170 points Problem 753 Show Flow of Costs to Jobs LO 72 3 Ki

1.70 points Problem 7-53 Show Flow of Costs to Jobs (LO 7-2, 3) Kim\'s Asphalt does driveway and parking lot resurfacing work for large commercial clients as well as small residential clients. An inventory of materials and equipment is on hand at all times so that work can start as quickly as possible. Special equipment is ordered as required. On May 1, the Materials and Equipment Inventory account had a balance of $54,000. The Work-in-Process Inventory account is maintained to record costs of work not yet complete. There were two such jobs on May 1 with the following costs: Job 33 Pine Ridge Estates S 54,300 27,150 Job 27 Materials and equipment Direct labor Overhead (applied) $18,075 15,300 4,590 8,145 Overhead has been applied at 30 percent of the costs ofiect labor During May, Kim\'s Asphalt started two new jobs. Additional work was carried out on Jobs 27 and 33, with the latter completed and billed to Pine Ridge Estates. Details on the costs incurred on jobs during May follow Job Materials and equipment Direct labor (wages payable) 34 35 $4,800 S6,600 $6.400 $4,700 6,300 8,550 7,700 3.400 Other May Events 1. Received $14,300 payment on Job 24 delivered to customer in April. 2. Purchased materials and equipment for $11,200 on account 3. Billed Pine Ridge Estates $148,000 and received payment for $140,000 of that amount. 4. Determined that payroll for indirect labor personnel totaled S830. 5. Issued supplies and incidental materials for current jobs costing $335 6. Recorded overhead and advertising costs for the operation as follows (all cash except equipment depreciation): Property taxes Storage area rental Truck and delivery cost Advertising and promotion campaign Inspections Telephone and other miscellaneous Equipment depreciation S730 855 500 780 380 505 630 Required a. Prepare journal entries to record the flow of costs for operations during May. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field.)

Solution

answer

a )

