Also D Calculate the operating profit per unit for the Hardy

Also

D. Calculate the operating profit per unit for the \'Hardy\" and for the \'Luxury\'\' using the activity -besed codting system .

E. Discuss one advantage and one disadvantage for allocating the overhead useing a single cost driver (the conventional method ) and for using activity based costing.

PLease answer it step by step and explaineach step with details .

QUESTION1 Winx Ltd manufactures and sells saddles. It manufactures two types of saddles, one intended for professional Race Riders called \'Luxury\" and one that is less expensive and intended for track riders called \"Hardy\". The \"Luxury\" sells for $1,500 and the Hardy\" sells for $900. The company currently uses a conventional costing system using a single cost driver to allocate the overhead. The following cost information has been used as a basis for pricing decisions over the past year Per-unit data Hard Luxu irect materials Direct r hours 5 hours nits produced ini Direct labour cost is $12 per hour and the machine usage cost is $1 per hour. Manufacturing overhead costs were estimated at $392,000 and were allocated based on machine hours The Company has decided to introduce an activity-based costing system to ascertain the manufacturing cost and the following data was collected: Activity Centre Cost driver Quality control Number of inspections Purchase orders Number of orders Machining Traceable costs S106,000 $95,000 $116,000 $75,000 Total traceable costs392,000 Machine hours Number of set-ups Number of events Total Activi Quality control Purchase orders Machining Machine set-ups Luxu 7,000 12,000 400019.000 Hard 7750 750 7,000 24,000 1,000 28,000 3,000 2,000 Sellins, general and administratite expenses per unit sold are $295 for the Hardy\' saddle and $245 for the \'Luxury saddle. Required: [show workings up to 2 decimal points, where applicable] a. Calculate the cost of each type of saddle using machine hours as the cost driver. (4 marks) b. Calculate the profit per saddle for the \"Hardy\" model and the \"Luxury model using the single cost driver, machine hours, to allocate the overhead. (4 marks) c. Calculate the total cost per unit for the \'Hardy\' and for the Luxury\' using the activity- based costing system. (5 marks) 1lPage Sem 1 20 18Solution

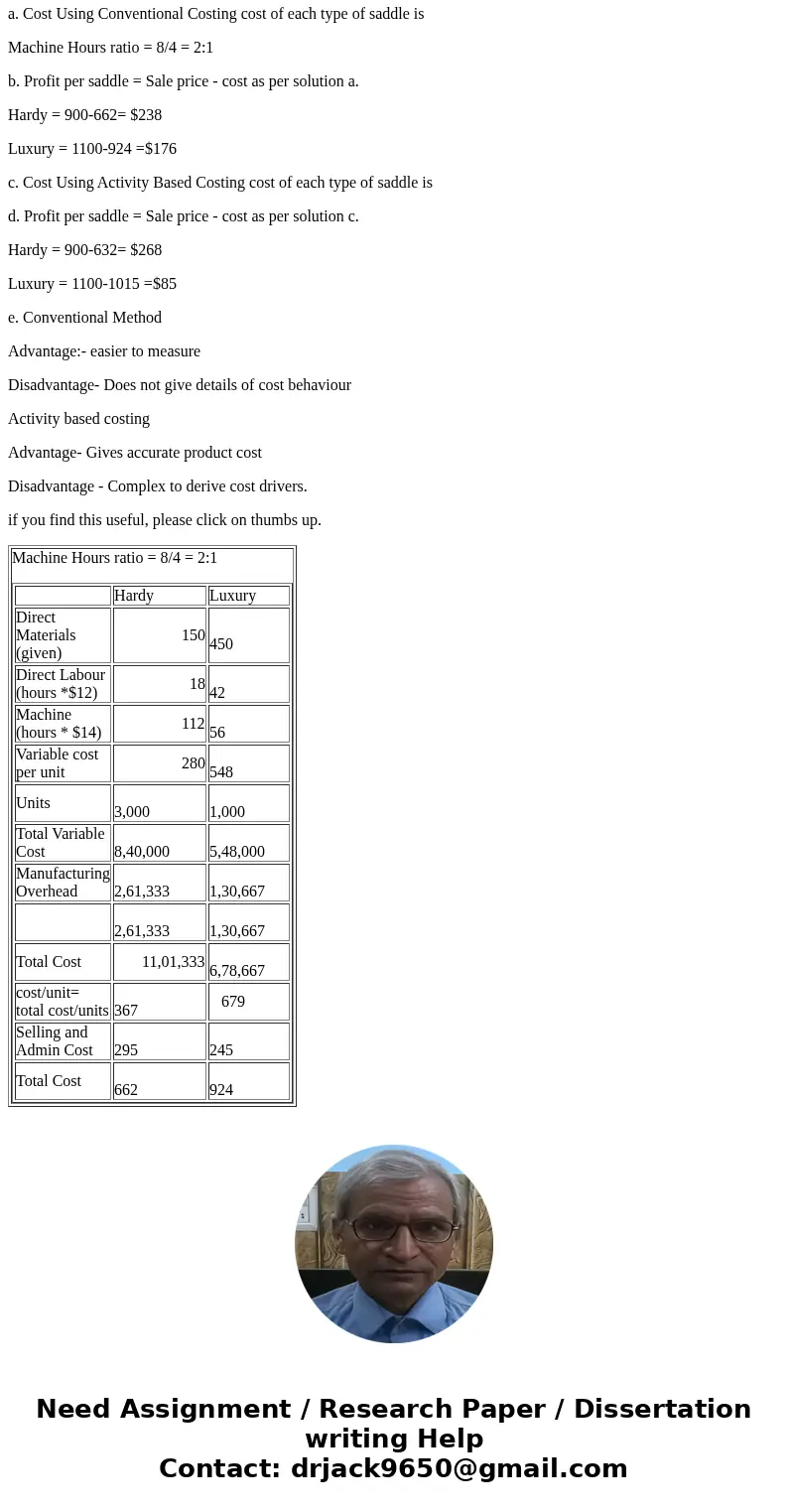

a. Cost Using Conventional Costing cost of each type of saddle is

Machine Hours ratio = 8/4 = 2:1

b. Profit per saddle = Sale price - cost as per solution a.

Hardy = 900-662= $238

Luxury = 1100-924 =$176

c. Cost Using Activity Based Costing cost of each type of saddle is

d. Profit per saddle = Sale price - cost as per solution c.

Hardy = 900-632= $268

Luxury = 1100-1015 =$85

e. Conventional Method

Advantage:- easier to measure

Disadvantage- Does not give details of cost behaviour

Activity based costing

Advantage- Gives accurate product cost

Disadvantage - Complex to derive cost drivers.

if you find this useful, please click on thumbs up.

| Machine Hours ratio = 8/4 = 2:1

|

Homework Sourse

Homework Sourse