CALCULATOR I FULLSCREEN pRINTER VERSIOIN 4 BACK CES NEXT P

Solution

Answers

No.

Accounts Title & explanation

Debit

Credit

Working

1

Cash

$ 1,46,397.00

[Total - Discount]

Sales Discount

$ 2,103.00

[70100 x 3%]

Accounts receivables

$ 1,48,500.00

[total A/R received]

(cash received)

2

Accounts receivables

$ 6,130.00

Allowances for Doubtful accounts

$ 6,130.00

(A/R reinstated)

3

Cash

$ 6,130.00

Accounts receivables

$ 6,130.00

(Collection)

4

Allowances for Doubtful accounts

$ 17,900.00

Accounts receivables

$ 17,900.00

(Written off account)

5

Bad Debt expense

$ 22,570.00

[See working below]

Allowances for Doubtful accounts

$ 22,570.00

(Allowance account adjusted)

Allowances for Doubtful accounts

Beginning Balance

$ 17,700.00

A/R Reinstated

$ 6,130.00

Written off

$ (17,900.00)

Unadjusted ending balance

$ 5,930.00

Adjusted Balance required

$ 28,500.00

Amount of Bad Debt expense [ 28500 – 5930]

$ 22,570.00

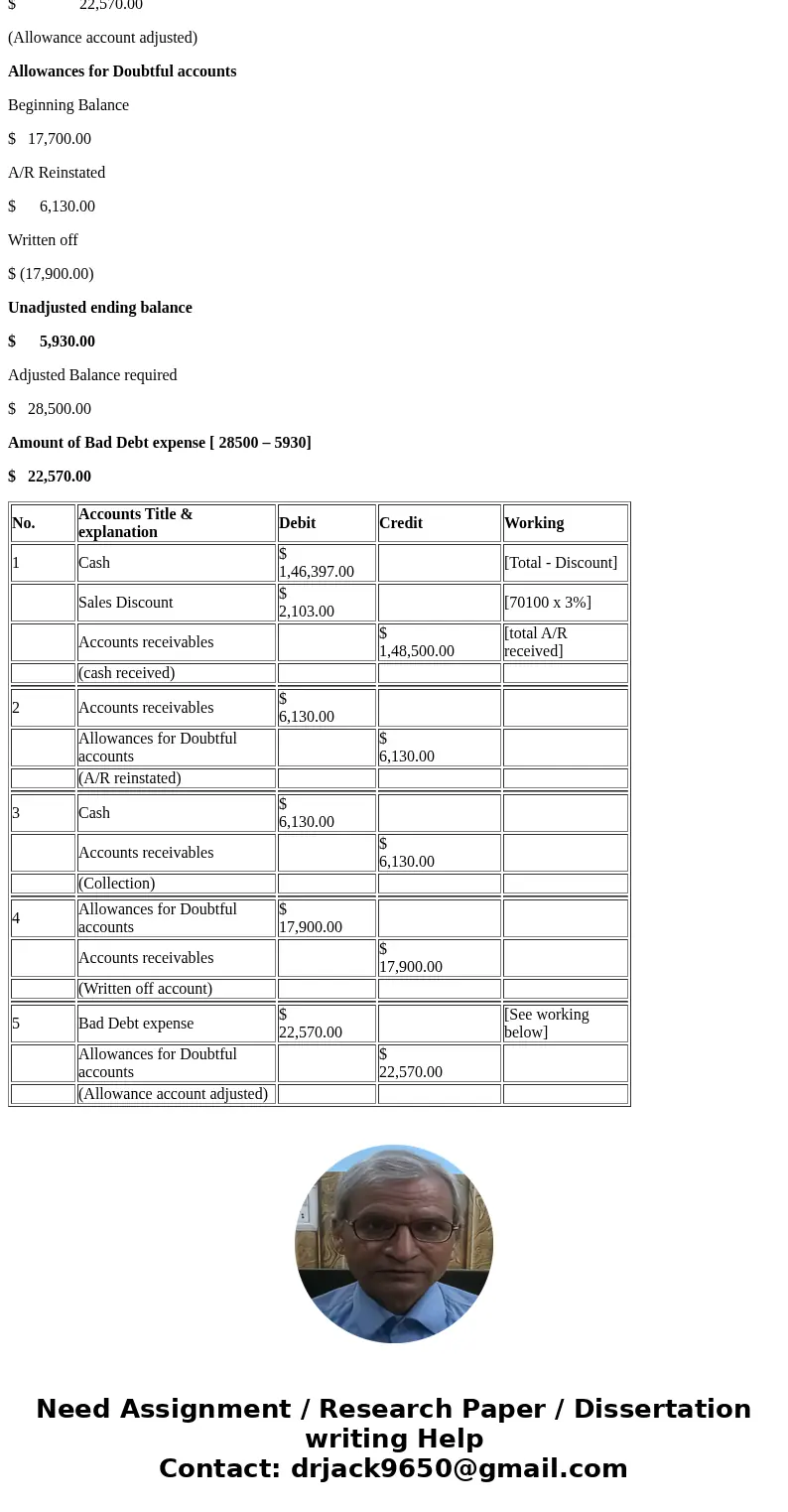

| No. | Accounts Title & explanation | Debit | Credit | Working |

| 1 | Cash | $ 1,46,397.00 | [Total - Discount] | |

| Sales Discount | $ 2,103.00 | [70100 x 3%] | ||

| Accounts receivables | $ 1,48,500.00 | [total A/R received] | ||

| (cash received) | ||||

| 2 | Accounts receivables | $ 6,130.00 | ||

| Allowances for Doubtful accounts | $ 6,130.00 | |||

| (A/R reinstated) | ||||

| 3 | Cash | $ 6,130.00 | ||

| Accounts receivables | $ 6,130.00 | |||

| (Collection) | ||||

| 4 | Allowances for Doubtful accounts | $ 17,900.00 | ||

| Accounts receivables | $ 17,900.00 | |||

| (Written off account) | ||||

| 5 | Bad Debt expense | $ 22,570.00 | [See working below] | |

| Allowances for Doubtful accounts | $ 22,570.00 | |||

| (Allowance account adjusted) |

Homework Sourse

Homework Sourse