Lotz Corporation has two manufacturing departmentsCasting an

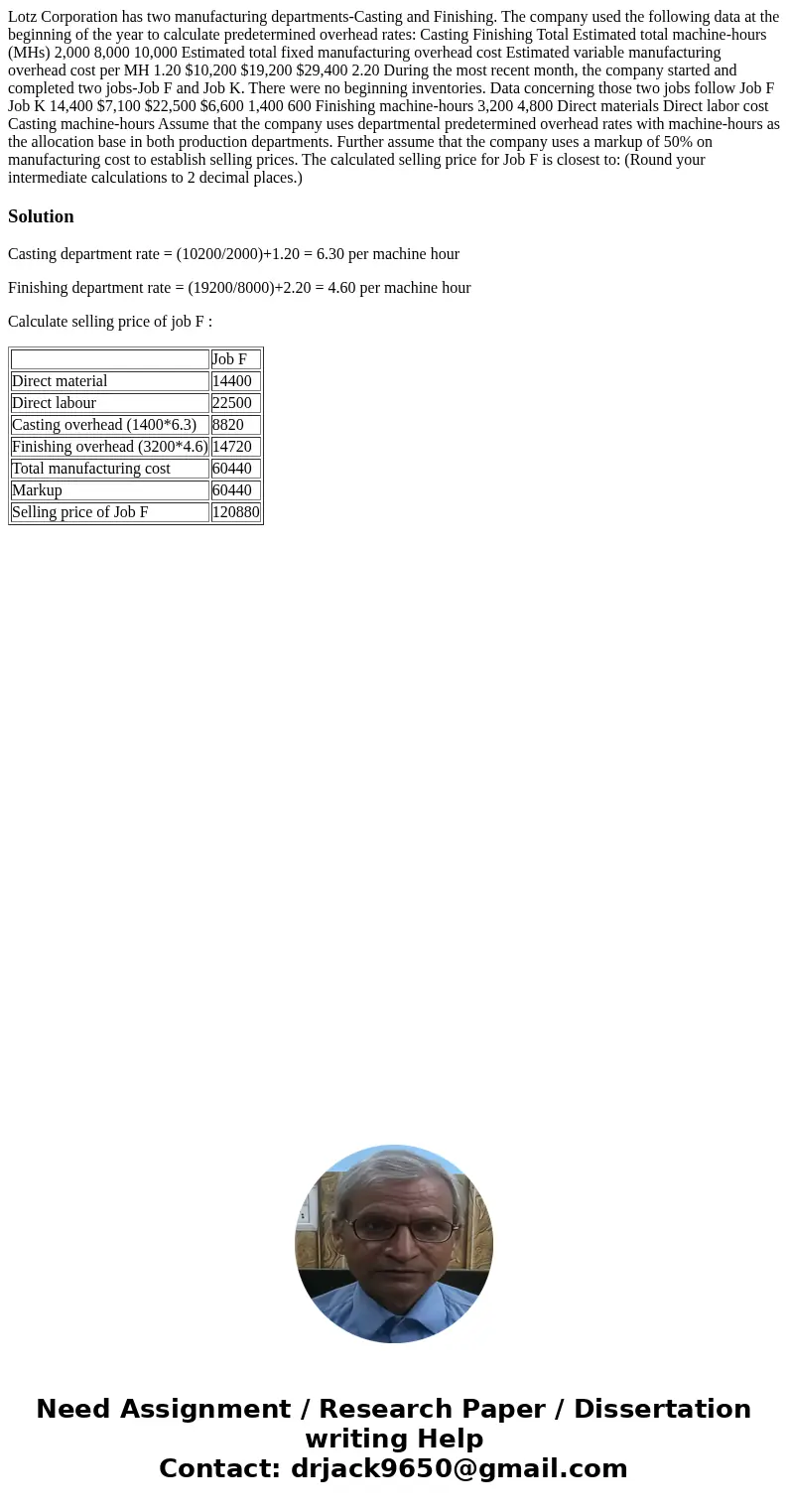

Lotz Corporation has two manufacturing departments-Casting and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates: Casting Finishing Total Estimated total machine-hours (MHs) 2,000 8,000 10,000 Estimated total fixed manufacturing overhead cost Estimated variable manufacturing overhead cost per MH 1.20 $10,200 $19,200 $29,400 2.20 During the most recent month, the company started and completed two jobs-Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow Job F Job K 14,400 $7,100 $22,500 $6,600 1,400 600 Finishing machine-hours 3,200 4,800 Direct materials Direct labor cost Casting machine-hours Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job F is closest to: (Round your intermediate calculations to 2 decimal places.)

Solution

Casting department rate = (10200/2000)+1.20 = 6.30 per machine hour

Finishing department rate = (19200/8000)+2.20 = 4.60 per machine hour

Calculate selling price of job F :

| Job F | |

| Direct material | 14400 |

| Direct labour | 22500 |

| Casting overhead (1400*6.3) | 8820 |

| Finishing overhead (3200*4.6) | 14720 |

| Total manufacturing cost | 60440 |

| Markup | 60440 |

| Selling price of Job F | 120880 |

Homework Sourse

Homework Sourse