b ) amount of over or under applied overheads

actual overhead = 830 +335 + 730 + 855 + 500 + 780 + 380 + 505 + 630

= 5545

direct labour cost = 6300 + 8500 + 7700 + 3400

= 25900

overheads = 30 % * 25900

= 7770

overhead of month = 7770 - 5545

= 2225

c ) balance for material and equipment inventory

opening material & equi inventory = 54000

add purchase material & equi = 11200

less used in jobs (4800+6600+6400+4700) =22500

closing material & equipment inventory = 42700

work in process = job 34 = 14100

= job 35 = 8100

= 22200

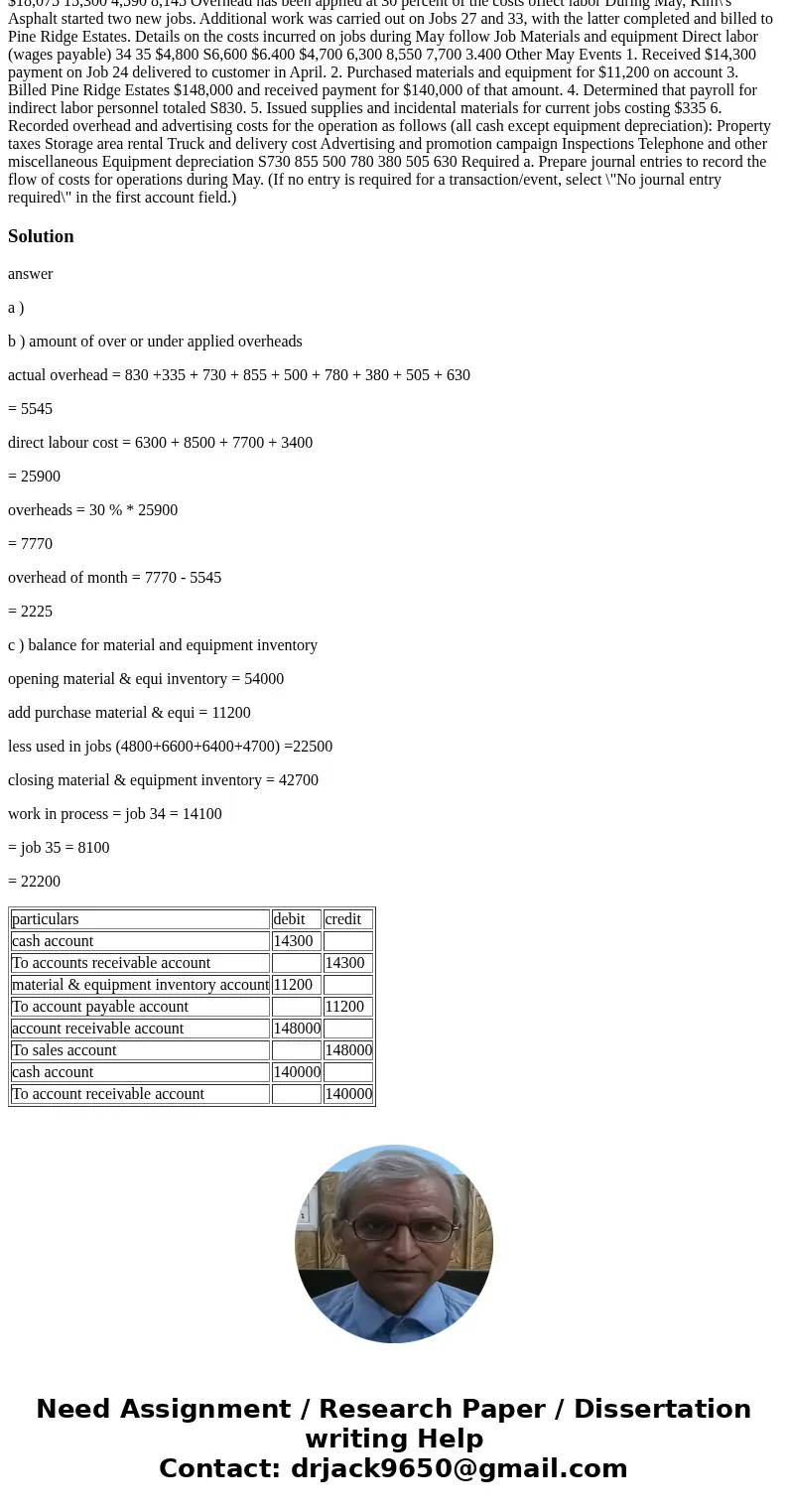

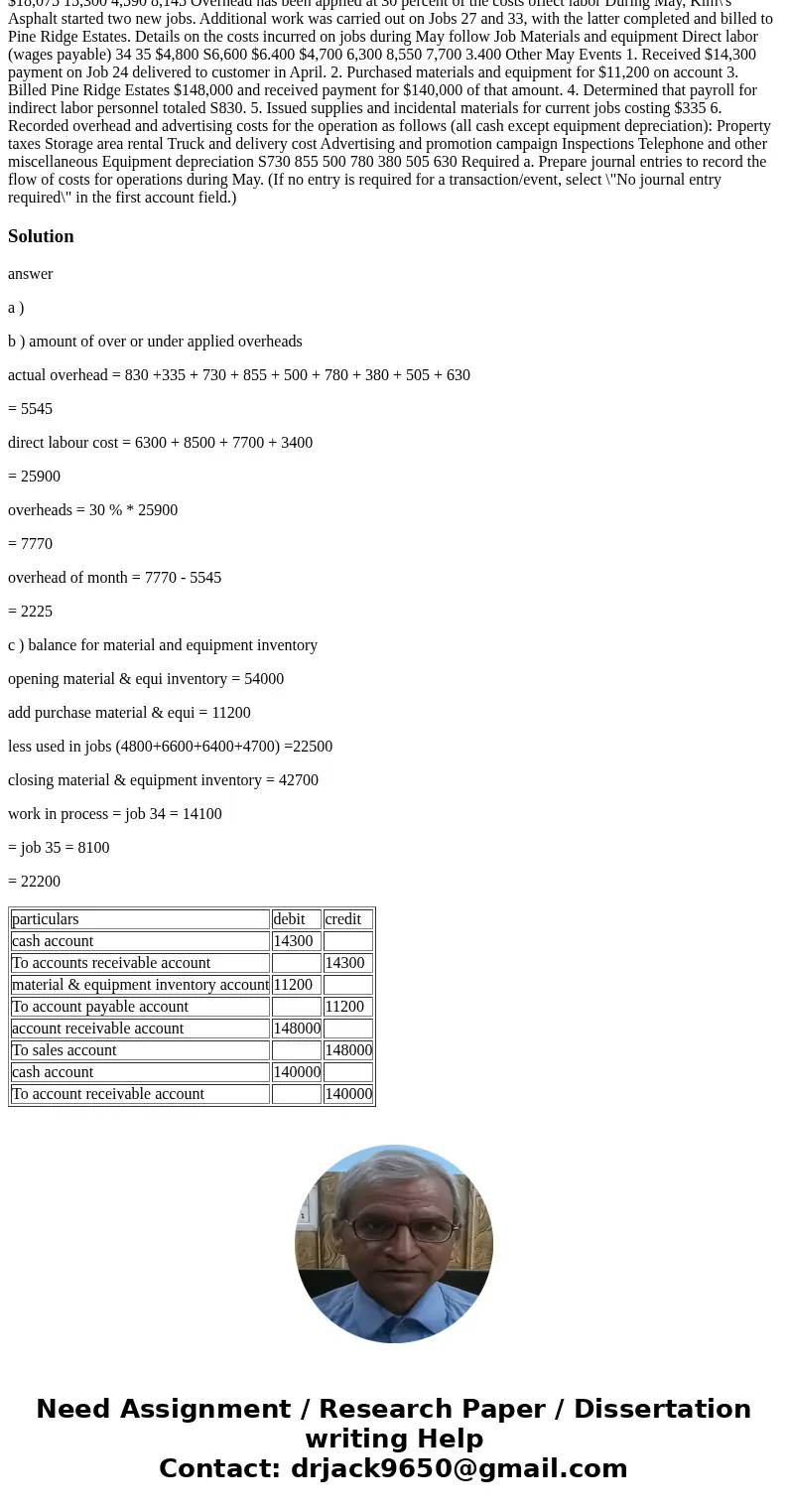

| particulars | debit | credit |

| cash account | 14300 | |

| To accounts receivable account | 14300 | |

| material & equipment inventory account | 11200 | |

| To account payable account | 11200 | |

| account receivable account | 148000 | |

| To sales account | 148000 | |

| cash account | 140000 | |

| To account receivable account | 140000 |

Homework Sourse

Homework Sourse