Vaughn Manufacturing started business in 2012 by issuing 209

Vaughn Manufacturing started business in 2012 by issuing 209000 shares of $21 par common stock for $28 each. In 2017, 25500 of these shares were purchased for $40 per share by Vaughn Manufacturing and held as treasury stock. On June 15, 2018, these 25500 shares were exchanged for a piece of property that had an assessed value of $753000. Vaughn’s stock is actively traded and had a market price of $46 on June 15, 2018. The cost method is used to account for treasury stock. The amount of paid-in capital from treasury stock transactions resulting from the above events would be

$153000.

$743000.

$453000.

$218000.

Solution

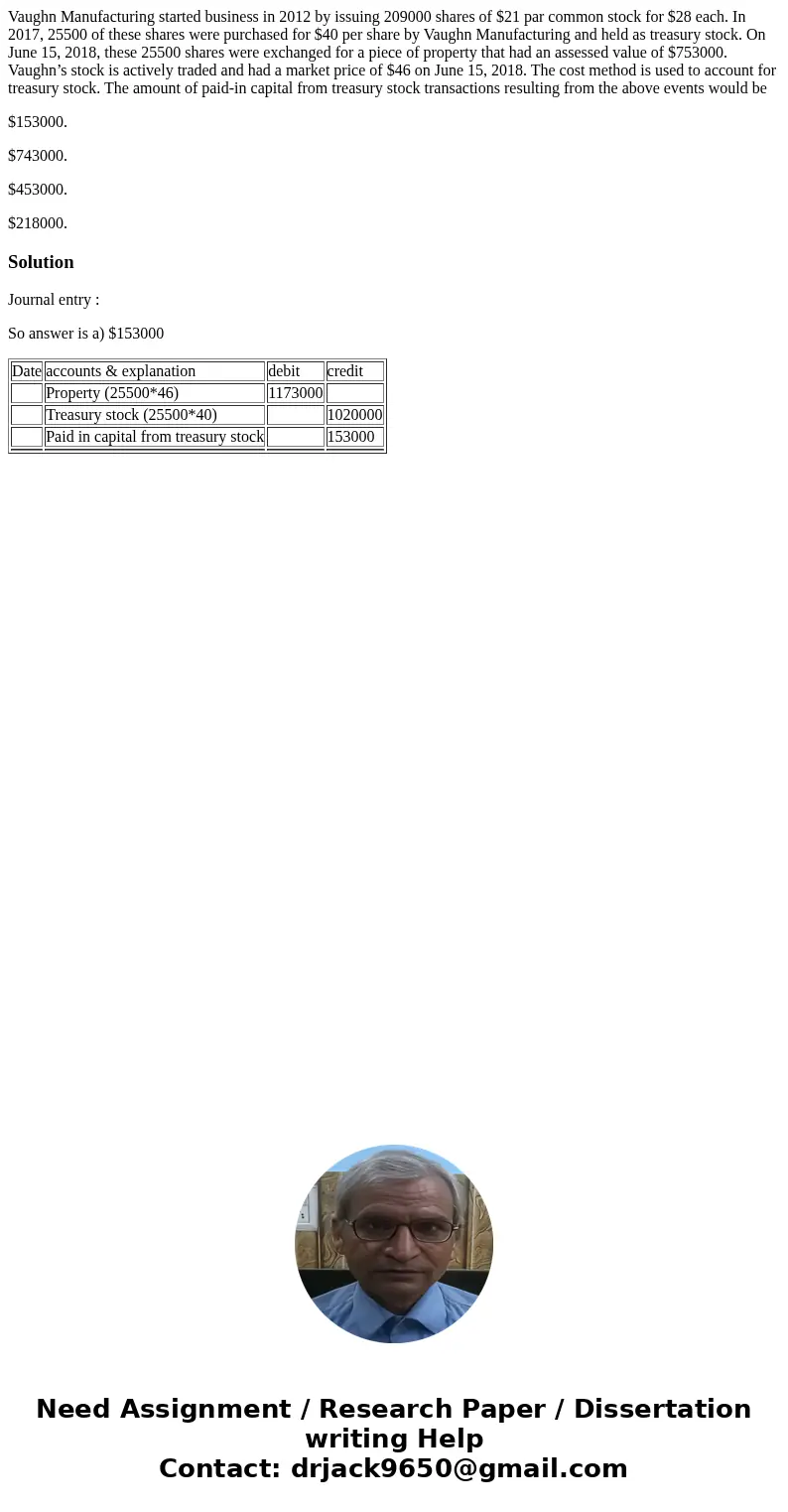

Journal entry :

So answer is a) $153000

| Date | accounts & explanation | debit | credit |

| Property (25500*46) | 1173000 | ||

| Treasury stock (25500*40) | 1020000 | ||

| Paid in capital from treasury stock | 153000 | ||

Homework Sourse

Homework Sourse