A company purchased a new vehicle for 45000 The vehicle has

Solution

Year

Beginning

Book Value

Depreciation

Percent

Depreciation

Amount

Accumulated

Depreciation

Amount

Ending

Book Value

1

$45,000

18.18%

$7,545

$7,545

$37,455

2

$37,455

16.36%

$6,791

$14,336

$30,664

3

$30,664

14.54%

$6,036

$20,372

$24,628

4

$24,628

12.73%

$5,282

$25,654

$19,346

5

$19,346

10.91%

$4,527

$30,181

$14,819

6

$14,819

9.09%

$3,773

$33,954

$11,046

7

$11,046

7.27%

$3,018

$36,972

$8,028

8

$8,028

5.46%

$2,264

$39,236

$5,764

9

$5,764

3.64%

$1,509

$40,745

$4,255

10

$4,255

1.82%

$755

$41,500

$3,500

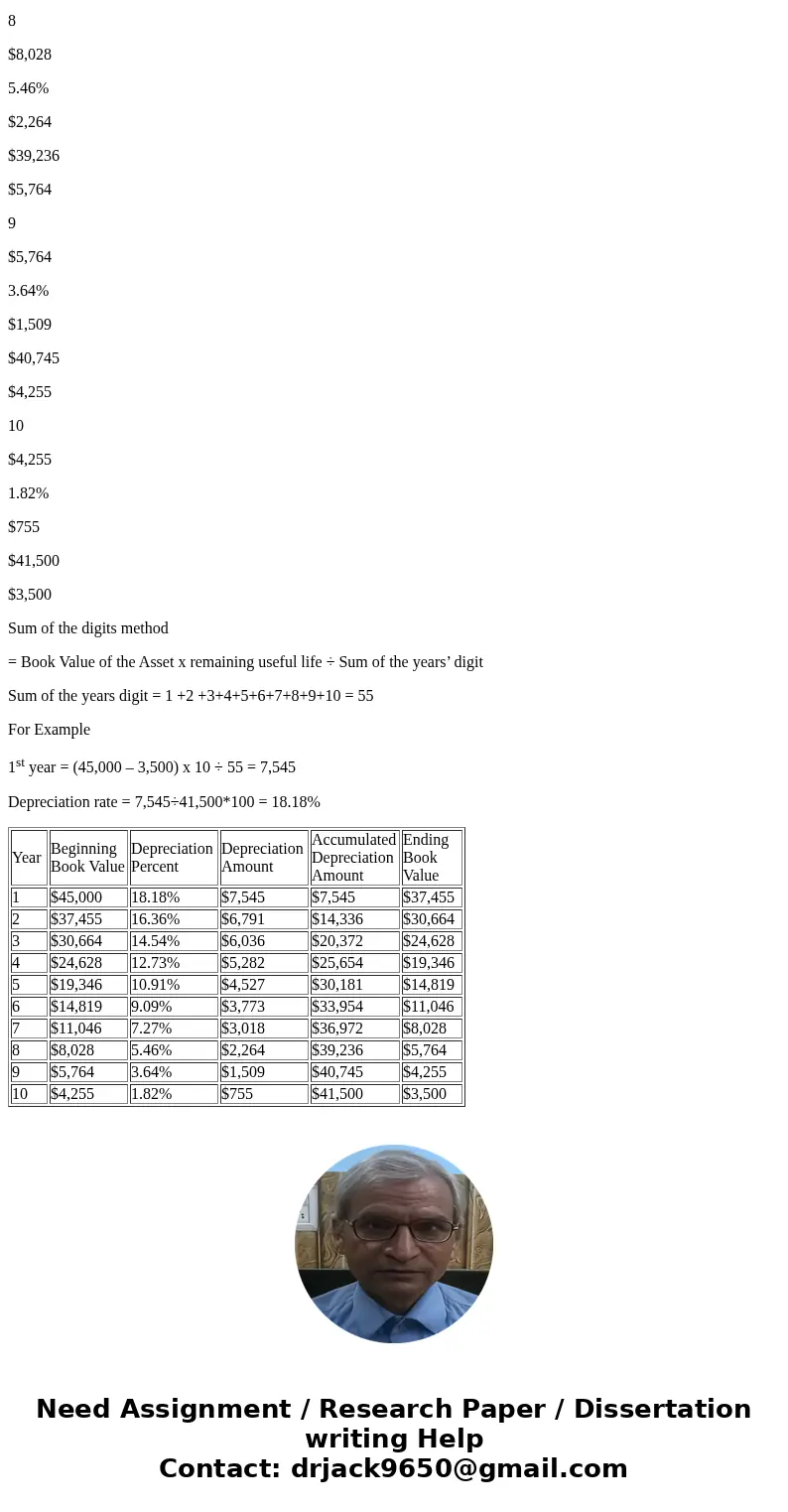

Sum of the digits method

= Book Value of the Asset x remaining useful life ÷ Sum of the years’ digit

Sum of the years digit = 1 +2 +3+4+5+6+7+8+9+10 = 55

For Example

1st year = (45,000 – 3,500) x 10 ÷ 55 = 7,545

Depreciation rate = 7,545÷41,500*100 = 18.18%

| Year | Beginning | Depreciation | Depreciation | Accumulated | Ending |

| 1 | $45,000 | 18.18% | $7,545 | $7,545 | $37,455 |

| 2 | $37,455 | 16.36% | $6,791 | $14,336 | $30,664 |

| 3 | $30,664 | 14.54% | $6,036 | $20,372 | $24,628 |

| 4 | $24,628 | 12.73% | $5,282 | $25,654 | $19,346 |

| 5 | $19,346 | 10.91% | $4,527 | $30,181 | $14,819 |

| 6 | $14,819 | 9.09% | $3,773 | $33,954 | $11,046 |

| 7 | $11,046 | 7.27% | $3,018 | $36,972 | $8,028 |

| 8 | $8,028 | 5.46% | $2,264 | $39,236 | $5,764 |

| 9 | $5,764 | 3.64% | $1,509 | $40,745 | $4,255 |

| 10 | $4,255 | 1.82% | $755 | $41,500 | $3,500 |

Homework Sourse

Homework Sourse