Financial Statements Develop an Income Statement for 20xX Ca

Solution

INCOME STATEMENT FOR THE YEAR ENDING20XX

PARTICULARS

Amt($)

Sales

33600

Less Cost of Goods Sold

12600

Gross Profit

21000

Less Operating and Admin. Expenses

Advertising Exp

2000

Bank Fees

150

Phone/Internet

1200

Shipping

1260

Utilities

900

Office Supplies

800

Depreciation

800

Total Admin/Operating Expenses

7110

Profit Before Tax and Interest

13890

Less

Repayment of note payable

5000

Interest on notes payable

350

Profit Before Tax

8540

Less Tax at 26%

2220

Net Profit

6320

.

Cash flow Statement:

Particulars

Amt($)

Sales (CASH)

33600

Additions

Sale of equipment(3000-800{cost-dep})

2200

Depreciation (since it is a non cash expenditure)

800

Deductions

Repayment of note payable

5000

purchase of machine

1600

Raw material (considering it to be purchased this year)

10500

Cash at the end of year

19500

Cash flow statement t shows the source and application or use of cash in business.

Balance Sheet:

Liabilities

Amt($)

Assets

Amt($)

Common Stock (Shares)

15000

Cash

10000

Notes

5000

Raw Material

10500

Retained Earnings

4500

Equipments After Depreciation

4000

Total Liabilities

24500

Total Assets

24500

Net profit ratio (NP Ratio)

NP Ratio= Net Profit x 100/ Sales

=6320 x 100/ 33600

=19% approx.

Quick Ratio (QR)

QR= Cash+ Receivables/ Current Liabilities

=10000/5000=2:1

Ideal ration although 1:1

Debt to Equity Ratio or D/E Ratio

Debt-Equity Ratio=Debt/ Equity funds

=5000/15000

=0.33

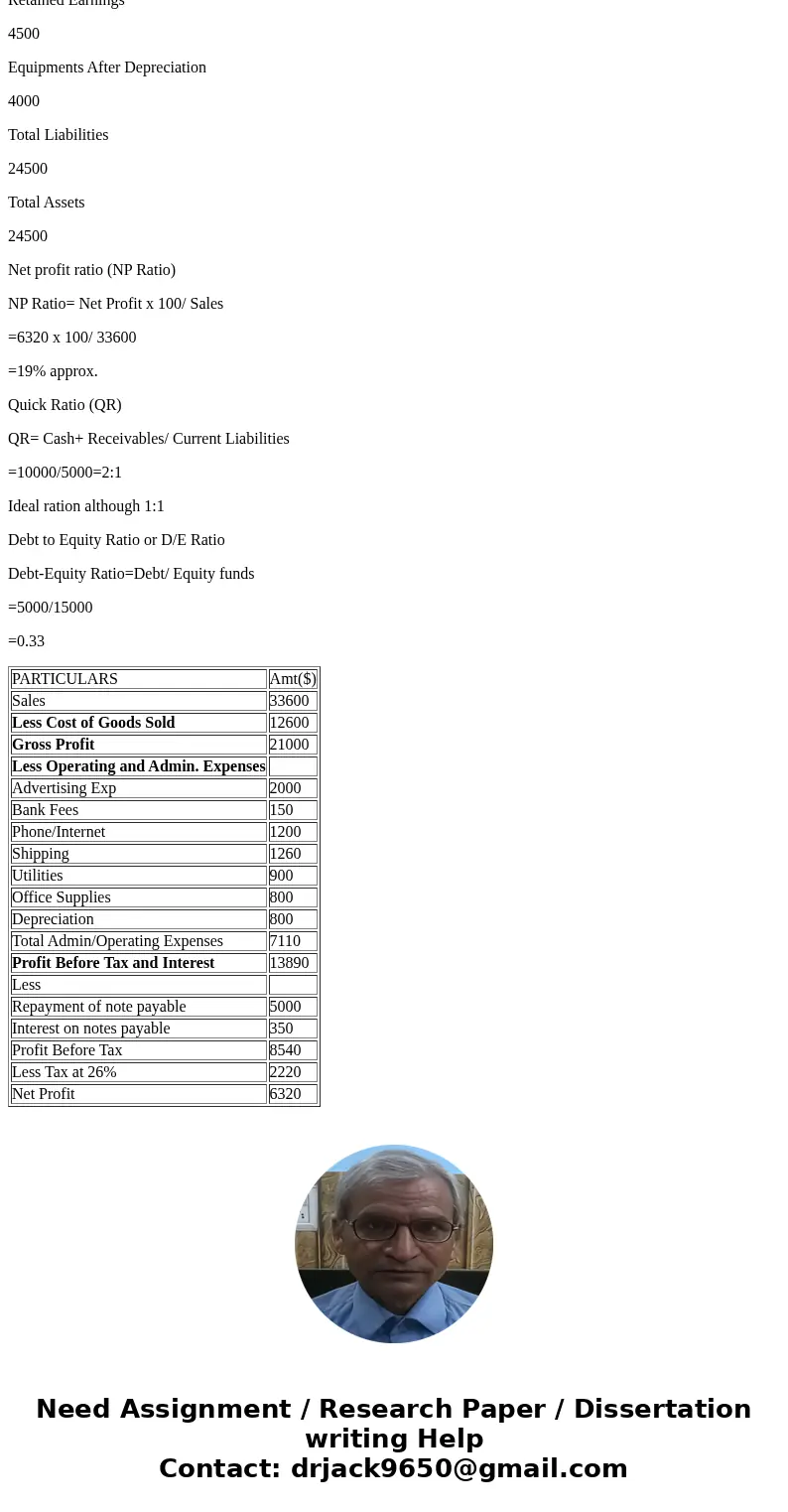

| PARTICULARS | Amt($) |

| Sales | 33600 |

| Less Cost of Goods Sold | 12600 |

| Gross Profit | 21000 |

| Less Operating and Admin. Expenses | |

| Advertising Exp | 2000 |

| Bank Fees | 150 |

| Phone/Internet | 1200 |

| Shipping | 1260 |

| Utilities | 900 |

| Office Supplies | 800 |

| Depreciation | 800 |

| Total Admin/Operating Expenses | 7110 |

| Profit Before Tax and Interest | 13890 |

| Less | |

| Repayment of note payable | 5000 |

| Interest on notes payable | 350 |

| Profit Before Tax | 8540 |

| Less Tax at 26% | 2220 |

| Net Profit | 6320 |

Homework Sourse

Homework Sourse