Q4 On January 1 2015 Parent Company purchased 70 interest in

Solution

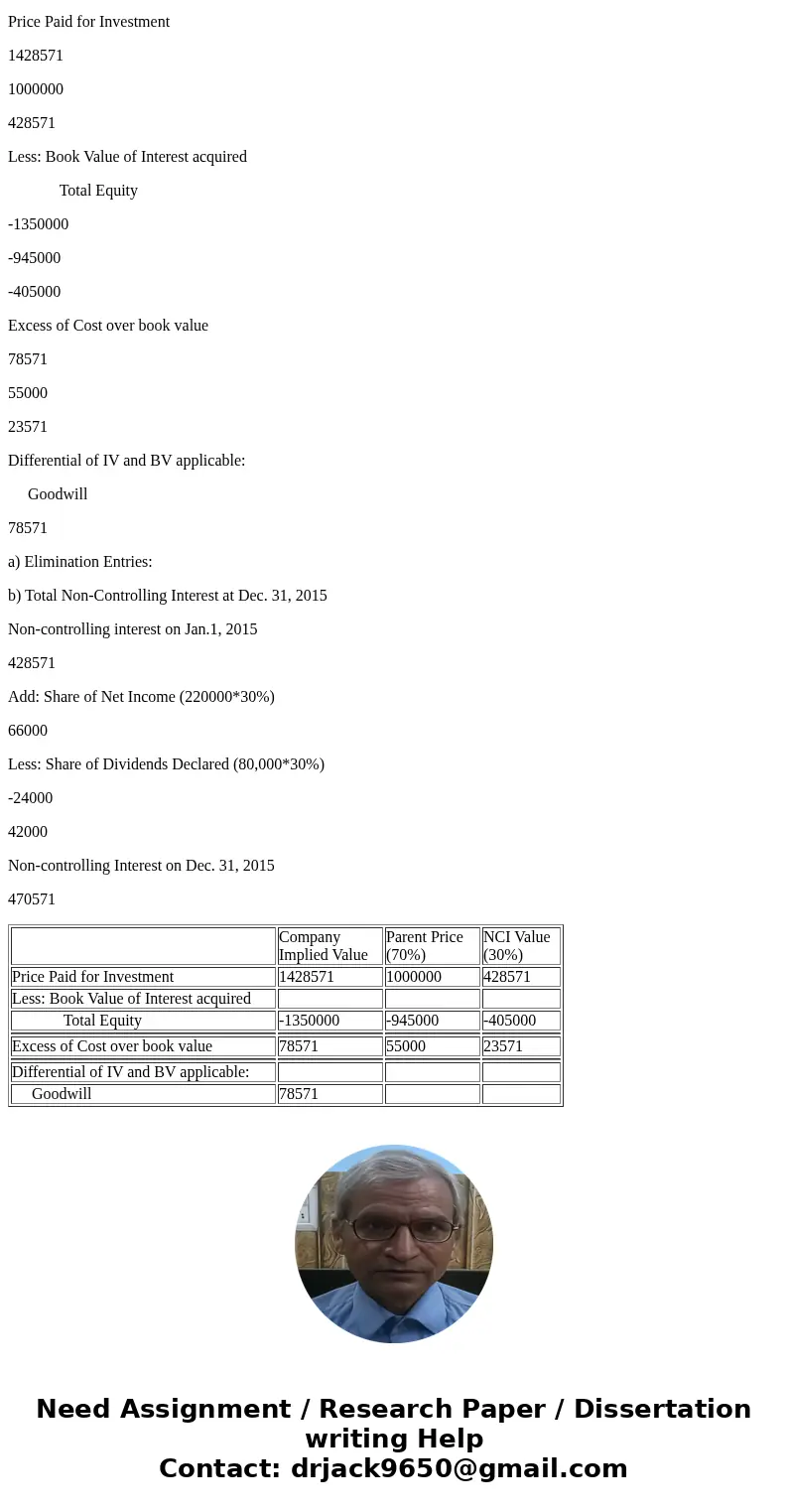

Company Implied Value

Parent Price (70%)

NCI Value (30%)

Price Paid for Investment

1428571

1000000

428571

Less: Book Value of Interest acquired

Total Equity

-1350000

-945000

-405000

Excess of Cost over book value

78571

55000

23571

Differential of IV and BV applicable:

Goodwill

78571

a) Elimination Entries:

b) Total Non-Controlling Interest at Dec. 31, 2015

Non-controlling interest on Jan.1, 2015

428571

Add: Share of Net Income (220000*30%)

66000

Less: Share of Dividends Declared (80,000*30%)

-24000

42000

Non-controlling Interest on Dec. 31, 2015

470571

| Company Implied Value | Parent Price (70%) | NCI Value (30%) | |

| Price Paid for Investment | 1428571 | 1000000 | 428571 |

| Less: Book Value of Interest acquired | |||

| Total Equity | -1350000 | -945000 | -405000 |

| Excess of Cost over book value | 78571 | 55000 | 23571 |

| Differential of IV and BV applicable: | |||

| Goodwill | 78571 |

Homework Sourse

Homework Sourse