Using the tables in Exhibits 263 and 264 determine the prese

Using the tables in Exhibits 26-3 and 26-4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent. (Round \"PV factors\" to 3 decimal places. Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.)

a. $8,500 to be received 20 years from today.

b. $13,000 to be received annually for 10 years.

c. $6,700 to be received annually for five years, with an additional $12,000 salvage value expected at the end of the fifth year.

d. $31,000 to be received annually for the first three years, followed by $20,000 received annually for the next two years (total of five years in which cash is received).

Solution

Answers

Year

PV factor at 15%

1

0.870

2

0.756

3

0.658

4

0.572

5

0.497

6

0.432

7

0.376

8

0.327

9

0.284

10

0.247

11

0.215

12

0.187

13

0.163

14

0.141

15

0.123

16

0.107

17

0.093

18

0.081

19

0.070

20

0.061

$ 8500 to be received in Year 20

PV = 8500 x PV factor of Year 20

= 8500 x 0.061

= $ 518.5 or $ 519

Sum total of PV factor from Year 1 to Year 10 = 5.019

PV of $ 13,000 to be received annually for 10 years = 13000 x 5.019

= $ 65,247

Sum total of PV factor from Year 1 to year 5 = 3.353

PV of 6700 to be received annually for 5 years = 6700 x 3.353 = $ 22,465

PV of $ 12000 received at the end of 5 year = 12000 x PV factor of 5th year = 12000 x 0.497 = $ 5,964

Total PV = 22465 + 5964 = $ 28,429

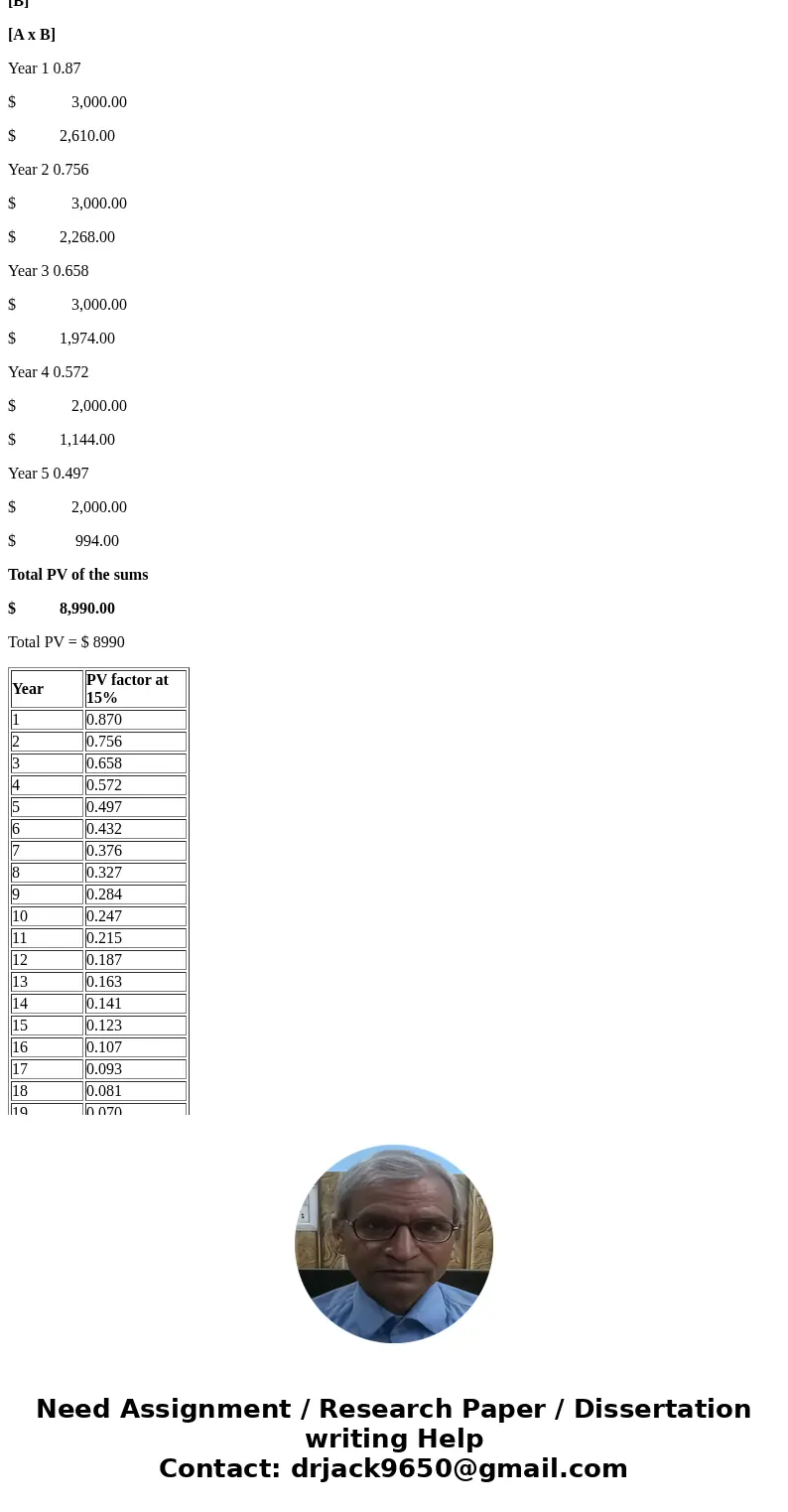

PV factor at 15%

Amount received

Present Value

[A]

[B]

[A x B]

Year 1 0.87

$ 3,000.00

$ 2,610.00

Year 2 0.756

$ 3,000.00

$ 2,268.00

Year 3 0.658

$ 3,000.00

$ 1,974.00

Year 4 0.572

$ 2,000.00

$ 1,144.00

Year 5 0.497

$ 2,000.00

$ 994.00

Total PV of the sums

$ 8,990.00

Total PV = $ 8990

| Year | PV factor at 15% |

| 1 | 0.870 |

| 2 | 0.756 |

| 3 | 0.658 |

| 4 | 0.572 |

| 5 | 0.497 |

| 6 | 0.432 |

| 7 | 0.376 |

| 8 | 0.327 |

| 9 | 0.284 |

| 10 | 0.247 |

| 11 | 0.215 |

| 12 | 0.187 |

| 13 | 0.163 |

| 14 | 0.141 |

| 15 | 0.123 |

| 16 | 0.107 |

| 17 | 0.093 |

| 18 | 0.081 |

| 19 | 0.070 |

| 20 | 0.061 |

Homework Sourse

Homework Sourse