Question 4 10 points Save Answer On 1231x0 Lotus Corporation

Question 4 10 points Save Answer On 12/31/x0, Lotus Corporation had a balance in earnings and profits (E&P;) of $25,000. The balance in current E&P; for the current year, 20x1, was $10,000. Current E&P; has not been either increased or decreased to reflect the effect (if any) of any of the distributions listed below. REPEAT: Current E&P; has not been adjusted to reflect the effect (s) of the following distributions. The corporation made the following distributions to its shareholders with respect to their stock ownership: Cash of $10,000 . 4/18/xl .6/2/x1 .9/25/xl .11/1/xl .Property worth $50,000; Lotus\' basis in the property was $30,000 Cash or $25,000 Property worth $15,000; Lotus\' basis in the property was $20,000 REQUIRED For each of the 4 distributions, determine the amount that will be considered a dividend. ?.SO B. $7,500 C. None of the other answers is correct D. $2,500 E. $33,000 F $10,000 G. $31,000 H. $3,750 The 4/1/x1 distribution will result in dividend income of -- The 6/2/x1 distribution will result in dividend income of The 9/25x1 distribution will result in dividend income of- . The 11/1/x1 distribution will result in dividend income of

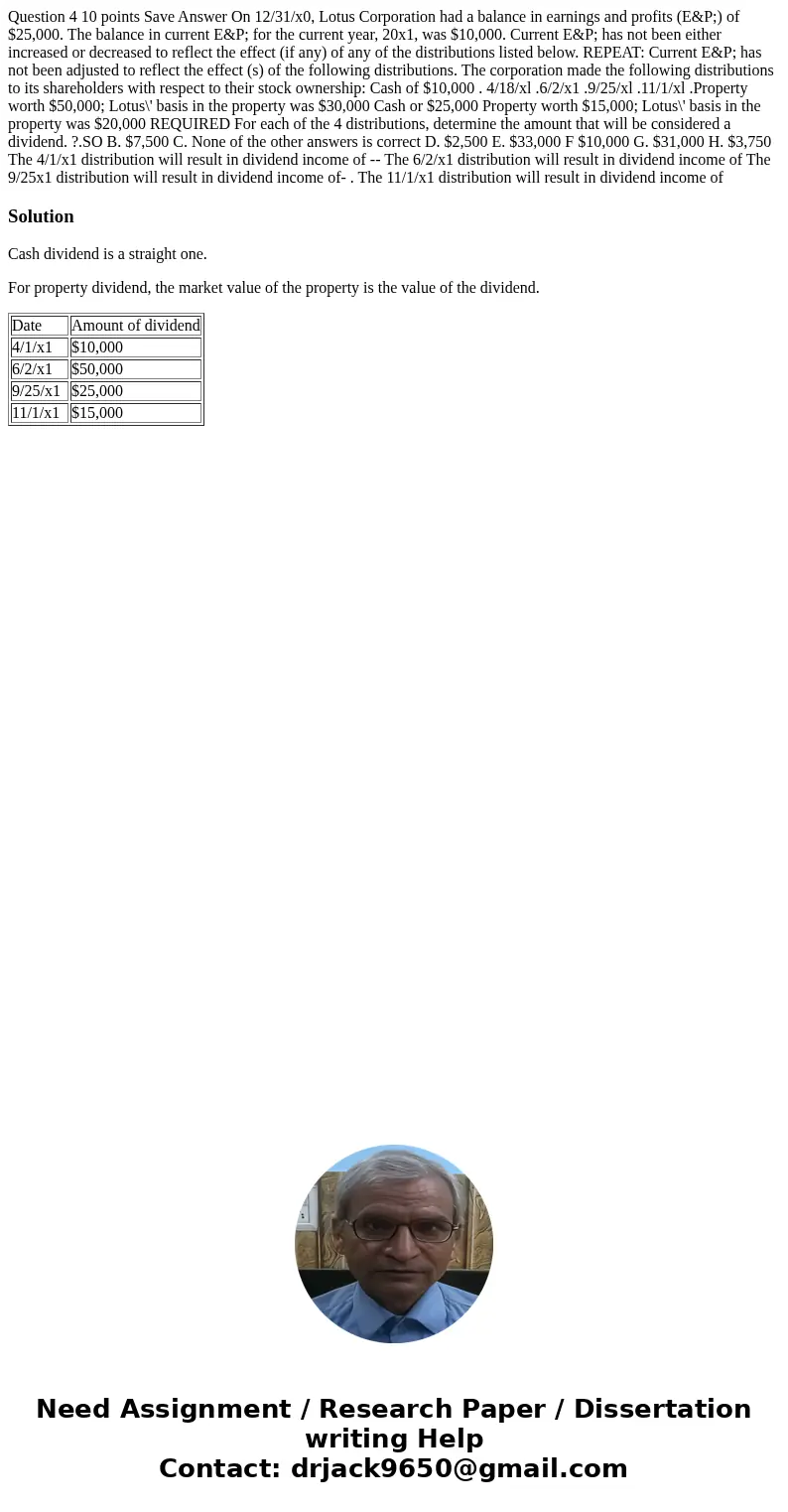

Solution

Cash dividend is a straight one.

For property dividend, the market value of the property is the value of the dividend.

| Date | Amount of dividend |

| 4/1/x1 | $10,000 |

| 6/2/x1 | $50,000 |

| 9/25/x1 | $25,000 |

| 11/1/x1 | $15,000 |

Homework Sourse

Homework Sourse