P1 10 points Why is it important for engineers designers and

P1 (10 points): Why is it important for engineers, designers, and decision-makers to understand accounting principles? Name a few ways that they can do so. P2 (30 points): The following data were taken from the balance sheet of one of your competitors. Determine the working capital, the current ratio, and the acid-test ratio. Cash Net accounts and notes receivable $90,000 $175,000 $210,000 $6,000 Prepaid expenses Accounts and notes payable (short term 322,000 Accrued expenses $87,000 P3 (20 points): Categorize each of the following costs as direct or indirect. Assume that a traditional costing system is in place Machine run costs Machine depreciation Cost of storage Material handling costs Insurance costs Cost of materials Overtime expenses Machine operator wages Machine labor Utility costs Support (administrative) staff salaries Cost to market the product Cost of product sales force Cost of tooling and fixtures P4 (40 points): The US Securities and Exchange Commission (SEC) requires that all publicly traded companies file the reports and paperwork with the federal government. All of these files are scarchable through the SECs scarch tool called EDGAR (https://www.sec.gov/edgar/searchedgar/companysearch. Look up your favorite publically traded company a All annual reports nd find their annual report. An annual report is c alled a \"10-K\" used for calculation should be submitted as part of the assignment (a) Calculate the working capital, current ratio, and acid test ratio for this company. (b) Using the past 3 annual reports, calculate these same ratios and plot the trends. Is the tren d positive or negative for this company?

Solution

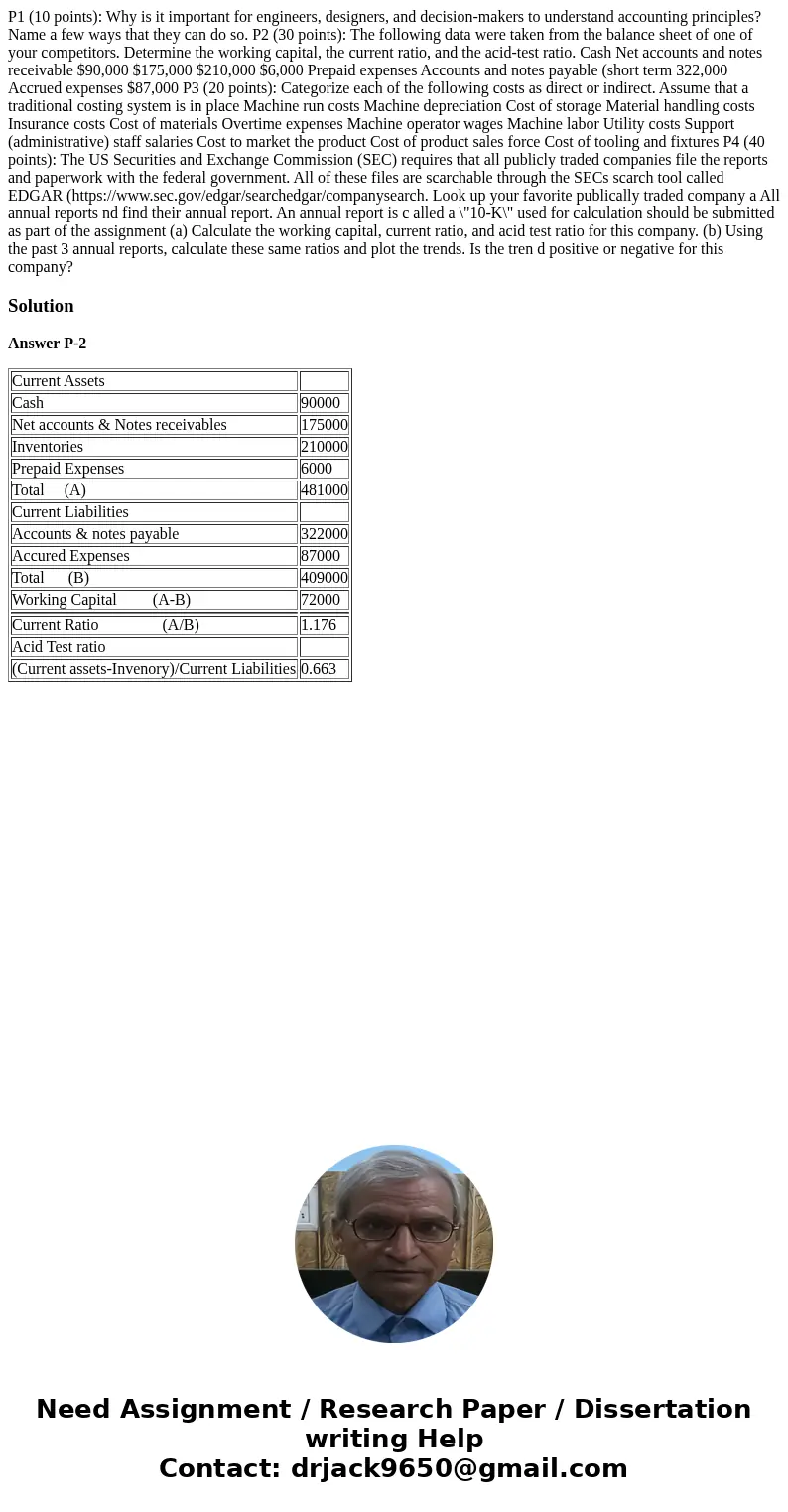

Answer P-2

| Current Assets | |

| Cash | 90000 |

| Net accounts & Notes receivables | 175000 |

| Inventories | 210000 |

| Prepaid Expenses | 6000 |

| Total (A) | 481000 |

| Current Liabilities | |

| Accounts & notes payable | 322000 |

| Accured Expenses | 87000 |

| Total (B) | 409000 |

| Working Capital (A-B) | 72000 |

| Current Ratio (A/B) | 1.176 |

| Acid Test ratio | |

| (Current assets-Invenory)/Current Liabilities | 0.663 |

Homework Sourse

Homework Sourse