Economics 3550 Intermediate MicroTheory Class Discussion que

Solution

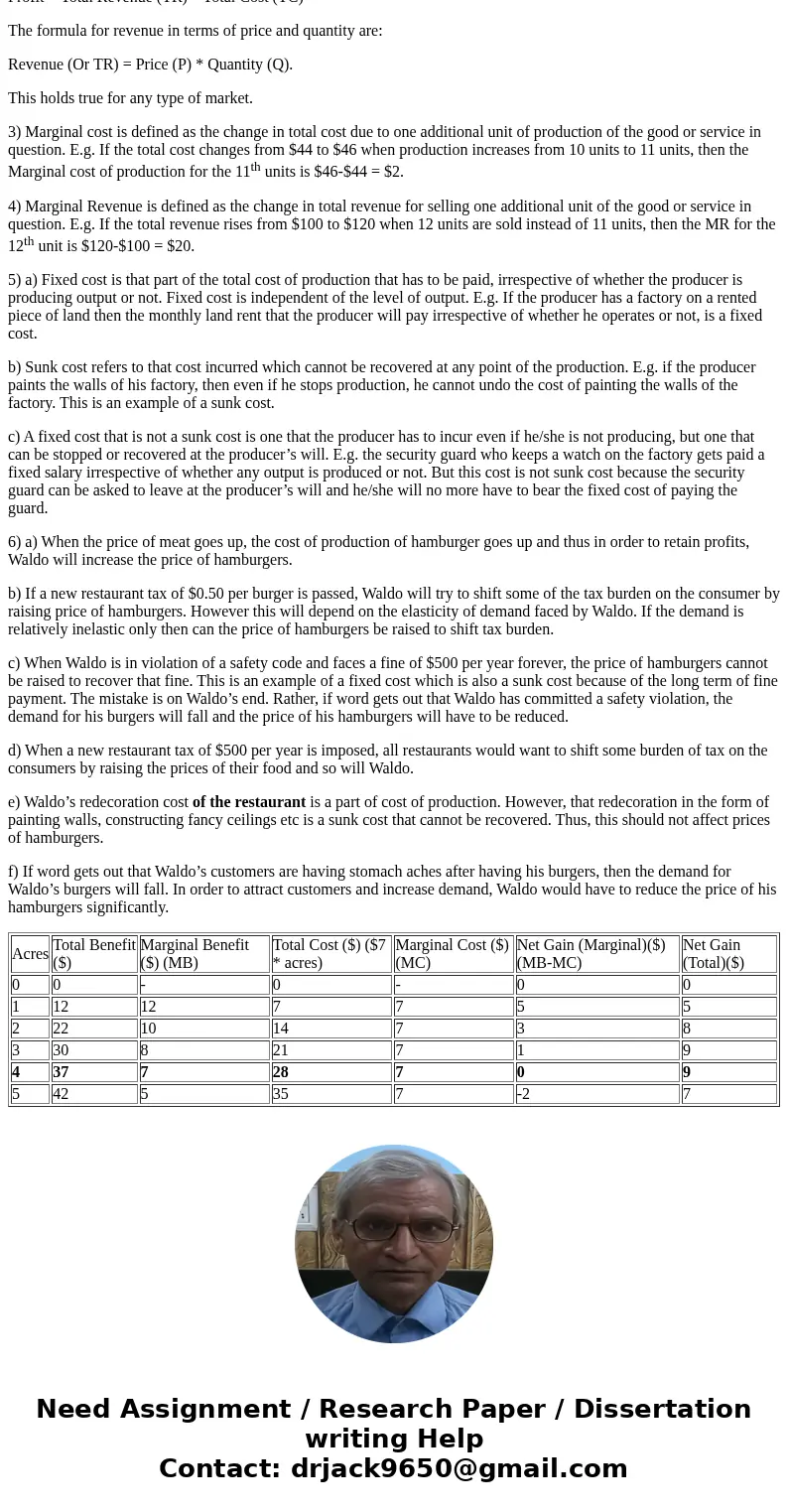

1. It is said that the per acre cost of spraying is $7 per acre.

a) Thus, the table of Cost and Benefit can be filled up as follows:

Acres

Total Benefit ($)

Marginal Benefit ($) (MB)

Total Cost ($) ($7 * acres)

Marginal Cost ($) (MC)

Net Gain (Marginal)($) (MB-MC)

Net Gain (Total)($)

0

0

-

0

-

0

0

1

12

12

7

7

5

5

2

22

10

14

7

3

8

3

30

8

21

7

1

9

4

37

7

28

7

0

9

5

42

5

35

7

-2

7

b) 1 method to calculate the number of acres that should be sprayed is when MB=MC. This happens when the number of acres is 4 and MB=MC=7. At this point, the net marginal gain is 0 which means beyond this point, marginal gain cannot be increased.

c) Another method to find the number of acres that should be sprayed is when the net total gain is maximized. At that point, the net marginal gain is 0 and beyond that point, spraying an additional acre of land will only reduce the net total gain below its maximum. The net total gain is maximum with value 9 when the number of acres is 4. This is exactly equal to the previous answer.

