On January 1 2018 the Highlands Company began construction o

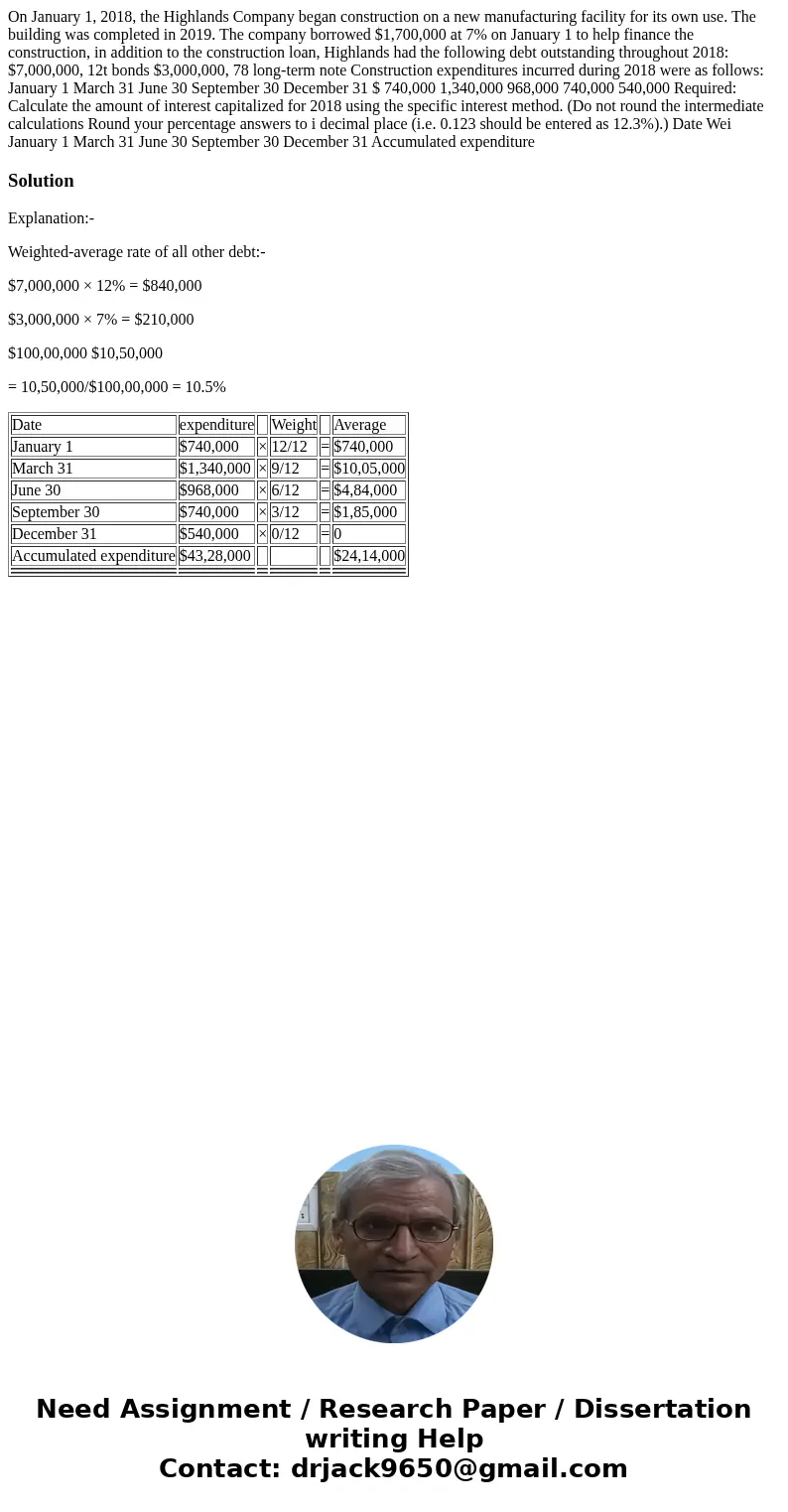

On January 1, 2018, the Highlands Company began construction on a new manufacturing facility for its own use. The building was completed in 2019. The company borrowed $1,700,000 at 7% on January 1 to help finance the construction, in addition to the construction loan, Highlands had the following debt outstanding throughout 2018: $7,000,000, 12t bonds $3,000,000, 78 long-term note Construction expenditures incurred during 2018 were as follows: January 1 March 31 June 30 September 30 December 31 $ 740,000 1,340,000 968,000 740,000 540,000 Required: Calculate the amount of interest capitalized for 2018 using the specific interest method. (Do not round the intermediate calculations Round your percentage answers to i decimal place (i.e. 0.123 should be entered as 12.3%).) Date Wei January 1 March 31 June 30 September 30 December 31 Accumulated expenditure

Solution

Explanation:-

Weighted-average rate of all other debt:-

$7,000,000 × 12% = $840,000

$3,000,000 × 7% = $210,000

$100,00,000 $10,50,000

= 10,50,000/$100,00,000 = 10.5%

| Date | expenditure | Weight | Average | ||

| January 1 | $740,000 | × | 12/12 | = | $740,000 |

| March 31 | $1,340,000 | × | 9/12 | = | $10,05,000 |

| June 30 | $968,000 | × | 6/12 | = | $4,84,000 |

| September 30 | $740,000 | × | 3/12 | = | $1,85,000 |

| December 31 | $540,000 | × | 0/12 | = | 0 |

| Accumulated expenditure | $43,28,000 | $24,14,000 | |||

Homework Sourse

Homework Sourse