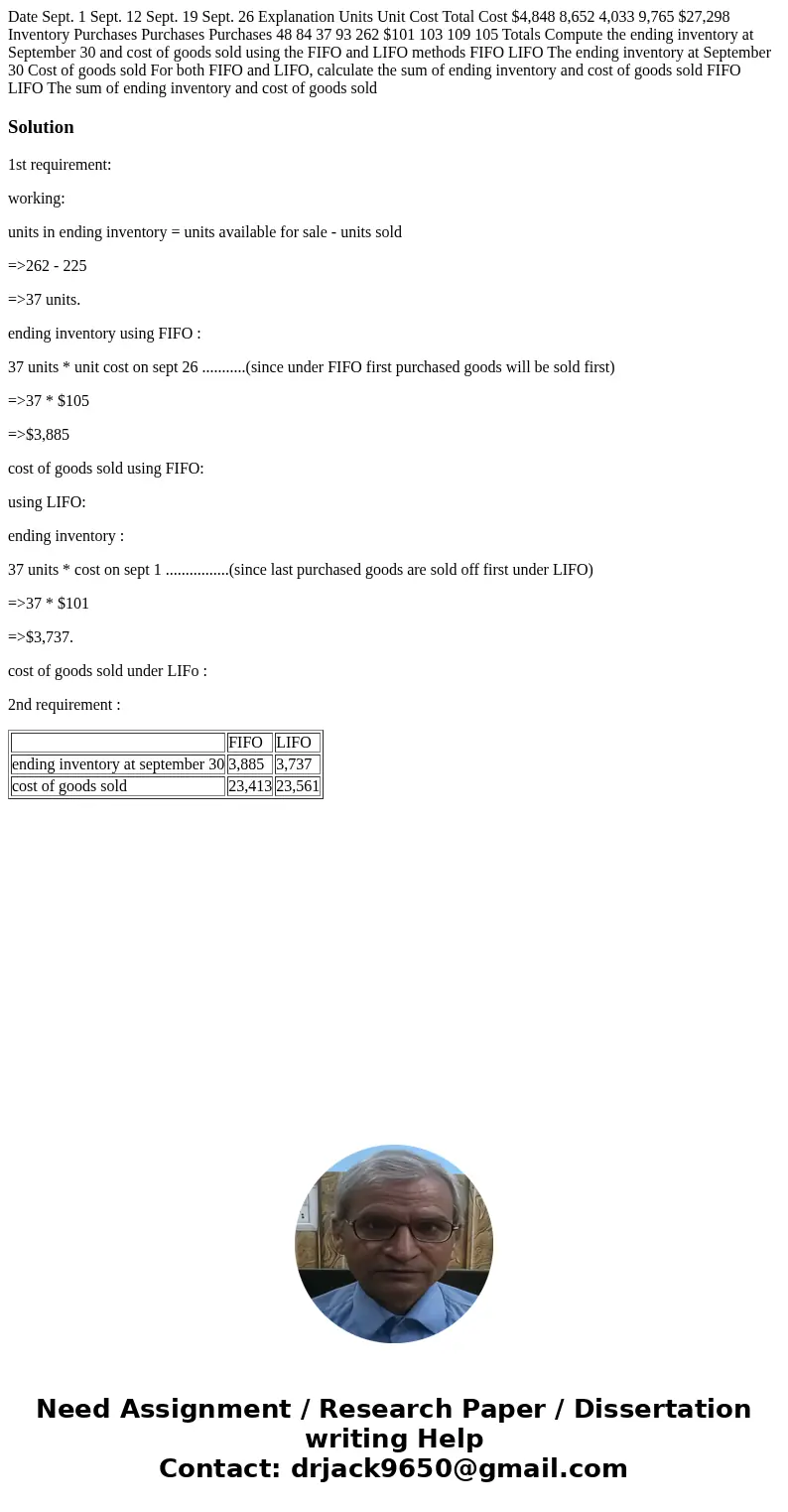

Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 Explanation Units Unit Cost Total Cost $4,848 8,652 4,033 9,765 $27,298 Inventory Purchases Purchases Purchases 48 84 37 93 262 $101 103 109 105 Totals Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods FIFO LIFO The ending inventory at September 30 Cost of goods sold For both FIFO and LIFO, calculate the sum of ending inventory and cost of goods sold FIFO LIFO The sum of ending inventory and cost of goods sold

Solution

1st requirement:

working:

units in ending inventory = units available for sale - units sold

=>262 - 225

=>37 units.

ending inventory using FIFO :

37 units * unit cost on sept 26 ...........(since under FIFO first purchased goods will be sold first)

=>37 * $105

=>$3,885

cost of goods sold using FIFO:

using LIFO:

ending inventory :

37 units * cost on sept 1 ................(since last purchased goods are sold off first under LIFO)

=>37 * $101

=>$3,737.

cost of goods sold under LIFo :

2nd requirement :

| FIFO | LIFO | |

| ending inventory at september 30 | 3,885 | 3,737 |

| cost of goods sold | 23,413 | 23,561 |

Homework Sourse

Homework Sourse