d) When the crop duster has a fixed cost (or fee) of $5, the total cost changes as every total cost rises by 5. However, the marginal cost remains the same. Thus, the farmer will still spray at the point where MB=MC which is at 4 acres of land. This is verified by the chart below:

Acres

Total Benefit ($)

Marginal Benefit ($) (MB)

Total Cost ($) ($5 + $7 * acres)

Marginal Cost ($) (MC)

Net Gain (Marginal)($) (MB-MC)

Net Gain (Total)($)

0

0

-

5

-

0

0

1

12

12

12

7

5

5

2

22

10

19

7

3

8

3

30

8

26

7

1

9

4

37

7

33

7

0

9

5

42

5

40

7

-2

7

e) When the crop duster raises the variable cost or fee to $10 per acre, then the number of acres to be sprayed changes because the MC changes accordingly. At this level, MB = MC when the number of acres is 2. The new chart is as below:

Acres

Total Benefit ($)

Marginal Benefit ($) (MB)

Total Cost ($) ( $10 * acres)

Marginal Cost ($) (MC)

Net Gain (Marginal)($) (MB-MC)

Net Gain (Total)($)

0

0

-

0

-

0

0

1

12

12

10

10

2

2

2

22

10

20

10

0

2

3

30

8

30

10

-2

0

4

37

7

40

10

-3

-3

5

42

5

50

10

-5

-8

2) In general the formula for profit in terms of revenue and cost is:

Profit = Total Revenue (TR) – Total Cost (TC)

The formula for revenue in terms of price and quantity are:

Revenue (Or TR) = Price (P) * Quantity (Q).

This holds true for any type of market.

3) Marginal cost is defined as the change in total cost due to one additional unit of production of the good or service in question. E.g. If the total cost changes from $44 to $46 when production increases from 10 units to 11 units, then the Marginal cost of production for the 11th units is $46-$44 = $2.

4) Marginal Revenue is defined as the change in total revenue for selling one additional unit of the good or service in question. E.g. If the total revenue rises from $100 to $120 when 12 units are sold instead of 11 units, then the MR for the 12th unit is $120-$100 = $20.

5) a) Fixed cost is that part of the total cost of production that has to be paid, irrespective of whether the producer is producing output or not. Fixed cost is independent of the level of output. E.g. If the producer has a factory on a rented piece of land then the monthly land rent that the producer will pay irrespective of whether he operates or not, is a fixed cost.

b) Sunk cost refers to that cost incurred which cannot be recovered at any point of the production. E.g. if the producer paints the walls of his factory, then even if he stops production, he cannot undo the cost of painting the walls of the factory. This is an example of a sunk cost.

c) A fixed cost that is not a sunk cost is one that the producer has to incur even if he/she is not producing, but one that can be stopped or recovered at the producer’s will. E.g. the security guard who keeps a watch on the factory gets paid a fixed salary irrespective of whether any output is produced or not. But this cost is not sunk cost because the security guard can be asked to leave at the producer’s will and he/she will no more have to bear the fixed cost of paying the guard.

6) a) When the price of meat goes up, the cost of production of hamburger goes up and thus in order to retain profits, Waldo will increase the price of hamburgers.

b) If a new restaurant tax of $0.50 per burger is passed, Waldo will try to shift some of the tax burden on the consumer by raising price of hamburgers. However this will depend on the elasticity of demand faced by Waldo. If the demand is relatively inelastic only then can the price of hamburgers be raised to shift tax burden.

c) When Waldo is in violation of a safety code and faces a fine of $500 per year forever, the price of hamburgers cannot be raised to recover that fine. This is an example of a fixed cost which is also a sunk cost because of the long term of fine payment. The mistake is on Waldo’s end. Rather, if word gets out that Waldo has committed a safety violation, the demand for his burgers will fall and the price of his hamburgers will have to be reduced.

d) When a new restaurant tax of $500 per year is imposed, all restaurants would want to shift some burden of tax on the consumers by raising the prices of their food and so will Waldo.

e) Waldo’s redecoration cost of the restaurant is a part of cost of production. However, that redecoration in the form of painting walls, constructing fancy ceilings etc is a sunk cost that cannot be recovered. Thus, this should not affect prices of hamburgers.

f) If word gets out that Waldo’s customers are having stomach aches after having his burgers, then the demand for Waldo’s burgers will fall. In order to attract customers and increase demand, Waldo would have to reduce the price of his hamburgers significantly.

| Acres | Total Benefit ($) | Marginal Benefit ($) (MB) | Total Cost ($) ($7 * acres) | Marginal Cost ($) (MC) | Net Gain (Marginal)($) (MB-MC) | Net Gain (Total)($) |

| 0 | 0 | - | 0 | - | 0 | 0 |

| 1 | 12 | 12 | 7 | 7 | 5 | 5 |

| 2 | 22 | 10 | 14 | 7 | 3 | 8 |

| 3 | 30 | 8 | 21 | 7 | 1 | 9 |

| 4 | 37 | 7 | 28 | 7 | 0 | 9 |

| 5 | 42 | 5 | 35 | 7 | -2 | 7 |

Homework Sourse

Homework Sourse