Matlock Corporation sells item A as part of its product line

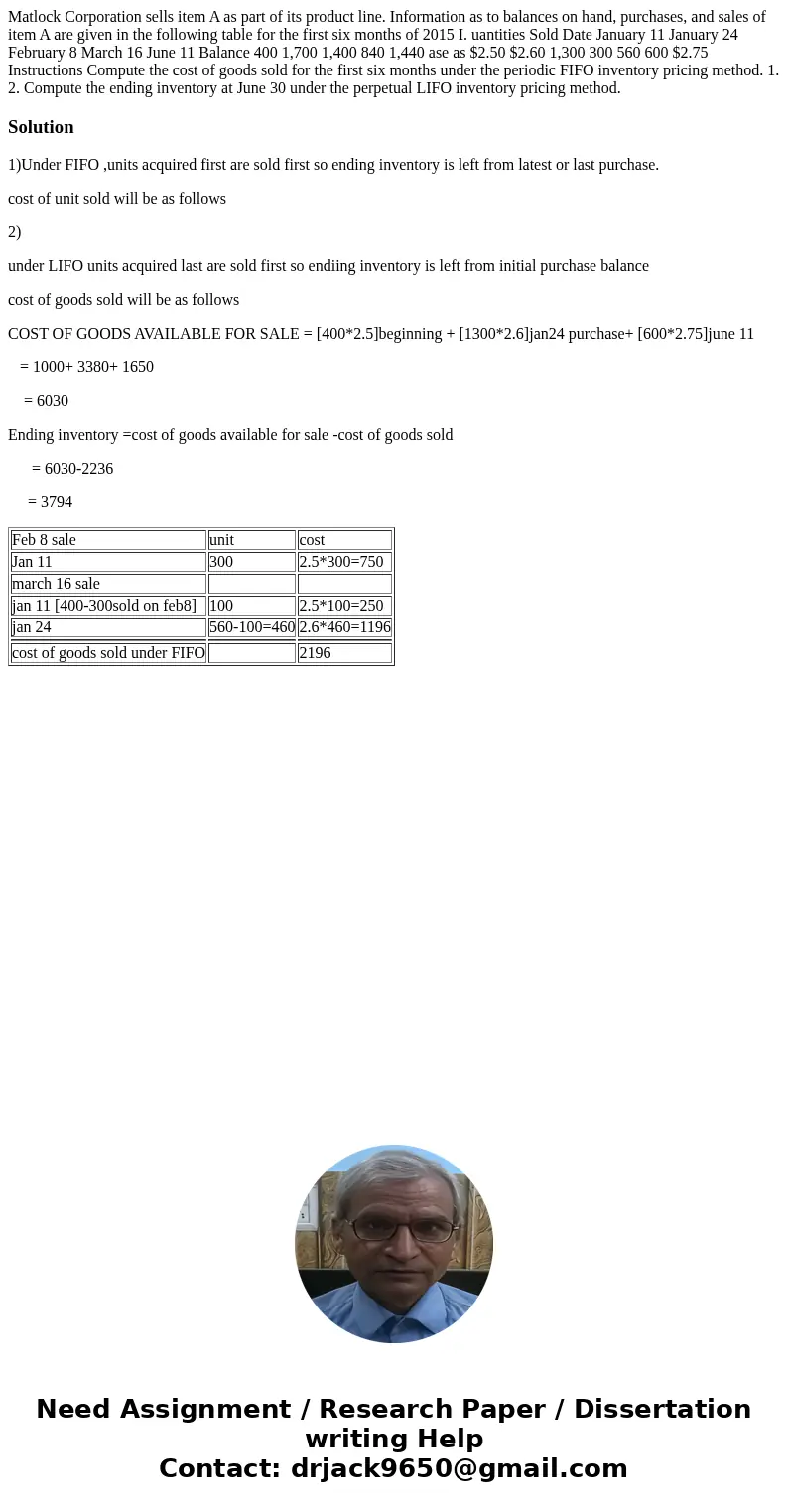

Matlock Corporation sells item A as part of its product line. Information as to balances on hand, purchases, and sales of item A are given in the following table for the first six months of 2015 I. uantities Sold Date January 11 January 24 February 8 March 16 June 11 Balance 400 1,700 1,400 840 1,440 ase as $2.50 $2.60 1,300 300 560 600 $2.75 Instructions Compute the cost of goods sold for the first six months under the periodic FIFO inventory pricing method. 1. 2. Compute the ending inventory at June 30 under the perpetual LIFO inventory pricing method.

Solution

1)Under FIFO ,units acquired first are sold first so ending inventory is left from latest or last purchase.

cost of unit sold will be as follows

2)

under LIFO units acquired last are sold first so endiing inventory is left from initial purchase balance

cost of goods sold will be as follows

COST OF GOODS AVAILABLE FOR SALE = [400*2.5]beginning + [1300*2.6]jan24 purchase+ [600*2.75]june 11

= 1000+ 3380+ 1650

= 6030

Ending inventory =cost of goods available for sale -cost of goods sold

= 6030-2236

= 3794

| Feb 8 sale | unit | cost |

| Jan 11 | 300 | 2.5*300=750 |

| march 16 sale | ||

| jan 11 [400-300sold on feb8] | 100 | 2.5*100=250 |

| jan 24 | 560-100=460 | 2.6*460=1196 |

| cost of goods sold under FIFO | 2196 |

Homework Sourse

Homework Sourse