D Question 9 6 pts Supoose that a 2MW wind burbine can be pu

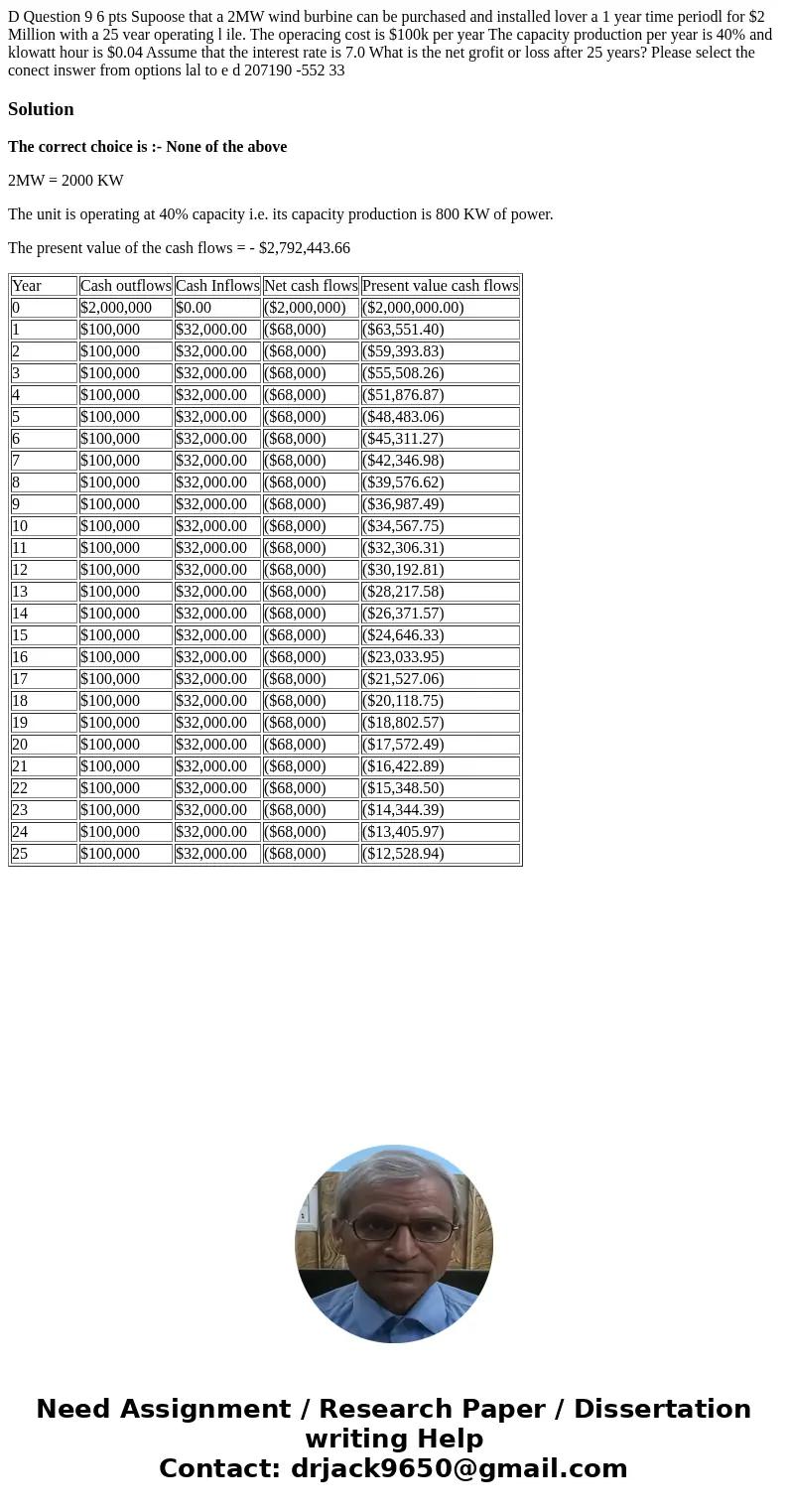

D Question 9 6 pts Supoose that a 2MW wind burbine can be purchased and installed lover a 1 year time periodl for $2 Million with a 25 vear operating l ile. The operacing cost is $100k per year The capacity production per year is 40% and klowatt hour is $0.04 Assume that the interest rate is 7.0 What is the net grofit or loss after 25 years? Please select the conect inswer from options lal to e d 207190 -552 33

Solution

The correct choice is :- None of the above

2MW = 2000 KW

The unit is operating at 40% capacity i.e. its capacity production is 800 KW of power.

The present value of the cash flows = - $2,792,443.66

| Year | Cash outflows | Cash Inflows | Net cash flows | Present value cash flows |

| 0 | $2,000,000 | $0.00 | ($2,000,000) | ($2,000,000.00) |

| 1 | $100,000 | $32,000.00 | ($68,000) | ($63,551.40) |

| 2 | $100,000 | $32,000.00 | ($68,000) | ($59,393.83) |

| 3 | $100,000 | $32,000.00 | ($68,000) | ($55,508.26) |

| 4 | $100,000 | $32,000.00 | ($68,000) | ($51,876.87) |

| 5 | $100,000 | $32,000.00 | ($68,000) | ($48,483.06) |

| 6 | $100,000 | $32,000.00 | ($68,000) | ($45,311.27) |

| 7 | $100,000 | $32,000.00 | ($68,000) | ($42,346.98) |

| 8 | $100,000 | $32,000.00 | ($68,000) | ($39,576.62) |

| 9 | $100,000 | $32,000.00 | ($68,000) | ($36,987.49) |

| 10 | $100,000 | $32,000.00 | ($68,000) | ($34,567.75) |

| 11 | $100,000 | $32,000.00 | ($68,000) | ($32,306.31) |

| 12 | $100,000 | $32,000.00 | ($68,000) | ($30,192.81) |

| 13 | $100,000 | $32,000.00 | ($68,000) | ($28,217.58) |

| 14 | $100,000 | $32,000.00 | ($68,000) | ($26,371.57) |

| 15 | $100,000 | $32,000.00 | ($68,000) | ($24,646.33) |

| 16 | $100,000 | $32,000.00 | ($68,000) | ($23,033.95) |

| 17 | $100,000 | $32,000.00 | ($68,000) | ($21,527.06) |

| 18 | $100,000 | $32,000.00 | ($68,000) | ($20,118.75) |

| 19 | $100,000 | $32,000.00 | ($68,000) | ($18,802.57) |

| 20 | $100,000 | $32,000.00 | ($68,000) | ($17,572.49) |

| 21 | $100,000 | $32,000.00 | ($68,000) | ($16,422.89) |

| 22 | $100,000 | $32,000.00 | ($68,000) | ($15,348.50) |

| 23 | $100,000 | $32,000.00 | ($68,000) | ($14,344.39) |

| 24 | $100,000 | $32,000.00 | ($68,000) | ($13,405.97) |

| 25 | $100,000 | $32,000.00 | ($68,000) | ($12,528.94) |

Homework Sourse

Homework Sourse