What dividend growth rate would be required to produce a cos

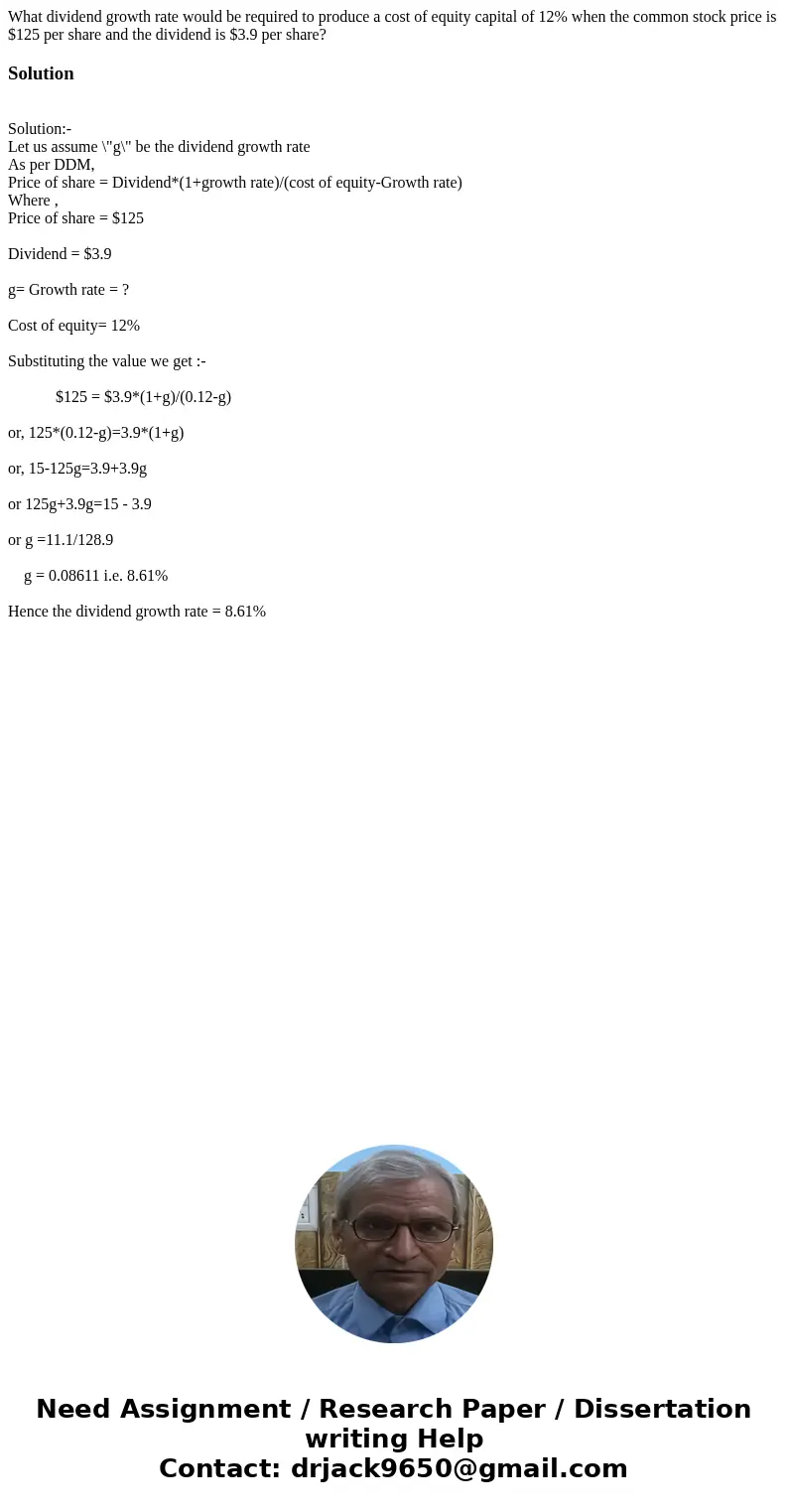

What dividend growth rate would be required to produce a cost of equity capital of 12% when the common stock price is $125 per share and the dividend is $3.9 per share?

Solution

Solution:-

Let us assume \"g\" be the dividend growth rate

As per DDM,

Price of share = Dividend*(1+growth rate)/(cost of equity-Growth rate)

Where ,

Price of share = $125

Dividend = $3.9

g= Growth rate = ?

Cost of equity= 12%

Substituting the value we get :-

$125 = $3.9*(1+g)/(0.12-g)

or, 125*(0.12-g)=3.9*(1+g)

or, 15-125g=3.9+3.9g

or 125g+3.9g=15 - 3.9

or g =11.1/128.9

g = 0.08611 i.e. 8.61%

Hence the dividend growth rate = 8.61%

Homework Sourse

Homework Sourse